- Despite multiple recession indicators flashing red, the actual downturn hasn’t materialized yet

- Economists think unique post-pandemic economic dynamics are disrupting traditional forecasting models

- Experts advise preparing for an inevitable downturn by considering safe haven assets like physical gold, silver, or a Gold IRA for long-term financial security

Disrupted Recession Signals

Our current economic situation presents a paradox. While numerous recession indicators are flashing red, the actual downturn has yet to materialize. This delay may be caused by the unique post-pandemic economic dynamics. Traditional forecasting models have been disrupted. However, as noted economist and Johns Hopkins professor Steve Hanke warns, “The average guy on the street corner knows that if they goose the money supply, you’re going to get inflation. And if they contract it — we’ve had four contractions in the history of the Fed since 1930 — and every one of those has led to a deflating economy and ultimately a recession.”1

Key Recession Indicators

1. Rising Initial Jobless Claims

One of the most reliable recession predictors, initial jobless claims, has surged 20% since January 2024. Historically, such upticks have preceded every U.S. recession. That includes the financial crises of 1990, 2001, and 2008. Analysts at the Game of Trades trading platform caution, “If initial jobless claims are set to rise substantially from here, that really doesn’t bode well for the stock market.”2

Declining Temporary Employment

The Bureau of Labor Statistics has found that declines in temporary employment typically precede a recession by 6 to 12 months. This pattern is emerging once again. Which makes sense. Companies reduce the number of temporary employees to avoid laying off permanent workers.

Chicago Fed president, Austan Goolsbee challenged the temp employment indicator. He said pandemic-era labor shortages “scarred employers so much that they’re like, ‘We don’t rely on temps anymore.” 3

3. Inverted Yield Curve

The inverted yield curve is a historically accurate recession predictor. This economic condition occurs when short-term interest rates exceed long-term rates. It is a sign that investors don’t hold high hopes for future growth. It has been inverted for two years—the longest stretch since the 1929 crash. However, the curve has not yet reached the steepness typically associated with a labor market collapse. Its persistent inversion is cause for concern among economists and investors alike.

4

4

4. Disconnected Financial Markets

A growing disconnect between rising stock markets and increasing unemployment is once again evident. This pattern was observed before the recessions of 1988 and 2006. Since January 2024, the S&P 500 has climbed approximately 15%. Jobless claims have also risen, suggesting that the market may be due for a significant correction.5

5. The Sahm Rule: A Near-Perfect Predictor

The Sahm Rule was developed by former Fed economist Claudia Sahm. It has an impressive track record for predicting recessions. According to this rule, a recession is likely when the three-month average unemployment rate increases by 0.5 percentage points over the previous 12 months. As of June, this increase stood at 0.43 percentage points, perilously close to triggering the rule.

However, Sahm herself acknowledges the unique nature of the current economic cycle: “What the pandemic kicked off in terms of a business cycle is very unusual… What’s worked relatively well in the past to signal a recession — it should be no surprise that now they are missing something.”6

6. M2 Money Supply

Steve Hanke identifies the money supply as a sign that a soft landing won’t be achieved. The M2 money supply is a measure of how much cash and other liquid assets is flowing through the economy. It has contracted for most of the past two years. Compare that to the 27% surge in 2021 from the massive pandemic stimulus.

Hanke explained that interest rates will need to come down drastically to keep the economy going. But he doesn’t think the Fed will act in time to avoid a recession.

“It’s one of the worst performances of the Federal Reserve,” Hanke said. 7

Timing the Downturn

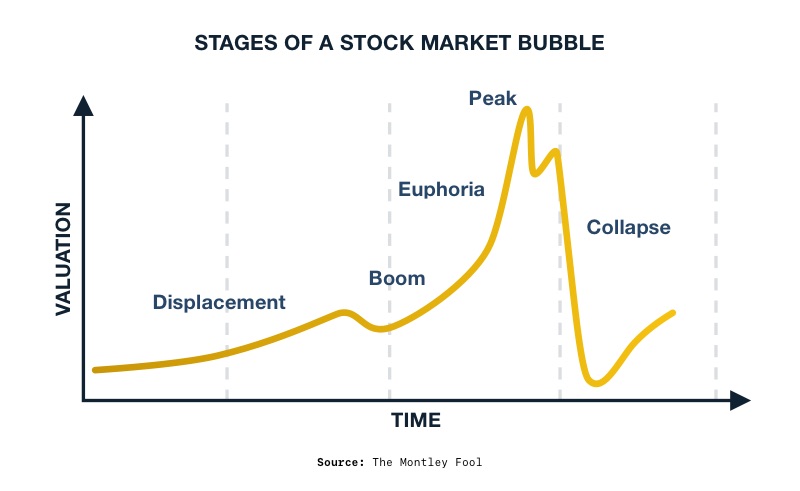

While precise timing remains elusive, many analysts anticipate the recession to hit in the latter half of 2024 or early 2025. This projection comes after the stock market’s recent record highs. A ‘last gasp’ steep climb in stock prices usually occurs before recession begins. Investors should brace for a potential sharp market correction.

Conclusion

Conventional wisdom held that two consecutive quarters of contracting GDP equals a recession. Despite U.S. economic growth being negative in the first and second quarters of 2022, the overall economy never qualified for the National Bureau of Economic Research’s official recession label.

So as economists try to reconcile trusted rules with new results in the post-pandemic economy, the convergence of these signals suggests that economic downturn is inevitable. If every sign points to rain and it’s still sunny out, that doesn’t mean you shouldn’t have an umbrella. The rain is coming, only now you have a chance to prepare for it. Moving funds into safe haven assets like physical gold and silver can protect their value from recession. A Gold IRA is designed to secure your finances for the long term. To learn more, contact us at 800-462-0071.

8

8

4

4

4

4

1

1

4

4

5

5

1

1

3

3

4

4

1

1