Exploding National Debt

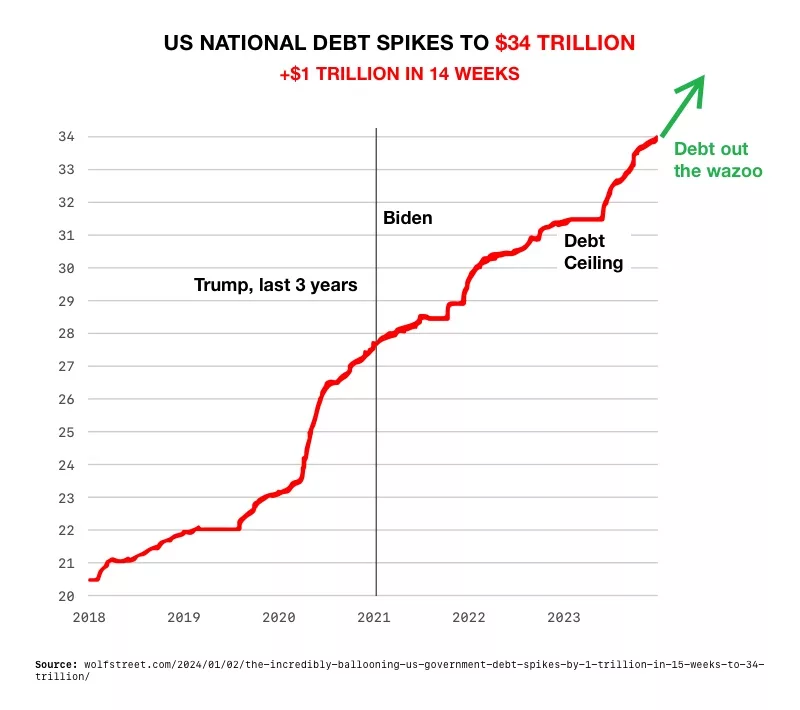

Danger to the economy surged this month as the national debt roared past an astounding $34 trillion. That is up $1 trillion from just three months ago. At $34 trillion, the United States’ debt is 1.2 times its annual economic output, higher than the 1.1 ratio dating back to World War II. The astronomical sum is the result of lawmakers raising the debt ceiling last year to avoid a default. Analysts fear we are coming to the end of the road, and the economy could soon be facing a cataclysmic reckoning.1

2

2

Debt as the ‘Boiling Frog’

In a recently issued warning, JP Morgan compared the national debt to a ‘boiling frog’ situation. A frog thrown in boiling water might jump out. But if the water comes to a boil slowly, it’s too late by the time it notices it’s being cooked. In other words, policy makers are failing to see the danger they are in before it is too late. The threat of the debt is being ignored until it becomes unsolvable, resulting in severe consequences.

“The problem for the US is the starting point; every round of fiscal stimulus brings the US one step closer to debt unsustainability,” JPMorgan strategist Michael Cembalest said. “However, we’re accustomed to deteriorating US government finances with limited consequences for investors, and one day that may change.”3

Rapidly Growing Problem

The government is allowing public debt to increase every year. The Congressional Budget Office estimates that the US’s entitlement spending, mandatory spending, and net interest payments on the debt will exceed the government’s total revenue by the early 2030s. And the government doesn’t appear to have any intent of cutting discretionary spending anytime soon.

A split Congress is making the situation worse. Republicans don’t want to raise taxes and Democrats don’t want to reel in spending – the two things that need to be done to bring the debt under control. Congress is facing another potential government shutdown on January 19th. A temporary budget deal was made, but there are doubts from both sides that it will pass.

Conventional wisdom never worried about massive debt. For a decade, large deficits were considered manageable when interest rates are low. And rates remained low due to the Federal Reserve’s bond purchases during the pandemic. But then rates shot through the roof to tame record inflation. Financing deficits at higher interest rates escalates debt servicing costs, making it harder to manage deficits and potentially pushing the national debt to unsustainable levels.

Debt Impact

Runaway debt could wreak havoc on the economy. Interest payments on the debt will increase since the Fed is going to keep interest rates higher for longer. As a result, per the Committee for a Responsible Federal Budget, interest payments will remain the fastest-growing government-budget spending item. The cost of the debt will eventually surpass Social Security and defense spending combined. With no money available, the government will be effectively bankrupt.

Reduced Foreign Investment: Foreign investors are becoming more reluctant to keep financing our debt as it looks less secure. That lack of financing only increases the strain on the government. Rating agencies have already downgraded US debt. The outlook on the US credit rating was lowered from “stable” to “negative” back in September.

Increased Taxes: Americans can also expect a tax hike. Tax rates are already set to increase in 2026 when a 2017 tax cut expires. Today’s rates may be as low as taxes get.

“The government is going to have to raise taxes, particularly on higher-earning people, in order to help bring the budget into balance,” said Pam Horack, owner of Pathfinder Planning.4

Stock Market Crash: The debt can lead to a major stock market crash for several reasons. As the national debt grows, the government needs to borrow more money. This increases demand for borrowing, which can lead to higher interest rates. High-interest rates can slow down economic growth, affecting the profitability of companies. An interest rate induced recession can also drive down stock prices.

The government will need to reduce spending or increase taxes. Reduced spending means fewer contracts for businesses, affecting their revenues. Higher taxes can also impact companies’ profits, making them less attractive to investors.

A soaring national debt increases uncertainty among investors. They might worry that the government won’t be able to manage its debt effectively, leading to economic instability. This uncertainty can lead to investors selling stocks, causing a market crash.

Conclusion

The debt will continue to skyrocket. The Treasury expects to borrow almost $1 trillion more by the end of March according to the Peterson Foundation. Like JP Morgan’s ‘boiling frog’, we may only realize how serious the situation is until it is too late. The national debt can lead to a doom loop of more borrowing, higher taxes, and cut services until eventually the government simply collapses. Left unchecked, Americans can expect hyperinflation and deep recession. While Congress does nothing, people interested in protecting their wealth can do something. Physical precious metals can safeguard the value of a portfolio from the effects of runaway debt, especially if they are placed in a Gold IRA. Contact us today at 800-462-0071 to learn more.