Silver Prices Swell

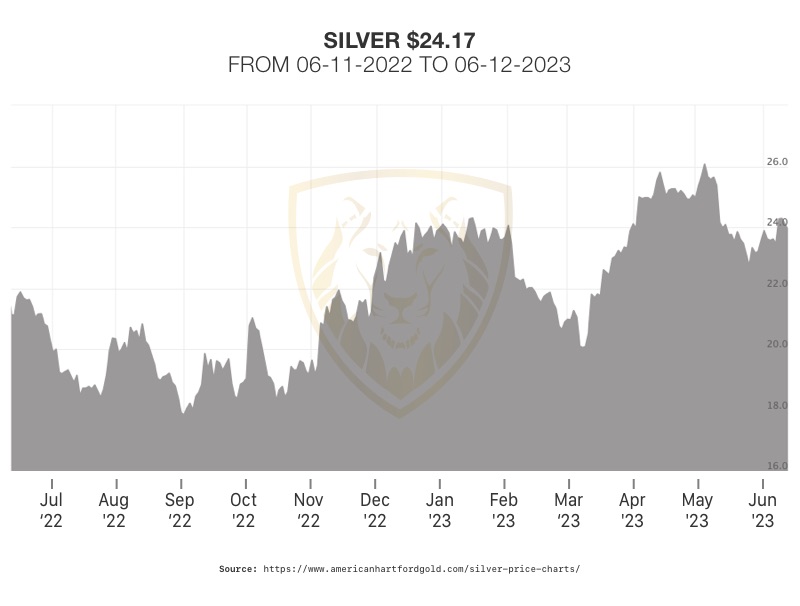

A golden opportunity is presenting itself in the silver market. Over the past few months, silver prices have been on the rise. In mid-September last year, silver traded at $20 an ounce. This week it reached $24, up by about a fifth. Measured in sterling, silver is around 17% higher. It is outpacing even gold’s impressive surge. But this may just be the beginning. The factors fueling this ascent are strengthening. Robust industrial demand, diminishing supply, and a macroeconomic landscape are polishing silver’s shine.1

2

2

Industrial Demand and Growing Applications:

Silver possesses a wide range of industrial applications. It is highly sought after beyond its appeal as an investment asset. Silver is a vital component for almost all electronics and solar cells. Silver’s value is bolstered by the increasing demand from the growing electric vehicle and solar power industries. In fact, the Silver Institute reports that all major categories reliant on silver achieved record highs in 2022. Last year, a new high in total silver demand grew by 18% and hit 1.242 billion ounces. Industrial demand for silver rose by 5%, physical investment increased by 22%, and the jewelry and silverware sectors saw impressive growth rates of 29% and 80%, respectively. Robust demand is projected to keep growing over the next few years.3

Supply and Demand Dynamics:

As demand was surging, global mine production of silver has been falling, creating a structural deficit. The 2023 World Silver Survey showed the market deficit hit 7,393 tons, an all -time high. The Silver Institute highlights that last year, the silver market achieved its second consecutive annual structural deficit. At 237.7 million ounces, it is possibly the most significant deficit on record. This supply-demand imbalance, coupled with diminishing silver supplies, suggests a continued upward pressure on silver prices.4

Macroeconomic Factors:

The current macroeconomic landscape further strengthens the case for silver. Lingering inflation concerns are keeping the pressure on central banks to keep interest rates high. As a tangible asset, silver serves as an effective hedge against inflation for investors seeking to preserve their wealth. Additionally, rising geopolitical tensions are sustaining market uncertainty. The ongoing situation in Ukraine and aggressive Chinese polices are reinforcing the appeal of safe-haven assets like silver.

The Gold-Silver Ratio:

It’s “the oldest continuously tracked exchange rate in history”, says Investopedia. 5 The gold-to-silver ratio is a simple metric that compares the price of gold to that of silver. It is calculated by dividing the price of gold per ounce by the price of silver per ounce. The gold-to-silver ratio is currently at 85. It historically ranges between 65 and 75. This indicates that gold prices have risen faster than those of silver.6

Analysts interpret this to mean that silver may outperform gold in the future. They have observed a pattern in the gold-to-silver ratio. Significant rallies in the price of silver occur when the ratio enters the 80 to 100x range. Notably, this pattern has unfolded in 1991, 2002, 2009, and 2020. As the current ratio hovers around 85, near the upper end of its century-long range, it implies that silver is undervalued compared to gold. It may therefore experience an upward correction, potentially resulting in substantial returns.

Future Outlook:

Analysts say silver will rise 20% over the next 9-12 months. Looking beyond 2023, the outlook for silver remains promising. Global demand for silver is projected to rise at a compound annual growth rate of 3% between 2022 and 2026. That would surpass the anticipated silver supply during the same period.7

Silver is positioned to do well whichever direction the economy turns. To stop inflation, the Fed may keep interest rates high and cause a recession. If a recession drives down demand for industrial uses, the demand for safe haven silver is likely to increase. Moreover, if the Federal Reserve starts cutting rates in response to bank failures, the opportunity costs of holding silver would decrease. This could potentially support another upsurge in its price. Analysts project the price of silver to break $100 per ounce within five years.8

The time may be right to add a silver lining to your portfolio. Silver prices are on the rise. Sustained industrial demand, supply constraints, and favorable economic conditions are predicted to push prices even higher. The historical evidence and market dynamics hold the promise of significant potential returns for years to come. Learn more about the role silver can play in a Gold IRA by contact us today at 800-462-0071.

Notes:

1. https://moneyweek.com/investing-in-silver-bull-market

2. https://www.americanhartfordgold.com/silver-price-charts/

3. https://www.valuewalk.com/silver-market-deficit-reaches-all-time-high-in-2022-amidst-investor-indifference/

4. https://www.valuewalk.com/silver-market-deficit-reaches-all-time-high-in-2022-amidst-investor-indifference/

5. https://investinghaven.com/commodities-gold/historic-silver-rallies-and-the-gold-to-silver-ratio/

6. https://moneyweek.com/investing-in-silver-bull-market

7. https://moneyweek.com/investing-in-silver-bull-market

8. https://moneyweek.com/investing-in-silver-bull-market