- Biden proposes massive new taxes targeting businesses and high worth individuals

- The new taxes could hurt corporations, IRAs, and the housing market

- Investigate a Gold IRA to protect your assets before these taxes take effect

Prepare for Higher Taxes

On top of facing record inflation, interest rates, and debt, Americans should now brace for higher taxes if the Biden administration has its way. As a former White House economist put it, Biden’s latest budget is a mix of tax hikes, handouts, and living with debt. While this government tries to fund its left-wing agenda, those interested in protecting the value of their savings should consider taking steps now to insulate themselves from new taxes.

New Taxes

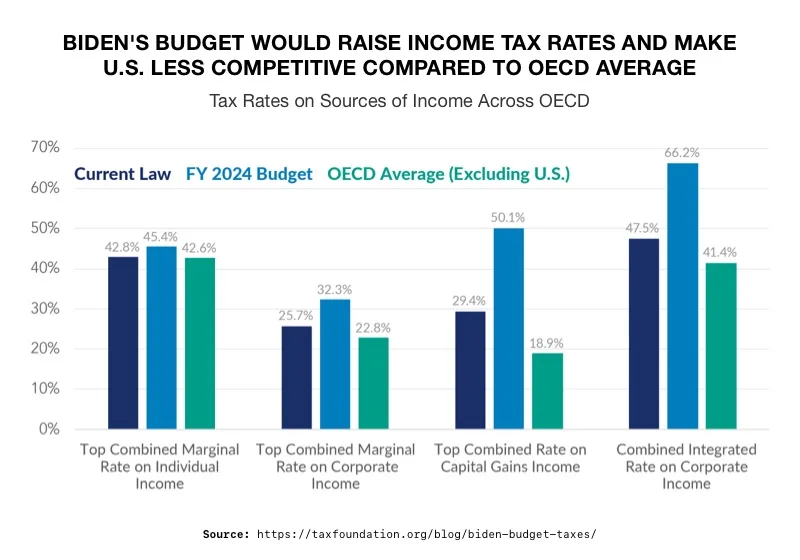

Biden’s new budget includes steep tax increases on businesses, high worth individuals, and retirement plans. His proposal amounts to a gross tax hike exceeding $5.1 trillion over 10 years. It creates more complex rules for taxpayers at all income levels. According to the Tax Foundation, the promised higher taxes would decrease economic output and incomes and reduce US competitiveness.1

2

2

The Tax Foundation maintains that the plan’s promised deficit reductions are based on several unrealistic assumptions. The decrease takes for granted that the 2017 tax cuts will be left to expire, despite Congress signaling otherwise. It also presumes the child tax credit won’t go beyond 2025 which goes against Biden’s platform. And it factors in robust economic growth that falls far short of what the Congressional Budget Office is predicting.

Businesses and corporations are hard targets in this proposal, facing a 33% increase in taxes. The Tax Foundation has found corporate income tax to be the most harmful tax for economic growth. US businesses are already hampered by one of the highest corporate tax rates in the world. Increasing it will further crush growth in an economy already on the cusp of recession. Studies have shown that lowering the corporate tax rate significantly boosts investment in the US – yielding economic benefits to every level of society.3

Beyond business taxes, the proposal includes raising the top individual income tax rate to 39.6%. It also intends to tax long-term capital gains at ordinary income tax rates and limit retirement account contributions for those with large IRA balances. For some taxpayers, Biden wants households to pay a minimum 25% tax rate on unrealized capital gains. In other words, you’d be paying taxes on profits you haven’t even collected yet.

Beefing Up the IRS

New tax laws don’t matter if they can’t be enforced. Biden plans to preserve the $80 billion funding for the IRS that was in the Inflation Reduction Act. It calls for an additional $104.3 billion in IRS funding on top of that.4

Another problem with Biden’s new tax plan is that it is exceptionally complicated, which is saying something when it comes to tax codes. A new higher corporate alternative minimum tax meant to be put into effect has been consistently postponed. The reason for the delay is that it is too complex to enforce, even for the IRS.

The Housing Market

The proposed taxes meant to help a stalled housing market are most likely going to make it worse. Biden has called for tax credits to subsidize home purchases and developers. But boosting demand though subsidies is likely to cause housing prices to go even higher. And market dynamics mean most of the credits will stay in the pockets of developers and financing agencies with no guarantee of more houses being built.

Reactions to the Budget

Kevin Hassett is a former Chairman of the Council of Economic Advisers. He said. “It’s just astonishing, this budget. What they’re doing is they’re borrowing to gin up GDP, but they’re not really getting much GDP out of it. In fact, they’re wasting a lot of the money.”

He continued, “”And so Biden is borrowing money from the Chinese to give jobs to illegal aliens and he’s doubling down on that in the budget, and it’s absolutely economic nonsense. It’s got to stop.”5

Senator Rick Scott said, “Prices keep going up, interest rates keep going up, and taxes keep going up, but President Biden wants to add another $6.4 trillion in debt over the next four years with more reckless, inflation-fueling spending.” And Senator John Cornyn said the massive new taxes on the job creators will cause prices to increase.6

Conclusion

The Biden administration is adding high taxes onto its legacy of inflation, debt, and government handouts. Analysts think that if even half of his tax proposals make it through Congress, businesses and individuals will suffer. Before these taxes become law, Americans interested in protecting their retirement savings from heavy new taxes should investigate a Gold IRA from American Hartford Gold. Learn how precious metals can safeguard your future today by calling 800-462-0071.