- The banking crisis is quietly persisting as bank stocks continue to slide

- “Higher for longer” interest rates are destabilizing traditional sources of bank income

- Banks are turning to unreliable ‘hot money’ (outside depositors) to stay afloat

Banking Crisis Continues

Now out of the limelight, the banking crisis continues. Surging interest rates are affecting their stability, profitability, and stock prices. The bond market upon which banks rely is eroding. This crisis isn’t just about banks; it affects consumers, government policies, and the overall financial stability of the nation.

Bank stocks are on pace for yearly losses as high interest rates take their toll. The S&P 500 financial sector was down 5.5% this year. Regional banks were hit harder. The S&P Regional Banking ETF was down about 32%.1

The downward slide accelerated when the Fed said it will keep interest rates higher for longer. Kathy Jones is the chief fixed-income strategist at Schwab Center for Financial Research. She said, “It’s fairly obvious it’s not good for banks. The rise in yields has just been relentless.”2

Bank stock prices have slumped in four of the last five years. That is according to the calculations of veteran bank analyst Dick Bove, chief financial strategist at Odeon Capital Group. Over that five-year period, only four of the 106 banks he follows have outperformed the S&P 500.3

Bond Market Troubles

The increase in longer-dated Treasury yields has largely wiped-out the US bond-market return for the year. The popular iShares Core US Aggregate Bond ETF recently closed at its lowest level since October 2008.

The higher yields on newly issued Treasury bonds erode the value of portfolios that include older bonds issued with lower rates. Old bonds are less valuable because the new ones are offering better returns. The value of bonds goes down when interest rates go up because of an inverse relationship between bond prices and interest rates. Here’s a simple way to understand it:

Imagine you have a bond that pays you a fixed interest rate, let’s say 3%. If you’re holding that bond and interest rates in the market suddenly rise to 4%, the new bonds are paying more interest than yours.

This means your bond, which pays less interest, is not as attractive to investors anymore. They can get better returns with new bonds. So, to make your bond more appealing in the secondary market, its price must drop. When its price drops, the effective interest rate it pays (relative to its new lower price) increases to be more competitive with the higher rates available in the market.

Other Factors

The uncertainty of the commercial real estate market is destabilizing some banks. Commercial property loans will be difficult to refinance as rates stay higher for longer.

Banks can see the trouble ahead. The Fed created an emergency lending fund for banks after the Silicon Valley Bank collapse. Demand on that fund spiked in September. Banks are bracing for recession by increasing their reserve levels. Reserves are at their highest in three decades. But that may not be enough to cover their exposure. Banks were exposed to an estimated $558.4 billion of unrealized losses in the second quarter from debts that are worth less than what they were bought for.4

Impact on Consumers

The growing bank risk forced the President to say the government would guarantee all deposits at all banks. Now the government is working to reduce the risky position it put itself in. They are trying to shrink bank exposure by raising the capital requirements needed to make loans. This, in turn, will make it harder for people to get mortgages, car loans and credit cards. Lending restrictions can lead to a negative loop that hurts a bank’s bottom line. The whole economy can suffer as people lose access to spending money.

‘Hot Money’

Availability of loans will become more difficult for another reason. Banks aren’t attracting and holding onto enough depositors. They aren’t making enough money to pay depositors a market rate.

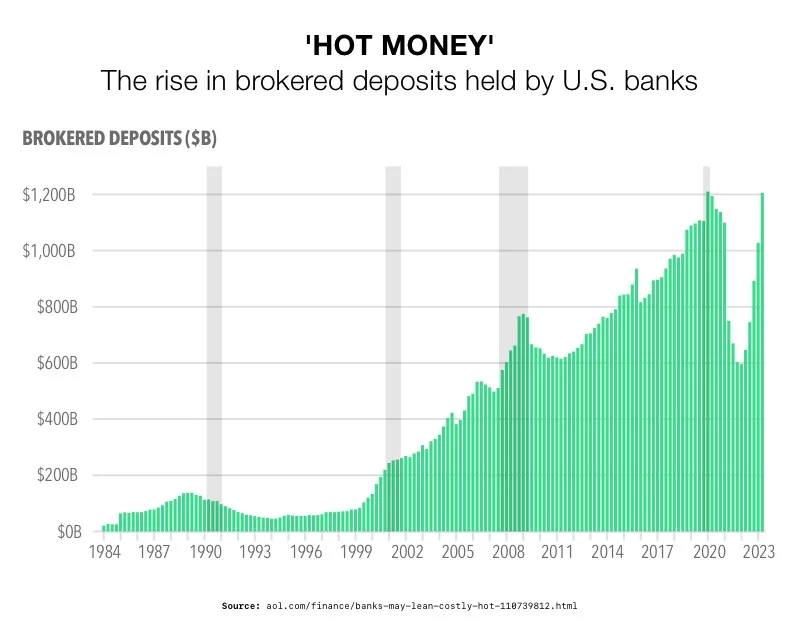

Banks are turning to ‘hot money’ to fill in the gaps. Hot money is brokered deposits from outside firms that funnel large amounts of customers to higher-yielding certificates of deposit offered by banks. These deposits are typically more expensive for a bank. They cut into profits during a challenging time for many financial institutions.

5

5

Brokered deposits across the banking industry surged to $1.2 trillion in the second quarter. That is up 86% from the same period the year before. They accounted for 6.5% of total US bank deposits, the highest percentage in four years.6

But reliance on ‘hot money’ presents a risk to banks. These new customers hold no loyalty to the banks and will leave during periods of stress. “There has been a significant increase in broker deposits in the banking system over the past year,” FDIC Chairman Martin Gruenberg said, “and they can present liquidity risk.”7

It’s not just the mid-sized banks. Big banks are taking in more hot money too. Among the country’s four largest banks, Wells Fargo’s concentration rose from near zero to 6.39%. Citigroup maintains the highest concentration of brokered deposits among the big four, at 9.54%.

Higher concentrations can be problematic according to Alexander Yokum, a regional bank analyst for CFRA. He said, “It’s symbolic that a bank’s core operations aren’t enough and it’s just less profitable.”8

Conclusion

In these uncertain times, it’s becoming increasingly clear that traditional banks may not be the safest haven for your hard-earned money. The banking crisis, lurking just out of the limelight, poses risks that can’t be ignored. Fortunately, there’s an alternative that has stood the test of time: gold. Unlike traditional currency, gold holds its value independently of the volatile banking and financial systems. If you’re looking to secure your financial future and protect your wealth, consider the stability and resilience of a Gold IRA from American Hartford Gold. It could be the smart choice for safeguarding your assets in an ever-changing economic landscape. Contact us today at 800-462-0071.