Gold Products

Buy Gold Bars and Coins Online

Embarking on the journey to diversify your wealth may seem intimidating, especially when it involves delving into the precious metal market.

At American Hartford Gold (AHG), we strive to illuminate your path by simplifying the process. No matter whether you’re just starting or already a seasoned player seeking to broaden your portfolio, our diverse collection of gold bars and coins caters to all your needs.

The Value of Gold: A Safe Haven Asset

Often, we encounter the question, “Why should we buy gold?” The response centers around the enduring appeal of gold: its resilient position as a safe-haven asset. Throughout the ages, gold has persevered in preserving its worth, shielding against inflation and the unpredictable shifts of currencies.

It’s more than an ordinary asset – it’s akin to an insurance policy for your portfolio. When the stock markets endure turbulence, the spot price of gold often moves contrarily, infusing a layer of robustness.

What Should You Know When Purchasing Gold Coins?

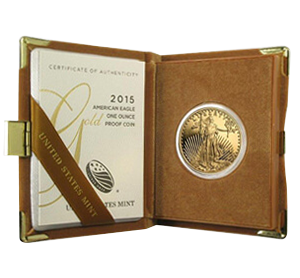

One of the popular avenues for acquiring physical gold is gold coins. Produced by various government mints worldwide, including the prestigious U.S. Mint and the Royal Canadian Mint, these gold coins come in many sizes and designs. Each coin, unique in its allure and value, offers something for everyone.

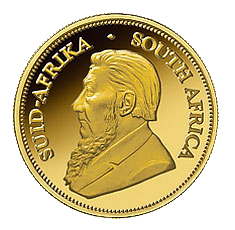

Notable gold coins that collectors are drawn to include American Gold Eagles, Canadian Maple Leafs, South African Krugerrands, and Australian Kangaroos.

As legal tenders, these coins hold a specific face value in their country of origin. However, their actual value usually overshadows the face value due to their intrinsic gold content.

Gold Coins: More Than Just a Purchase

Gold coins represent security for your future, a sentiment that resonates with people globally. These treasures offer more than just their weight in gold. They tell a story, reflect the rich history of the mint they come from, and become keepsakes to pass down through generations.

Each coin’s unique design carries its charm. For instance, the American Gold Eagles, produced by the U.S. Mint, showcase Augustus Saint-Gaudens’ rendition of Lady Liberty on the obverse, and the American Gold Buffalo flaunts James Earle Fraser’s classic design of a Native American in profile.

On the other side of the Atlantic, the Britannia coin produced by the Royal Mint in the UK showcases the helmeted icon of Britannia.

With each design carrying significant cultural and historical implications, your gold coin is more than a purchase – it’s a conversation piece.

What Are the Basics of Gold Bars?

Gold bars are a reliable option alongside gold coins. Gold bars offer versatility and are available in a wide variety of sizes, from as small as one gram to as large as a kilo. They cater to all purchasers, from those seeking a small gold purchase to those desiring larger quantities. Due to their cost-effectiveness, gold bars are a popular choice for many.

Both government and private mints manufacture gold bars. Renowned refiners in the industry include Perth Mint, PAMP Suisse, and Austrian Mint. Each gold bar comes accompanied by an assay certificate, confirming its weight, purity, and authenticity.

Gold Bars: Simplicity and Efficiency

Gold bars are an excellent option for those who prefer a straightforward and efficient way to buy gold. The allure of gold bars lies in their simple form. Unlike gold coins, they carry minimal artistic embellishments, focusing instead on the purity and weight of the gold within.

This simplicity often results in lower premiums over the gold spot price than gold coins, making them a cost-efficient asset.

Gold and Your Individual Retirement Account (IRA)

Many people buy gold for the opportunity to include it in an Individual Retirement Account (IRA). Gold IRAs present tax advantages akin to traditional retirement accounts.

However, they add an extra layer of security and diversification due to the inclusion of physical gold. As always, conducting thorough research and seeking advice from a professional before proceeding with such a significant decision is critical.

Buying Gold With American Hartford Gold

Buying gold presents people with a proven strategy to diversify and protect their wealth. AHG offers various options to align with your goals, from gold coins to gold bars. Gold isn’t merely an asset; it’s a stabilizing force for your portfolio, providing a sense of certainty in times of financial turbulence.

When you’re ready to buy gold, AHG stands ready to assist. Discover our vast selection of gold coins and bars today, and begin your journey to financial security.

Frequently Asked Questions

How Can I Buy Gold Coins?

Buying gold coins is straightforward with American Hartford Gold. Explore our extensive selection, and call-in to make a request.

We accept payment via check, wires, or IRA rollover. We provide both physical delivery to your doorstep or inside of a retirement account like an IRA, 401K, or TSP.

What Makes the Canadian Gold Maple Leaf Special?

The Canadian Gold Maple Leaf holds a distinguished position due to its exceptional qualities. Produced by the esteemed Royal Canadian Mint, these coins are renowned for their unparalleled purity. With a gold content of .9999 fine, they rank among the purest gold coins available worldwide. These coins derive their name from the iconic design featuring a solitary maple leaf on the reverse side, symbolizing the rich heritage of Canada.

What Role Do Central Banks Play in the Gold Market?

Central banks occupy a crucial position within the global gold market, exerting significant influence through their participation. These esteemed institutions strategically include gold in their reserves, enabling them to shape market dynamics through buying and selling activities.

Central banks often acquire gold to mitigate their reliance on the U.S. dollar and enhance the diversification of their reserves, a prudent measure to safeguard their economic stability and foster long-term financial resilience.

What Is a Gold Ingot?

A gold ingot is synonymous with a gold bar and is a tangible asset. Usually rectangular, these bars are crafted by both government and private mints.

Available in various sizes, ranging from small grams to large kilos, gold ingots cater to the diverse needs of people seeking a reliable and secure way to hold their wealth in the form of pure gold.

What Does “Karat” Mean When It Comes to Gold?

The term “karat” refers to a unit of measurement used to determine the purity of gold. Pure gold is designated as 24 karats. For example, a gold coin labeled as 22 karats contains 22 parts of gold and two parts of other metals, blended to enhance its durability without compromising its intrinsic value.

Why Is U.S. Gold Considered a Wise Purchase?

U.S. Gold, specifically the highly regarded American Gold Eagle coins and American Gold Buffalo coins, is widely recognized as an exceptional choice. These coins, crafted by the esteemed U.S. Mint, embody qualities that make them immensely appealing.

With their recognized quality, exquisite design, high gold content, and credibility associated with their origin, they provide a reliable and valuable asset for wealth preservation and growth.

What Is the Gold Philharmonic?

The Gold Philharmonic is an exquisite coin minted by the prestigious Austrian Mint. This captivating coin has garnered a devoted following among collectors worldwide. Its popularity stems from its striking design and meticulous craftsmanship, paying tribute to the illustrious Vienna Philharmonic Orchestra.

Reflecting Austria’s rich cultural heritage, the coin captures the harmonious blend of artistic expression and the intrinsic value of gold, making it a cherished piece in any collection.

How Do Refineries Contribute to the Gold Industry?

Refineries hold a crucial role in the gold supply chain. These specialized facilities are responsible for processing and refining raw gold, transforming it into high-purity gold bars, coins, or other valuable products.

Furthermore, refineries often play a role in recycling scrap gold, ensuring that even previously used gold can be reprocessed and reintroduced into the market.

What Factors Should I Consider When Buying Gold Online?

When purchasing gold online, it is essential to consider several key factors. These include the reputation and reliability of the seller, the pricing transparency, the purity of the gold product, and the weight of the gold item. Opting for a reputable dealer like American Hartford Gold ensures secure transactions and reliable delivery, granting peace of mind to online buyers.

Why Is Gold Considered a Safe Haven Asset?

Through the annals of time, gold has garnered an unwavering reputation as a safe haven asset, revered for preserving value even during economic uncertainty and volatile market conditions. While paper currencies and stocks may be susceptible to inflationary pressures and sudden fluctuations, gold remains a steadfast guardian of wealth, resistant to such adversities.

People turn to gold as a dependable means of protecting and preserving their assets amidst economic turbulence. Its intrinsic value and timeless appeal provide a secure harbor for those seeking stability and reassurance in an unpredictable financial landscape.

Can I Store My Gold at Home?

Yes, it is possible to store your gold at home. However, it is crucial to prioritize security measures to safeguard your precious metals. Employing secure storage options such as safe boxes or vaults can help ensure the physical protection of your assets.

It is essential to review your home insurance policy as some policies may not cover precious metals, necessitating additional insurance coverage. Alternatively, reputable third-party storage facilities offer peace of mind by providing professional and secure storage solutions.

How Liquid Is Gold?

Gold offers a high degree of liquidity, enabling easy and swift conversion into cash. Gold can be sold at various locations worldwide, often fetching competitive prices. Its inherent desirability and enduring allure make gold a highly liquid asset, attracting a diverse range of buyers and ensuring a reliable avenue for converting assets into cash when needed.

Get Your Free 2024 Guide