Is the World Leaving the Dollar Behind?

The U.S. dollar’s value rests on the full faith and credit of the government, but what happens when that faith begins to waver? In 2025, investors and institutions around the world are starting to ask that very question. Confidence in paper currencies is slipping, and gold is emerging as a trusted alternative. As the dollar weakens and the risks to fiat assets grow, these shifts aren’t just affecting global markets. They are beginning to touch every American’s savings and long-term financial planning.

The Dollar’s Worst Start in Over 50 Years

Rather than strengthening, the dollar has stumbled in 2025. The Bloomberg Dollar Spot Index, which tracks the dollar against 10 leading global currencies, fell nearly 11% in the first half of the year. It marks the worst six-month performance since 1973. U.S. trade policies, fiscal risks, and political uncertainty have shaken America’s status as a financial safe haven. Meanwhile conversations about reducing global reliance on the dollar are gaining momentum.1

2

What De-Dollarization Means

The U.S. dollar is still the world’s primary reserve currency, but its dominance is showing cracks. “The world has become long on the dollar in recent years, but as U.S. exceptionalism erodes, it should be reasonable to expect the overhang in USD longs to diminish as well,” said Luis Oganes, head of Global Macro Research at J.P. Morgan.3

This structural shift, known as de-dollarization, is already visible across multiple markets:

- Central bank reserves: The dollar’s share in foreign exchange reserves has slipped to a two-decade low. At the same time, the share of gold in reserves has more than doubled compared to a decade ago.

- Bond markets: Foreign ownership of U.S. Treasuries has fallen from over 50% during the Global Financial Crisis to about 30% in early 2025.

- Commodities: Energy and trade contracts are increasingly priced in non-dollar currencies, with the Chinese yuan gaining traction.

These moves point toward a world that is less dependent on the dollar and more open to alternatives like gold.

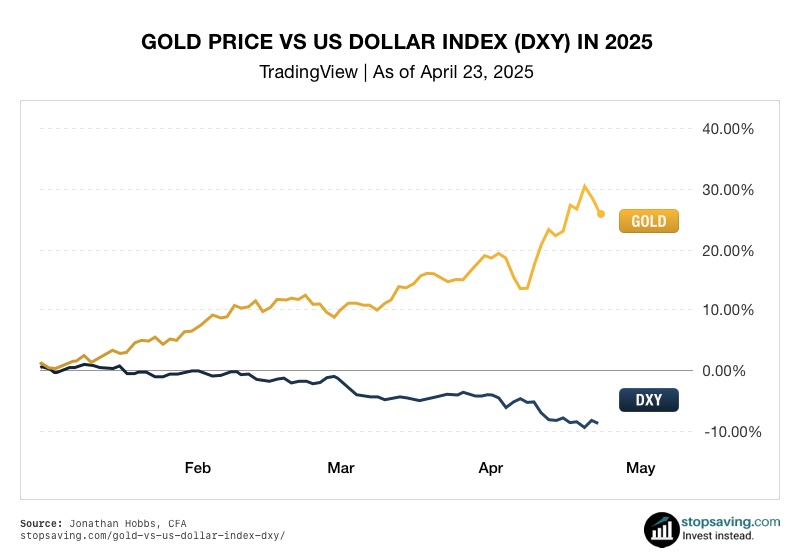

Gold Benefits

Gold has been one of the biggest beneficiaries of de-dollarization. Demand from emerging market central banks has helped fuel a long-term bull market. Analysts are forecasting prices could approach $4,000 per ounce by mid-2026.4

Already, gold is holding steady above $3,300 an ounce. It is reaching record highs against currencies such as the Japanese yen and nearing records against the British pound, euro, and Canadian dollar.

Thorsten Polleit, Honorary Professor of Economics at the University of Bayreuth, explained: “People are becoming skeptical of the purchasing power of all fiat currencies, and we can see this in the global gold market.”5

This shift is not just about fear. It is about recognizing gold’s unique role as a store of value in an era of monetary uncertainty.

Debt, Inflation, and Dollar Doubts

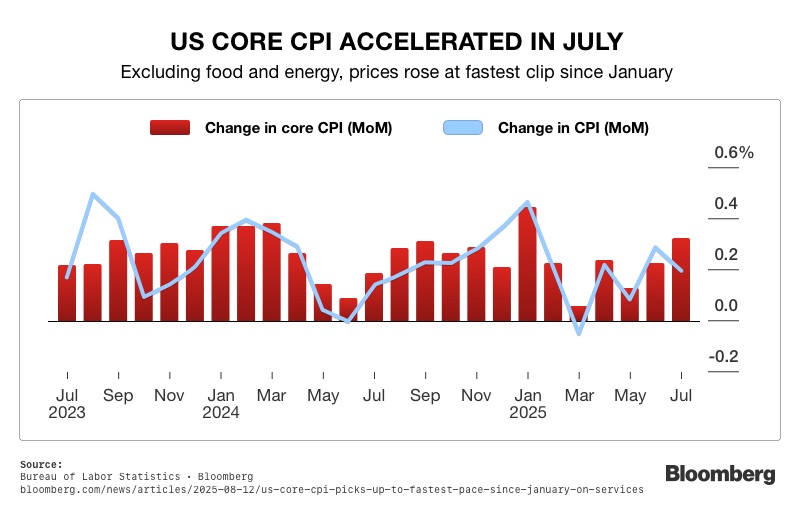

The weakness of the dollar also reflects the heavy burden of U.S. debt and persistent inflation. The Consumer Price Index rose 3.1% in July, underscoring the erosion of the dollar’s purchasing power.

Running deficits of 6% to 7% of GDP, much of it due to interest payments, has raised concerns that the U.S. may ultimately need to print more money to finance its obligations. As Polleit noted, “Once you get to the point where interest is basically overwhelming growth, that to me is an obvious signal that the debt cannot be repaid.”6

This environment makes it nearly impossible for central banks to raise interest rates aggressively without slowing growth. While markets anticipate rate cuts in the months ahead, lower yields are likely to push gold prices even higher.

Investor Sentiment Shifts Away from the Dollar

As confidence in the U.S. dollar wanes, global investors are reducing their exposure to the greenback. A Bank of America survey in August 2025 showed allocations to the dollar at their lowest since 2005, with fund managers favoring gold, Eurozone equities, the Swiss franc, and the Japanese yen instead. Bloomberg likewise reported that portfolios are being positioned for continued dollar weakness, as the greenback trades near levels last seen in the early 1970s.

These shifts are a clear sign of growing concerns about the longevity of the dollar’s dominance in global markets and the stability of fiat currencies overall. They are driving more investors to turn toward gold as a reliable store of value.

All Roads Lead to Gold

Ryan McIntyre is managing partner at Sprott Inc. He summed up the trend: “Gold obviously has great history as a safe-haven asset, and people have gravitated towards it. That’s why ultimately, I think all roads lead to gold for people looking for a safe haven.”7

This sentiment reflects a broader reality. Americans, like global investors, are looking for stability amid uncertainty. Political turmoil, fiscal imbalances, and weakening confidence in fiat currencies are steering capital toward assets that cannot be printed or inflated away.

Conclusion

The dollar’s recent performance signals more than just a cyclical dip. It reflects a deeper structural shift in global markets. A new financial order is emerging where the dollar no longer holds unrivaled supremacy. Alternative stores of value, particularly gold, are taking center stage. With dollar-denominated assets increasingly at risk, gold continues to rise as a reliable long-term store of value.

A Gold IRA can provide a long-term safeguard against these risks. It can help preserve wealth and maintain purchasing power over time. Call American Hartford Gold today at 800-462-0071 to learn more about securing a Gold IRA and protecting your financial future.