- The Federal pause on student loan repayment is coming to an end

- The Supreme Court is deciding the legality of Biden’s loan forgiveness

- Economic hardship caused by renewed payments may be enough to tip the economy into recession

Student Debt Comes Due

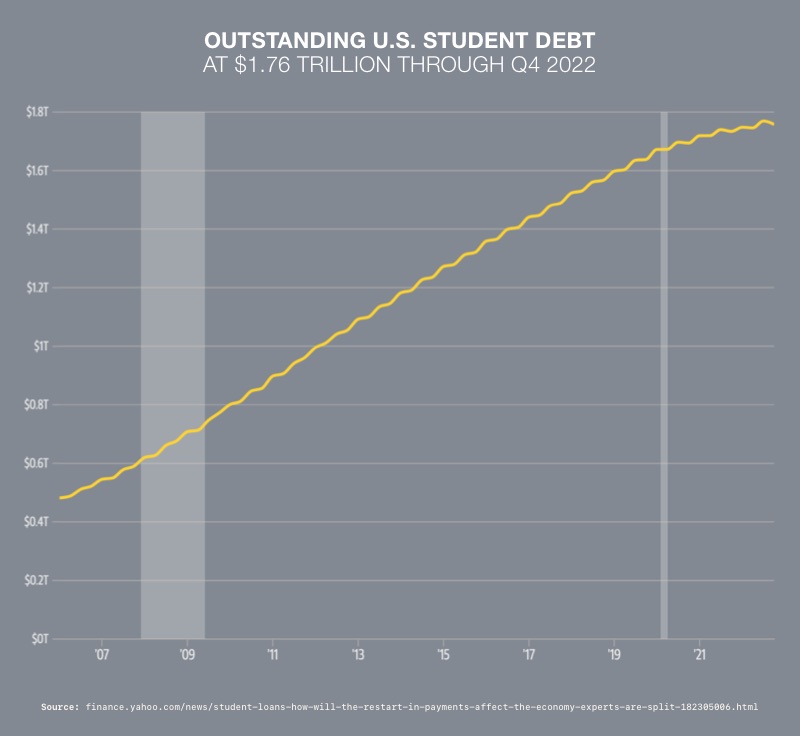

America’s higher education bill is coming due, and the economy may pay the price. For more than three years, federal student loan borrowers haven’t had to make monthly payments. Those payments hover between $200 and $300. All told, borrowers are set to resume paying about $10 billion a month. As we speak, the Supreme Court is weighing the merits of Biden’s loan forgiveness. While politicians and borrowers await the Supreme Court’s ruling, analysts fear the economy will suffer, along with retirement funds, no matter what the Court decides.1

2

2

Student Debt Paused

In March 2020, President Trump implemented a student-loan payment pause to give relief during the pandemic. Biden has continued to extend the pause. He most recently extended it 60 days after June 30. In other words, 60 days after the Supreme Court issues a final decision on the legality of Biden’s plan to cancel up to $20,000 in student debt. This most recent extension will most likely be the last. The end of the pause was written into the debt ceiling deal with Speaker of the House McCarthy.

Some economists saw the pause as a boon to the economy. The Education Department estimated the pause put $5 billion back in borrowers’ pockets. Money that would have gone to debt payments went into consumer spending instead. Marshall Steinbaum is an economics professor at University of Utah. He said, “it’s pretty clear the payment pause has been very stimulative to the macroeconomy.” Conversely, he followed up by saying the government is going to be put in the position of trying to collect debt that can’t be repaid. And that squeezing borrowers will be bad for the economy. Resulting in what Steinbaum called, “a pretty severe fiscal contraction.”3

Supreme Court Decides

Eight million borrowers stand to receive loan forgiveness. The Supreme Court will issue a decision about the legality of the student debt relief this month. Lawmakers aren’t waiting for that decision. They’ve already passed a bill to overturn Biden’s debt relief and end the payment pause.

4

4

Tipping the Scales into Recession

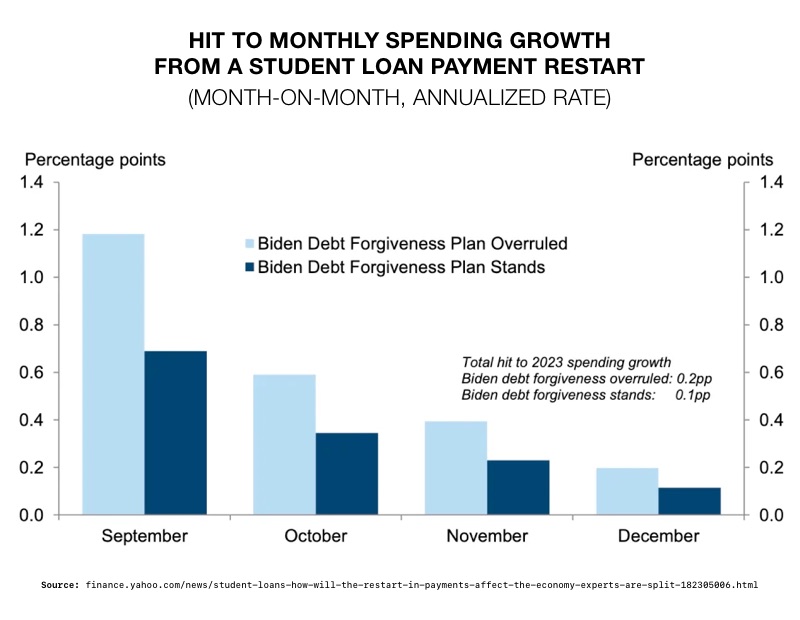

The economy, while fragile, is recovering from the pandemic. Some analysts think resuming student loan payments may jeopardize that recovery.

Mark Zandi is the Chief Economist at Moody’s Analytics. He said, “In a typical economy, the impact of restarting payments wouldn’t tip the US into recession. But in the current environment with the economy as weak as it is, recession risks as high as they are, a couple of tenths of percent can matter.”5

The odds of entering a recession are being debated now. A resilient labor market and strong consumer spending, even after aggressive rate hikes, are giving some hopes of a ‘soft landing.’ Deutsche Bank holds no such hopes. They’ve declared that an economic downturn is 100% inevitable. They base this opinion on a few factors. The short-term benchmark fed funds rate stands at the highest level since 2006. But inflation’s still twice the Fed’s goal. Fed Chairman Jerome Powell warned that more rate hikes will likely be necessary to further cool inflation. Deutsche Bank thinks a recession is needed to finally break ‘sticky’ inflation. Their chief economist stated, “Avoiding a hard landing would be historically unprecedented.” 6

Goldman Sachs sees the end of the pause as a break-even situation. If the Court rules in favor of forgiveness, Goldman Sachs estimates $400 billion in loan balances would be erased. If the Court rules against relief, Goldman predicts the decrease in disposable income would create a drag on public spending. Their calculations show a return to loan payments will equal the loss of consumer spending.7

Borrowers themselves are much less optimistic. A Credit Karma survey found that 43% of borrowers do not feel financially stable and 21% had no savings. A similar survey found that 53% of borrowers said their financial stability depends on loan forgiveness or the federal forbearance period. 26% were using money that would have gone to loan payments for bills and necessities.8

The Federal Reserve Bank of New York found missed debt payments are higher than before the pandemic. This could be a sign of more financial problems for borrowers once the federal forbearance ends.

Economic Impact of Repayment

While general spending may decrease across the board, retailers will be particularly hard hit. UBS and JPMorgan both warn of a coming “ice-age for retail” because it caters to millennials, the largest holders of student loan debt.

The resumption of student loan payments alone won’t crash the economy. But they may be the straw that breaks the camel’s back and pushes the US into a recession. A recession would bring increased unemployment and reduced corporate earnings. Stock prices, and in turn, retirement funds, could drop as a result. Government relief or not, that bill is going to be paid one way or another. Someone else’s education may result in a drop in your retirement savings. To preserve the value of your retirement funds before this happens, investigate the benefits of a Gold IRA. Contact an American Hartford Gold specialist at 800-462-0071 to learn how you can protect your savings.