Banking Crisis Continues

As we approach the one-year anniversary of the 3rd and 4th biggest bank failures in American history, a new round of bank collapses may emerge. The banking crisis of 2023 began with the fall of Silvergate Bank on March 8th. Silicon Valley Bank (SVB) collapsed on March 10th, becoming the third largest bank failure after Washington Mutual in 2008 and First Republic in May, 2023. SVB triggered a bank run by announcing it needed to raise capital after being forced to sell bonds at a loss. That same day, Signature Bank customers withdrew more than $10 billion in deposits – resulting in the fourth largest bank failure at the time. In Europe, Credit Suisse failed soon after and had to be taken over by UBS.1

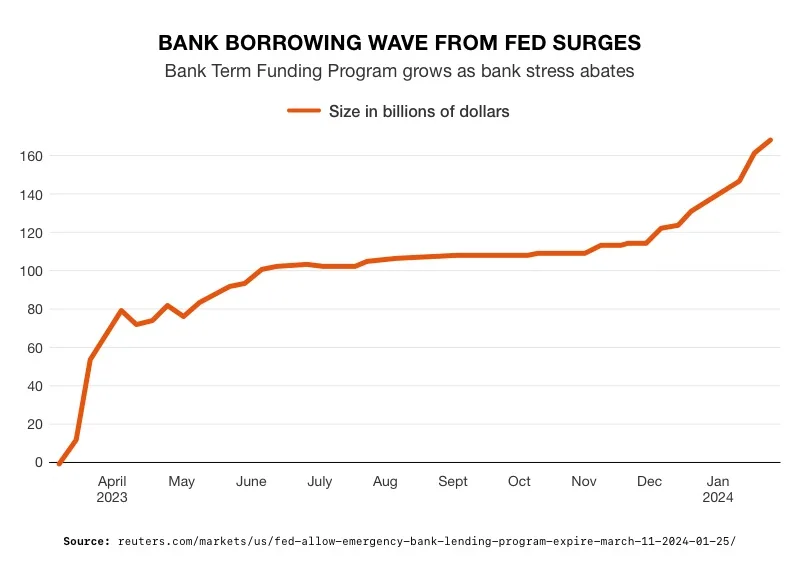

Alarm is growing in the banking sector. The federal program created to stop the banking crisis is ending on March 11th. The Bank Term Funding Program (BTFP) managed to help limit the number of bank failures. BTFP let banks borrow from the Fed using their bonds as collateral. The bonds were priced at their original value. This let them undo the impact of the new, high interest rates.

2

2

Only First Republic Bank crashed since the program began. But the closure of BTFP exposes the banking sector to a fresh new round of risk. Ending the BTFP will increase bank’s borrowing costs and cut into profit margins. Banks may raise their lending rate or cut back on how much they will lend to customers. Tightening up credit can push the economy into recession.

Regional Banks Vulnerable

Regional banks are barely hanging on as is. Share prices are down across the sector. First Horizon is down 43% and Comerica’s share price is down 30%. But the bank hitting the panic button is New York Community Bank (NYCB). Its shares plunged almost 40% and could drop further. The bank has lost over $250 million on commercial real estate (CRE). Their CRE loans exceed their total capital by more than 300%. Ironically, it was NYCB that took over the assets of Signature Bank when they failed.3

A failing commercial real estate sector could result in the failure of around 385 small and medium-sized banks. There are more than $900 billion in commercial property loans coming due this year. In the face of high interest rates and devalued assets, those banks are likely to experience numerous defaults. Commercial property loans constitute around 18% of regional bank loan portfolios. A wave of defaults could lead to a series of catastrophic bank failures.4

Fed Policy Spurs Bank Failures

Desmond Lachman was a deputy director in the International Monetary Fund’s Policy Development and Review Department. He said Fed Chair Powell is “inviting a banking crisis.”

According to him, the Fed is making things worse by keeping interest rates high and reducing the money supply. By doing so, the Fed is increasing the chances of a recession and a renewed banking crisis.

The Fed policy of quantitative tightening (QT) is also creating the conditions for a severe banking crisis. Dating back to the global financial crisis of 2008, the Fed had a policy of quantitative easing (QE). Meaning, they were creating new money and buying government bonds and other financial assets. The banks were able to turn around and loan that money out. QE increased during the pandemic to keep the economy afloat. But as a result, inflation ballooned up to record levels. Now, the Fed is using QT to reduce the money supply by removing the assets they bought from the financial system.

Lachman said, “In 2021, the Fed chose to ignore the markedly expansionary fiscal policy stance when it kept flooding the market with liquidity. The net result was a surge in inflation by June 2022 to a multi-decade high of over 9%. Today, it seems to be making the opposite mistake of keeping monetary policy tight on the eve of a banking crisis at home and a weakening economic situation abroad. Unfortunately, this raises the risk of a hard economic landing within the next year or so.”5

QT is likely to further stifle bank’s lending and raise rates as money becomes tight. Already heightened interest rates have resulted in drastically tighter credit standards. Loan demand has dropped accordingly. In addition, geopolitical conflicts are drying up international investments and increasing the risks of bad debts. Combined with the CRE crisis, a new round of bank failures and recession could be upon us.

Inflaming the banking crisis can have dire consequences for retirements funds. That’s why thousands of Americans are converting portions of their portfolios into real assets like physical gold and silver. When held in a Gold IRA, physical precious metals offer a layer of protection against the effects of a collapsing banking sector. Contact American Hartford Gold today at 800-462-0071 to learn how you can start protecting your future today.