Silver Prices Predicted to Soar

Analysts say 2024 is silver’s year to ‘shine.’ The metal is predicted to outperform this year due to limited supply, rising demand, and a weaker dollar. And with a gold/silver ratio pointing to a potentially massive upswing in price, now is the time to learn how silver can fortify your portfolio.

Silver’s demand is multifaceted, stemming from jewelry, silverware, investment, and various industrial applications. Its unique properties are essential for the burgeoning solar and electronic sectors, further fueling its widespread consumption.

Not Enough Silver in the World

Peter Krauth is the author of The Great Silver Bull. He sees silver on exponentially upward trajectory. He grounds his forecast in the deficit of silver in the world compared to international demand. The current deficit is the second highest on record. If you add together the deficits of the last three years, it’s nearly half of the entire silver supply for 2023.

Silver prices did drop in 2023. But Krauth says demand is correcting not collapsing due the massive buying in 2022. “Physical investment was off the charts last year (2022), 333 million ounces,” he said. “And if you look at jewelry last year, also off the charts, 235 million ounces. These two categories were just so outsized compared to where they’ve been, so it’s just not all that surprising that we’re seeing things come back down to earth a little bit.”1

Deficits are going to stay elevated way into the future as supply won’t be able to catch up. Mine production continues to be down. Bank of America said, “we’re not revisiting the 2016 highs in mine supply for any number of years going forward.” And recycling, only 15% of overall supply, is only expected to grow 1%.2

This deficit will increase as demand rises. A report by Oxford Economics for the Silver Institute projects total demand growth of 42% between now and 2033. That is double the growth rate of the last ten years.3

Investment Demand

Kraut sees outsized growth coming from the investment community. Investment demand was at 163 million ounces in 2023. Analysts forecast that number jumping up to 282-290 million ounces for physical investment in 2024.4

Investment demand can counterbalance any drop in industrial demand caused by a recession. However, the impact of an economic slowdown on silver may not be too great. That’s because there is tremendous government support for solar and green transitions. When the recession ends, or if the Fed manages a ‘soft landing’, industrial demand is forecasted to leap.

Investment Banks Like Silver

Analysts at TD securities said lower interest rates, rising industrial demand, and increasing investor interest will cause silver to outperform in 2024. They see silver hitting $26 by the middle of the year.

JP Morgan’s commodity analysts are also bullish on silver. “Across commodities, the only structural bullish call we hold is on gold and silver,” they wrote, adding that “a breakout rally is expected around midyear 2024.” They also expect silver prices to reach $26 per ounce by mid-year, and $30 in 2025.5

And BMO capital markets upgraded their already positive forecast for silver. They see gold’s rise, which should help pull up silver, and silver’s fundamentals resulting in an additional 5% increase over their original 2024 projections.

BMO noted investment demand will power the increase. Investors will be competing with consumers for materials, driving up prices. They also see the global move away from the dollar giving price support.

“This is over and above the wider trend of emerging market de-dollarization and diversification of holdings, which we expect will continue to underpin gold and potentially silver demand again in 2024.”6

Kraut also points to de-dollarization lifting silver. “Gold and silver are the ultimate anonymous liquid alternative,” Krauth said. “In terms of sovereignty, these things (silver) can start to become a lot more attractive. And we know that major nation central banks want to move away from the dollar.” A weaker dollar is very supportive of silver.7

UBS stated that silver is on course to “really, really shine” as interest rate cuts come to pass. They cited that silver tends to outperform a move in gold. With the bank predicting gold to hit $2,200 after rate cuts, they think a move in silver “could be quite dramatic.”8

Heed The Gold/Silver Ratio

9

9

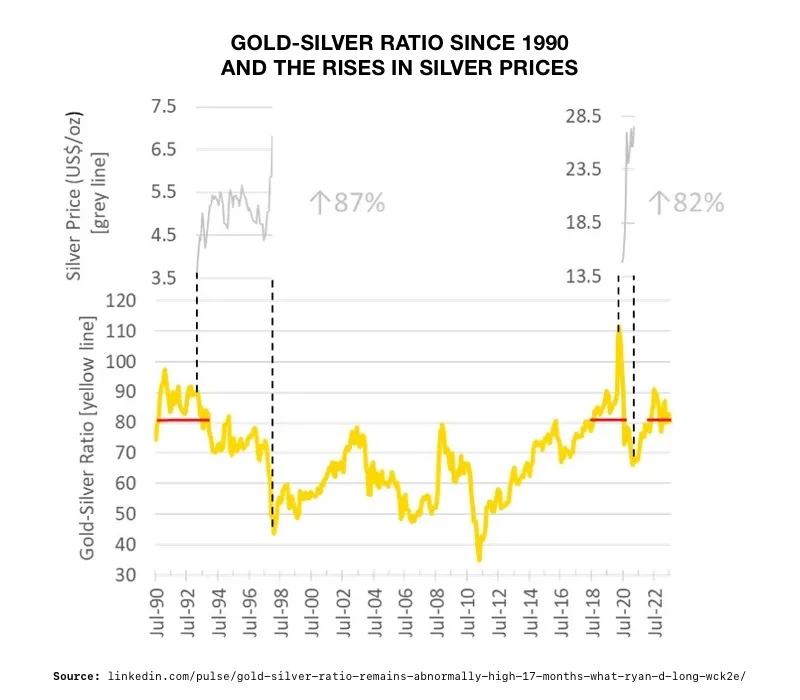

The gold/silver ratio, currently above 90, indicates how many ounces of silver are needed for one ounce of gold. This ratio can change over time based on market conditions. It is used by investors to decide which precious metal might be a better value at a given moment.

Historically, the price of silver has exploded exponentially when the ratio has been in this position before. In the early 1990’s, the gold-silver ratio remained above 80 for 39 months. At the end of this high-ratio period, the silver price rose 87% over the next 5 years. In 2008, when silver was trading at $9.70, we saw a 400% increase in the silver price over the next three years to hit a record high of $49.82.10

Then, in the late 2010’s, after the gold-silver ratio remained above 80 for 20 months, the price rose 82% over 15 months.

The gold-silver ratio has, by and large, remained above 80 since May 2022. Based on historic data, when the ratio does drop below 80%, silver prices could rise from their current level of about $21 an ounce to all-time highs.11

Conclusion

Market forces, interest rates and geopolitics are setting the stage for a potentially massive leap in silver prices. Now is the time to investigate how diversifying your precious metals holdings in a Gold IRA can protect, and potentially increase, the value of your portfolio. Call today at 800-462-0071 to learn more.