- The stock market dropped over 500 on news of rising inflation

- Fears of higher-for-longer interest rates fueled the massive sell off

- To hedge against stock market volatility, investigate the benefits of a Gold IRA

Stocks Crash on Inflation News

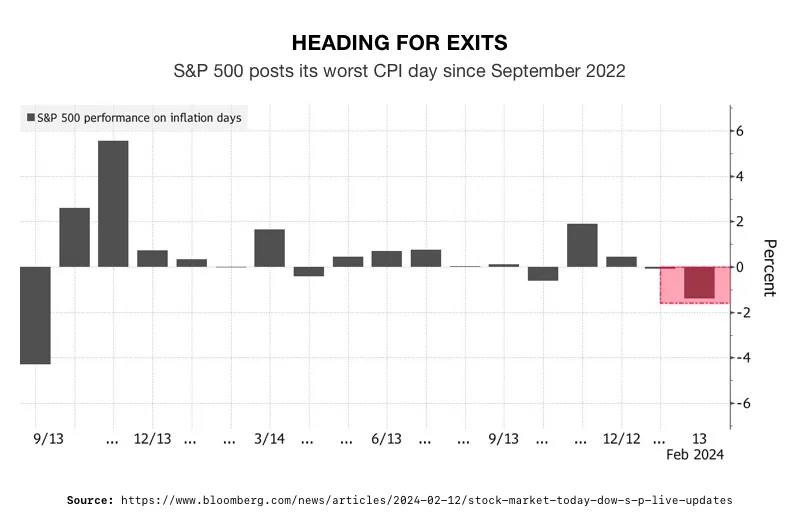

A volatile stock market plummeted more than 500 points after the release of the most recent inflation data. Coming in higher than expected, the elevated Consumer Price Index (CPI) created fears of higher-for-longer interest rates. The extreme uncertainty haunting the market emphasized the need for safe haven assets to protect portfolio value.

The Dow Jones Industrial Average fell 525 points on the CPI news. It was the largest single-day drop since March 2023. The benchmark erased almost half its gains for 2024. The blue chip index nosedived more than 700 points at its session lows. Meanwhile, the S&P 500 and the Nasdaq also fell. All 11 S&P sectors ended in the red, with rate-sensitive names falling the most.

The selloff comes after the Dow hit a record high close and the S&P 500 closed above 5,000 for the first time. Investors were riding a crest of enthusiasm based on signals that inflation was under control and interest rate cuts were on the horizon. That optimism crashed along with the market.1

2

2

State of Inflation

The latest Consumer Price Index report showed prices rose 3.1% for the 12 months ending in January. CPI rose on a monthly basis as well. Core inflation has been even more stubborn as housing costs have stayed higher than anticipated.3

Both inflation measures were hotter than expected. Economists thought inflation would slow to 2.9%. Shelter prices accounted for much of the rise. It contributed more than two-thirds of the headline increase. On a 12-month basis, shelter rose 6%.4

Food prices were also higher. But a drop in fuel costs is what caused headline inflation to be 3.1% while core inflation is up at 3.9%. With the Middle East so volatile right now, fuel could send inflation lurching back up on a moment’s notice. Inflation-adjusted hourly earnings increased .3% for the month. But, when adjusted for the decline in the average workweek, real weekly earnings actually fell .3%.5

The Fed vs Wall Street

Stock prices rose on expectations of a rate cut as soon as May. Now traders don’t foresee a first rate cut until June or July.

“The stock market can’t keep rallying if rates are going to be higher-for-longer — especially if the assumption that the Fed is completely done raising rates is incorrect,” wrote Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, in a Tuesday note.6

Wall Street had priced in about six rate cuts for 2024. They interpreted Fed signals that rates would start coming down from 22-year highs. Atlanta Fed President Raphael Bostic squashed Wall Street’s optimism by saying he doesn’t see the Fed cutting rates until the summer. The Fed wants to avoid any upticks in inflation. They believe cutting too early could raise that risk.

“We continue to expect the FOMC to leave the Fed funds rate unchanged at the March meeting and to begin the easing cycle in May,” said Jan Hatzius, chief economist at Goldman Sachs.

While over 91% of market participants agree with Hatzius, the majority, 62%, don’t expect any move at the May meeting, according to the CME’s Fed Watch Tool. Expectations for June are even more iffy, with just 24% expecting a cut.7

The Fed is, and has always been, focused on inflation. They explicitly have stated that rates won’t come down until there is clear data that inflation is on a definite trajectory to 2%. With continued growth and a strong labor market, the Fed does not feel the need to worry about high rates crushing growth.

But an overeager Wall Street only seemed to be hearing what they wanted to hear.

“The much-anticipated CPI report is a disappointment for those who expected inflation to edge lower allowing the Fed to begin easing rates sooner rather than later,” said Quincy Krosby, chief global strategist at LPL Financial. “Across the board numbers were hotter than expected making certain that the Fed will need more data before initiating a rate cutting cycle.”8

Conclusion

Wall Street may be setting themselves up for a bigger fall. A Bank of America survey found investors are cutting cash holdings and plowing it into stocks. Global stock allocation is at a two-year high. It seems as if investors are experiencing FOMO on the surge of the ‘Magnificent 7’ tech stocks. But they are building on uncertain foundations. Even a slight uptick in inflation sent the market plummeting. Overvalued stocks could fall even further with just a hint of negative news from the Fed.

Therefore, now is the time to look for assets that can protect the value of your portfolio, such as physical precious metals. Even with the prospect of higher-for-longer interest rates, analysts point out that gold is staying in a range of approximately $2,000 and $2,100. Worsening economic, political, or financial issues could take gold over $2,100. When placed within a Gold IRA, you can obtain wealth protection and tax advantages. To learn more before stocks dive again, call us today at 800-462-0071.9