Gold Prices Soar

Gold prices are experiencing a remarkable surge. They are poised for the most substantial monthly gain in four months. Gold has rallied more than 5% in the past 6 months and around 15% in the past year. It is supported by signs that rate hiking is nearing an end, buying by central banks, and safe haven demand. This past May, gold approached its record high of $2,075 set in 2020. Major banks are now predicting gold to hit new heights in 2024 as recession undercuts paper assets.1

Impact of Interest Rates

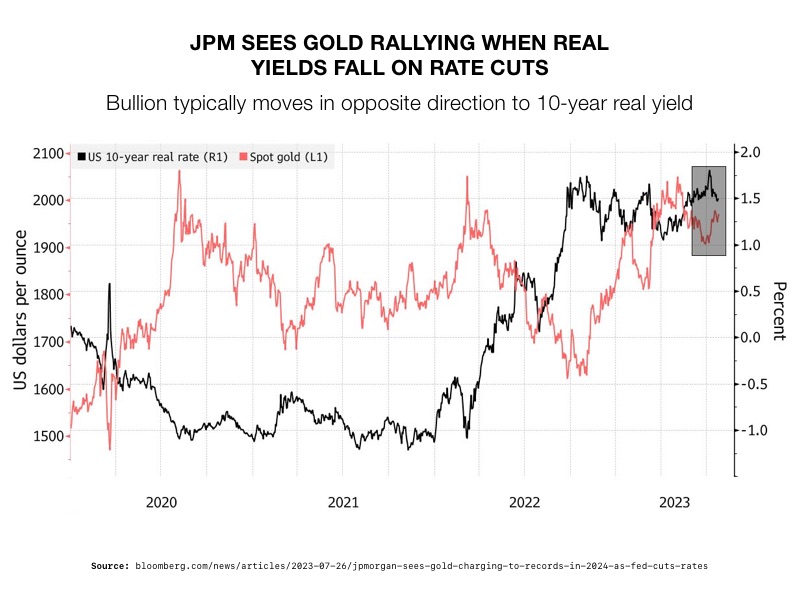

The fate of interest rates is one of the primary tailwinds pushing up the prices of gold. There is a belief amongst investors that interest rates are at or near their terminal level. This belief was bolstered when, in June, inflation rose at its slowest pace in over two years. That opened the door to the end of the most aggressive rate cycle since the 1980s. The European Central Bank also hinted at an end to their steepest and longest series of rate increases. As interest rates decline, the appeal of non-interest-paying assets like bullion rise.

Meanwhile, the dollar is heading for its second consecutive monthly decline. As gold is priced in dollars, this contributes to its further upward trajectory.

Another catalyst will be if the Fed not only stops hikes but begins cutting rates. Fed Chair Powell said, “The federal funds rate is at a restrictive level now. So, if we see inflation coming down credibly, sustainably, then we don’t need to be at a restrictive level anymore, we can, you know, we can move back to a neutral level and then below a neutral level at a certain point.” Naturally, he added that the Fed “of course would be very careful about that,” but he continued: “you’d stop raising long before you got to 2% inflation, and you’d start cutting before you got to 2% inflation too.”2

The predicted upward swing in gold is support by global factors as well. Analysts see the price going a higher as China’s stimulus measures take hold. In addition, central banks continue to buy record volumes of gold. JPMorgan’s Director of Global Commodities said, “There’s an eagerness here to really buy in and diversify allocation away from currencies.” He added that geopolitical risks have made gold even more appealing to governments. Overall, global central bank gold reserves increased by 228 tons in the first quarter of 2023. This was 38% higher than the previous first-quarter record set in 2013.3

According to the 2023 Central Bank Gold Reserve Survey released by the World Gold Council, 24% of central banks plan to add more gold to their reserves in the next 12 months. Seventy-one percent of central banks surveyed believe the overall level of global reserves will increase in the next 12 months. That was a 10-point increase over last year.4

Rooting for Bad News

Goldman Sachs economists said markets are returning to a “bad is good” reaction to economic data. A worsening stock market and contracting economy make the Fed more likely to cut rates. “Equity investors may actually prefer soft growth data—because growth above the 1-2% channel of 2022 would make additional rate hikes more likely.” According to them, the path to rate cuts runs thru worsening economic conditions.5

JPMorgan Chase sees opportunity in gold ahead of a likely US recession. They predict prices will push past $2,000 by year end. The bank sees prices hitting fresh records in 2024 as interest rates fall. JPMorgan predicts gold hitting $2,175 an ounce in the final quarter of 2024. A recession forecast could push it even higher. A more pronounced recession could result in more dramatic rate cuts, which translates into higher gold prices.

6

6

And that recession is looming. There have been 15 consecutive drops in the index of leading economic indicators, an inverted yield curve , and a rising number of corporate defaults. When the Fed cut off access to ‘free’ money, it pulled the rug out from under the economy. Now it’s bottoming out. The situation has a frightening resemblance to the situation in 2008 when the Fed took easy money out of an overleveraged economy. 7

Analysts from other major banks are all bullish on gold. Goldman Sachs recently hiked its 12-month gold price target to $2,050 an ounce from $1,950, joining others such as Citi, ANZ, and Commerzbank in raising forecasts. Bank of America has its price target set at $2,100. Wells Fargo recently raised its 2023 year-end target range for gold to $2,100 – $2,200 per troy ounce, and established its 2024 year-end target range of $2,400 – $2,500.8

Driven by a variety of factors, the price of gold seems bound to an upward trajectory. Now is the time to move into gold before prices go even higher. Especially when retirement funds are facing the threat of recession. You can protect the value of your 401(k) or IRA with a Gold IRA from American Hartford Gold. Contact us today at 800-462-0071 to learn how.