Stagflation Risks Grow

An overheated market may soon come crashing headlong into stagflation and recession, putting the value of retirement funds at risk. While the market is optimistic that we are in a ‘Goldilocks scenario’ where the economy is not expanding or contracting too much, JPMorgan Chase analysts are warning that 1970s-style stagflation may be returning. And even a mild recession could deal a brutal blow to the market.

As inflation spiked in 2022, so did stagflation fears. Those fear calmed a bit as the pace of inflation slowed and recession was delayed. But worries are returning as the prospect of recession increases and inflation has grown ‘sticky’.

Analysts at JPMorgan said they wouldn’t be surprised if inflation stops dropping altogether given “outsized gains in equities, tight labor markets and high immigration and government spending.” Inflation may be harder to tame due to an overvalued stock market adding trillions of dollars of paper wealth. In addition, any tightening of the money supply has been offset by massive government spending. The inflationary effects of the more than $2 trillion dollars that Biden pumped into the economy haven’t fully been felt yet. As a result, the Federal Reserve may need to keep interest rates higher for longer, increasing the odds for recession.1

Paul Dietrich is chief investment strategist at B. Riley Wealth. He said, “Once the money is appropriated and spent, it takes about two years for the inflation to actually catch up. And that’s why I believe the last mile of inflation going down to 2% is going to be very, very difficult and very slow … It could, and probably will, cause stagflation we saw in the 70s.”2

Economists see similarities between now and the conditions that caused 1970s stagflation. Back then, inflation came in waves. JPMorgan analysts said, “There are many similarities to the current times. We already had one wave of inflation, and questions started to appear whether a second wave can be avoided if policies and geopolitical developments stay on this course.”3

Strategists pointed to other parallels between now and the 1970’s geopolitically. There are conflicts in Eastern Europe, the Middle East, and the South China Sea. There is also a growing energy crisis as oil shipping is disrupted in the Red Sea.

Stagflation, a combination of economic stagnation and rising inflation, could be ruinous to retirement funds. It may lead to lower stock returns due to a sluggish economy, affecting the equity portion of the account. Rising interest rates meant to control inflation can hurt fixed-income investments. Additionally, inflation erodes the purchasing power of money, impacting the real value of savings in the 401(k). Finally, job market challenges and industry-specific risks during stagflation can further contribute to volatility and potential losses in the account.

Recession

4

4

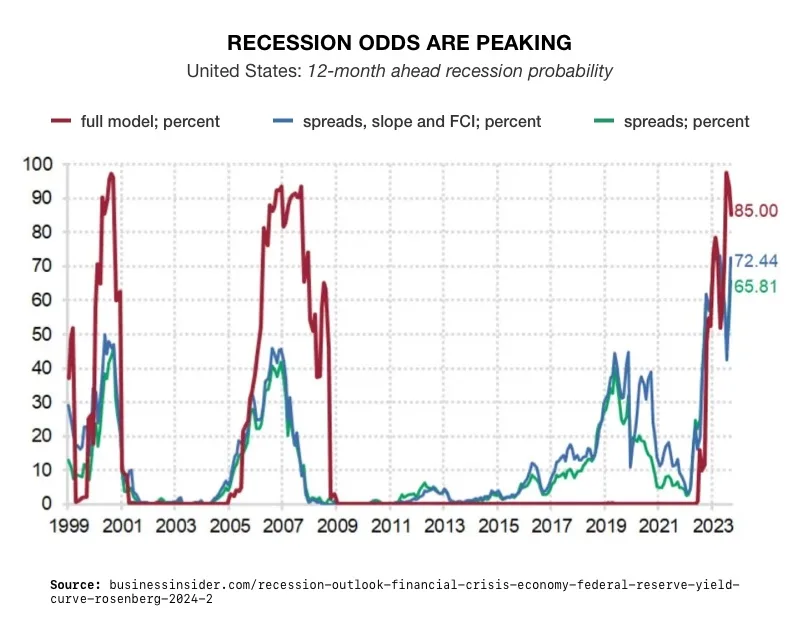

As inflation lingers, the chance for the other component of stagflation, recession, grows more likely. A recession in 2024 could burst the biggest stock bubble since the dot-com craze. US stocks are hitting fresh records following upbeat earnings reports from Nvidia. But the higher the stocks go, the more they can fall in a potential recession. According to analysts, the market could drop 40%.

Wall Street is banking on optimism, hoping for hefty interest rate cuts this year and a continuing AI boom. The CME Fedwatch tool says investors are expecting a 100 basis-point rate cut. Even as overall growth seems to continue, Dietrich pointed out that several economic indicators are already in “deep recession territory.”

The unemployment rate remains near an all-time low, but continuing unemployment claims have hovered close to 1.9 million since the start of 2024. Dietrich described that level as recessionary. At the same time, consumer debt is reaching unsustainable levels. Credit card debt broke a record $1.13 trillion. Consumers may soon run into credit limits. That could put the brakes on growth when consumer spending accounts for 70 percent of the total U.S. economy.

Historically, a recession, even a mild one, can cause massive losses. In the 2001 recession, GDP dipped less than 1%. But stocks plummeted 49% peak-to-trough. And the Nasdaq plunged 78% as the dot-com bubble burst. With analysts calling stocks the most overvalued since 2001, today’s market could experience even worse losses. Especially since record highs are hanging on the performance of a small handful of tech stocks.5

Conclusion

New York Fed economists say there is a 61% chance of a recession by next January. Other indicators are pricing the odds of recession at 85%, the highest risk recorded since the Great Financial Crisis. For those people looking to protect the value of their retirement funds, now is the time to investigate safe haven assets that can protect against stagflation and recession. Physical precious metals in a Gold IRA can safeguard your savings. Contact us today at 800-462-0071 to learn how.6