- The latest Consumer Price Index shows inflation is slowing down but far from over

- Coupled with the banking crisis, the Federal Reserve may pause any future interest rate hikes

- Gold is increasing in price, with analysts predicting potential new highs

New Data Shows Persistent Inflation

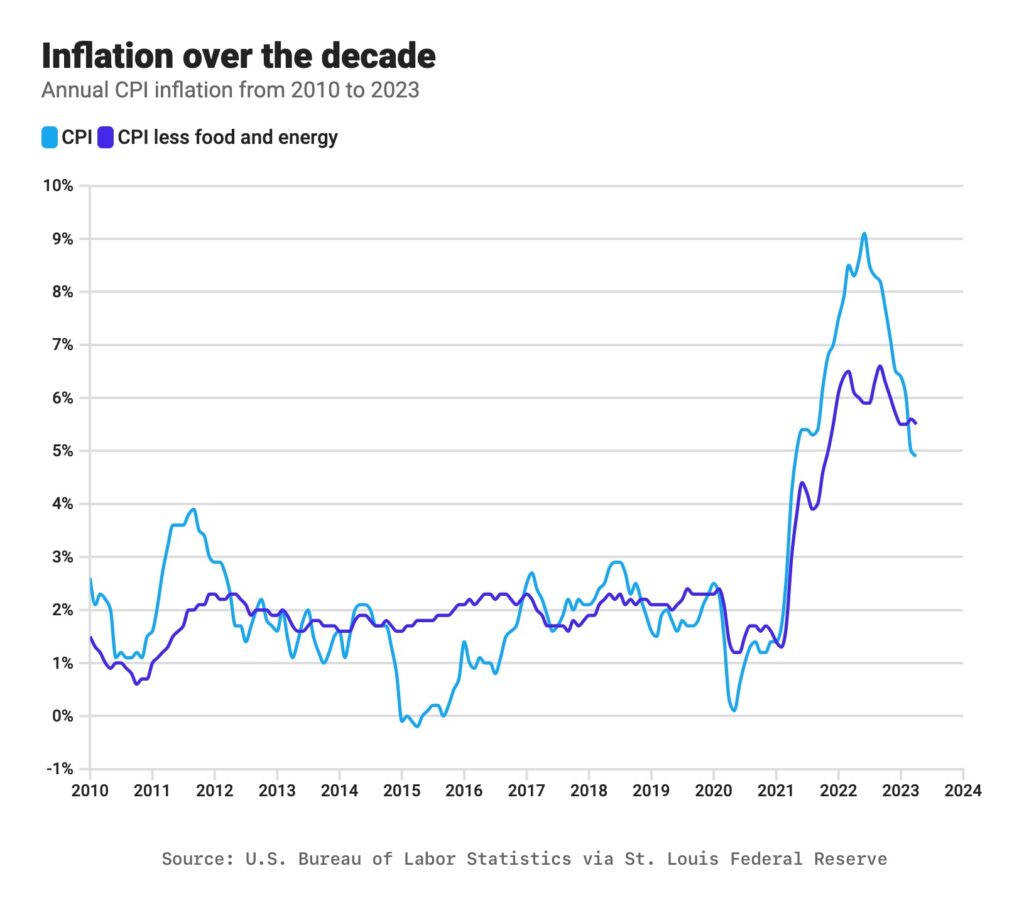

The latest Consumer Price Index report shows that while inflation may be decelerating, it is bound to linger in our economic landscape well into the foreseeable future. The index rose 4.9% in April from a year earlier. This marks the 10th straight month of easing inflation. Yet, inflation remains historically high despite the slight easing, with a recent peak of 9.1% in June 2022. US stocks opened higher, the dollar fell, and US Treasury prices rose in response to the data. But consumers are still suffering in essential areas, while Federal Reserve policy and the price of gold react to the new information.1

Rising prices of shelter, gasoline, and used cars contributed to the inflation numbers. Shelter costs, contributing to 40% of core inflation, rose by 0.4% in April and 8.1% over the past year. Gasoline prices spiked after a decrease in March. The rise was driven by OPEC+ oil producers’ announcement of further oil output cuts. Used car and truck prices increased by 4.4% in April, reversing previous declines. The cost of groceries fell slightly, but food prices are still higher compared to a year ago.2

Core prices, excluding food and energy, rose for the fifth consecutive month. Economists consider core prices as a better predictor of future inflation. In the 12 months through April, the core CPI increased by 5.5%, showing strong underlying inflation.3

“Inflation has moved beyond sticky at this point and after three months of core CPI hanging above 5%, it’s become tenacious,” said Robert Frick, corporate economist with Navy Federal Credit Union. “Given the biggest contributor to high CPI once again was shelter, and home sales prices have hit their own plateau, we may not see significant drops in CPI until this fall.”4

5

5

Federal Reserve

Analysts believe the new CPI data is giving the Federal Reserve room to alter their policy. The Federal Reserve has been raising interest rates aggressively to combat inflation. The Fed’s rate increases have had significant effects on mortgage rates, auto loans, credit card borrowing, and business loans. Economists fear the rate hikes are driving the country into recession and fueling a recent wave a bank failures.

Even with the downward trend, inflation is still well above the Fed’s 2% target. “Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go,” Fed Chair Powell said. The CPI report suggests a potential need for rates to remain high for longer than anticipated, according to economists.6

The Federal Reserve recently raised interest rates to the highest level in 16 years. This is its fastest monetary policy tightening campaign since the 1980s. The Fed has hiked its policy rate by 500 basis points since March 2022. But the language in their statement suggested a possible pause in further increases. The Fed will weigh various factors to determine the need for future rate hikes.7

Powell indicated that the Fed has yet to decide whether to suspend rate hikes but acknowledged the possibility. He said Fed will take a data-dependent approach moving forward. In a statement after its latest policy meeting, the Fed removed a sentence from its previous statement that had said “some additional” rate hikes might be needed. It replaced it with language that said it will now weigh a range of factors in “determining the extent” to which future hikes might be needed.8

Gold

Gold prices rallied after the CPI report came in close to market expectations. Gold’s uptrend depends on a weaker U.S. dollar and lower interest rates. Some analysts believe gold could reach record highs due to a pause on interest rate hikes, debt ceiling concerns, and China’s continuing buying spree. China is expanding its gold reserves and potentially reducing its holdings of US Treasuries in favor of gold.

Edward Morse is the global head of commodities strategy at Citi Research. He predicts gold prices will eventually reach $2,400 an ounce. Citigroup is bullish on gold but emphasizes the need for patience and acknowledges the choppy road ahead. He said, “The gold prices are really an anticipation of what’s going to happen to interest rates and what’s going to happen to the US dollar. Clearly, there is a lot of money to be made.”9

The latest Consumer Price Index information holds both promise and pitfalls. Consumers should brace for elevated inflation to become a fact of life. However, there is now more cause for the Federal Reserve to pivot from its course of aggressive rate hikes. Even more so in the face of a spreading bank crisis and a looming recession. With gold positioned to rise, now is an opportune time to safeguard your portfolio with precious metals. A Gold IRA from American Hartford Gold can not only secure your wealth from inflation but can also potentially grow it. Contact us today at 800-462-0071 to learn more.