$2,400 Gold in 2024

For everything else going on in the world, 2023 was a great year for gold. And by the looks of it, 2024 is going to be even better – with projected prices upward of $2,400 an ounce. The World Gold Council released their analysis for the upcoming year. According to them, there is only a small percent chance of gold prices NOT continuing their surge.1

Gold prices rose in 2023, hitting an all-time high of $2,071 an ounce on December 1st. They increased in all but one of the last 8 weeks. Year to date, gold prices have risen 12%. They were initially lifted by investors seeking safe haven assets after the collapse of Silicon Valley Bank sparked a banking crisis. They were also supported by the heightened uncertainty and fear fueled by the conflicts in the Ukraine and the Middle East.2

Gold Prices and the Economy

The trajectory of gold prices in 2024 are largely dependent on which direction the economy goes in the next twelve months – whether we have a soft landing (inflation dropping without a recession), a hard landing (inflation dropping with a recession) or no landing (inflation continues to rise). The World Gold Council sees only a 5% to 10% chance of the ‘no landing’ scenario that would push gold prices down. In the other two cases, gold prices are expected to keep climbing.

Until we see either the soft or hard landing, there is enough economic uncertainty to sustain the demand for gold. The uncertainty is stemming from geopolitical conflicts, looming US elections, and potential rate cuts by the Federal Reserve.

Soft Landing

World Gold Council economists put the probability of a soft landing between 45% and 65%. Currently, the market outlook for 2024 foresees modest growth. The slowdown may reduce inflation. In which case, central banks could consider rate cuts. This soft-landing is favored by stock investors because cutting rates usually increases stock prices. But a soft-landing hinges on precise policymaking and external factors aligning perfectly.3

Historically, the Fed has managed a soft landing only twice following nine tightening cycles over the past five decades. The other seven ended in a recession. This makes sense because when interest rates stay higher for longer, pressure on financial markets and the real economy generally builds.

In a soft-landing scenario, gold prices may not climb as quickly, but they are not predicted to go down.

Hard Landing

The World Gold Council gives 25% to 55% chance of a hard landing with a recession. Several commonly monitored indicators still indicate a fair to substantial likelihood of a recession. On average, these signs indicate a 45% chance of a recession within the next 12 months.4

Economists point to the unemployment indicator in particular. The factors supporting the strong labor market are shifting more and more quicky. Historically, US recessions start roughly between five to 13 months after payroll growth hit levels comparable to today. Additionally, the Sahm rule, a St. Louis Fed-developed unemployment gauge, hints that a recession might be only a few months away.

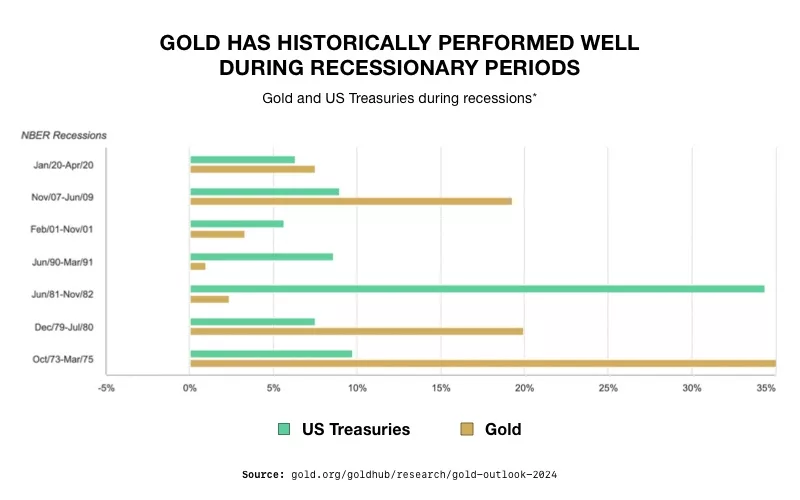

A recession will help push inflation towards the Fed’s 2% target. Interest rates would eventually be cut in response. Such an environment has historically created a positive environment for gold. Under these conditions, gold prices would rise “notably higher.”

5

5

No Landing

The only situation where gold does not benefit is the ‘no landing’. This situation involves a resurgence of inflation and growth. The chance of this happening is very small. The Council puts it at 5%.

Even if a no-landing scenario happens, it would most likely be temporary. As Morgan Stanley put it, “A no landing is just a soft or a hard landing waiting to happen”. Any action by the Fed is most likely to force a hard landing situation. 6

Other Factors

Historically, a soft-landing or no landing situation does not benefit gold. But now, there are a couple of factors working in gold’s favor.

Geopolitical risks: In 2023 there were two significant event risks – the SVB failure and the Israel-Hamas conflict. Geopolitics added between 3% and 6% to gold’s performance. As the banking crisis simmers and the middle east conflict heats up, major elections are taking place globally – increasing uncertainty all around. The demand for portfolio hedges will likely be higher than normal.

Central bank demand: Purchases by official institutions have helped gold defy expectations over the past two years. In 2023, central bank demand added 10% or more to gold’s performance. Central banks are predicted to keep up their buying pace in 2024. The Council anticipates that any above-trend buying (i.e. more than 450–500 tons) should provide an extra boost.7

Conclusion

The World Gold Council presents a case whereby there is only a small percent chance that gold does not keep rising in 2024. And even if that case does occur, it will most likely be temporary. Gold’s appeal as a safe haven asset against inflation, recession, and geopolitical uncertainty can drive it to new all-time highs next year. Which means the time to start investigating how a Gold IRA can benefit you is now. Contact us today at 800-462-0071 to learn more.