The Looming Recession

The specter of a recession in 2023 has been haunting economists and the general public alike. As government officials evaluate various economic indicators, people are forming their own perceptions about the state of the economy. Current data is leading to different views on the timing, severity, and impact of the impending recession.

The Government Point of View

There is a common belief that a recession has started when real gross domestic product (GDP) has fallen for two consecutive quarters. But the official declaration of recession is left to the National Bureau of Economic Research (NBER). And according to them, we are not in one…yet. NBER looks at several factors before they will call a recession. They define one as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

NBER said there was no recession in 2022 despite real GDP falling in the first and second quarters of the year. There are a few reasons why they say we haven’t entered a recession. First, real GDP grew in the 3rd quarter. Growth continued into the 4th quarter. Also, low unemployment rates are keeping NBER from calling a recession. There have been large tech layoffs in the headlines. But they aren’t large enough to drive the unemployment rate higher.

Many experts are predicting that NBER will call a recession later this year. Real GDP growth slowed again in the 1st quarter of 2023. The slowdown is attributed to aggressive interest rate hikes from the Federal Reserve. Inflation peaked in June 2022 at 9.1%. Since then, inflation has declined. It dropped to 4.9% in April 2023. But is still way above the Fed’s target of 2%. The higher rates translate into less cash available for investment. The credit crunch results in a contraction of economic activity. Profits decline and growth rates shrink.

There is already a consensus amongst international concerns that there will be a global recession. Macroeconomic trends are dragging down the global economy. High inflation, interest rate hikes by global central banks, and geopolitical tensions are stalling growth. Two thirds of The World Economic Forum economists expect a global recession in 2023.

View from the Private Sector

Small Business owners are not confident about the future. The National Federation of Independent Business saw its Small Business Optimism Index fall last October. It has not risen since. The index has been under its 49-year average for 15 consecutive months now.

Cliff Asness is a billionaire hedge fund manager. He sees the bond market pointing to aggressive rate cutting in the following years. According to him, the only way that would happen is if the country is hit by a severe recession. The Fed would then need to make drastic cuts to prime the economy. He followed that by saying “If inflation stays sticky or it comes down because we enter a nontrivial recession — it’s equities that I think are a scary place.” In other words, investors could expect a major drop in stock value.1

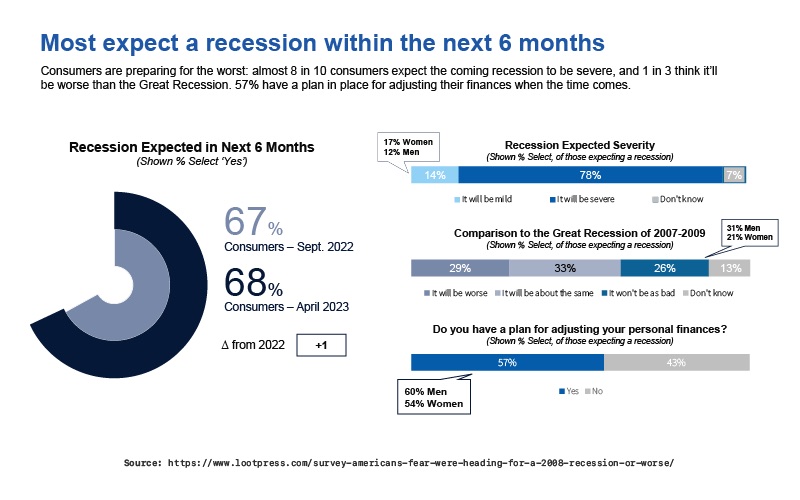

Professionals may be split on the likelihood of a recession, but the American sentiment is leaning towards one. The Nationwide 2023 Economic Impact Survey showed more than two thirds of Americans expect a recession in the next six months. Nearly 80% of those people expect it to be severe. And 62% think the next recession will be as severe or worse than the 2007-2009 Great Recession.2

Based on their data, Nationwide’s Chief Economist offered a mildly hopeful prediction. “Despite elevated inflation, trouble in the banking sector, and 10 consecutive interest rate hikes, we continue to forecast a moderate recession in the second half of this year, which stands in contrast to fears that we’re heading for another Great Recession,” said Kathy Bostjancic. Recession appears to be a certainty. Now it is a question of degree.3

4

4

Upside of Recession?

At the moment, the Fed is divided on which way to go on interest rates. Federal Reserve officials, including St. Louis Fed President James Bullard and Minneapolis Fed President Neel Kashkari, indicated that sticky core inflation may keep monetary policy tighter for longer. It could require more hikes this year. The more hikes, the worse the market does.

Micheal Yoshikami is founder and CEO of Destination Wealth Management. He said a recession could be ‘good news’ for markets. He believes the only way to get interest rate cuts is if the Fed responds to a prolonged recession. Without it, interest rates will remain high and the problems they cause will continue.

“If the economy avoids [recession] and keeps on its frothy path, then I think we’re going to have some problems in the market in the second part of the year,” said Yoshikami.5

Recession impact on Retiring

People nearing Social Security age or currently receiving Social Security should know how a looming recession could potentially impact their benefits.

Recessions often lead to job loss. If your income is cut or lowered during a recession, it can lead to a lower monthly social security benefit in retirement. Social Security calculates your benefits by taking a percentage of your average income during the 35 years when your earnings were highest (adjusted for inflation). A drop in income could lower one (or more) of the 35 years of earnings that will be used to calculate your Social Security benefit.

Studies have shown there’s an increase in early Social Security claims during recessions. People simply need the money sooner. But claiming your benefits early reduces the amount of money you receive each month. This could lead to a substantial loss of income over your retired years.

In addition, Social Security uses a cost-of-living adjustment (COLA) to help offset the effects of inflation. If a recession causes inflation to slow drastically, the COLA could be noticeably lower the following year. In the event it turns into deflation (which isn’t ideal), there would be no COLA at all.

There are some analysts holding out hope for a ‘soft landing.’ But building on hopes is like building on sand. Instead, you should make plans based on the evidence. And the evidence is pointing to recession. If you want to protect the value of your funds as the market contracts, then you should investigate a Gold IRA. It is designed to secure your wealth against recession. Call American Hartford Gold today at 800-462-0071 to learn more.