- Experts fear China’s gold buying binge is a prelude to an attack on Taiwan

- A Chinese attack on Taiwan is predicted to send the price of gold skyrocketing, hitting up to $5,000 an ounce

- Central banks and individuals are flocking to physical gold to secure their wealth during this time of political chaos

China Gold Buying: Prelude to Taiwan Attack?

Having learned a lesson from Russia, China has been sanction-proofing their economy for two years. Now, China’s leader Xi may be ready to achieve the long-sought goal of annexing Taiwan. A Chinese attack on Taiwan would shake the global economy and send gold prices soaring.

Experts say China has been preparing for a major action. They have been building trade relationships in the ‘Global South’, stocking up on oil and gas, and most notably, buying gold on a colossal scale.

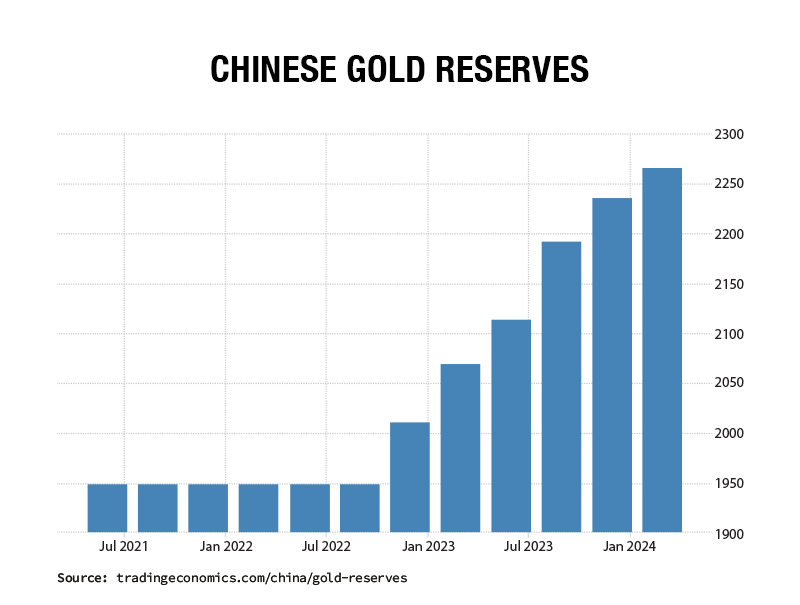

In the last 17 months, Chinese gold reserves, that we know about, soared 17%. They now have 73 million ounces of gold currently worth $170 billion. They have also raised their foreign exchange reserves to their highest level since 2015. This is looking to some analysts as a war chest meant to defend against sanctions brought on in response to an attack on Taiwan.1

2

2

Once thought impossible, a Chinese attack on Taiwan is looking more probable. Xi himself ordered his armed forces to be “ready to invade Taiwan by 2027.”3

Xi is thought to be encouraged by a few factors. He may have perceived Western weakness and disarray on Ukraine. China can capitalize on Iran increasing global instability. Thanks to Western sanctions, China has access abundant cheap energy from Russia. They have also secured supply chains and built-up strategic reserves of vital resources.

“Xi seems to have studied the sanctions playbook the West used against Russia over Ukraine and subsequently initiated long-lead protective measures to batten down the hatches of China’s economy to resist similar pressure,” Michael Studeman, former head of the Office of Naval Intelligence. Studeman continued, “”Xi likely knows attempting to assimilate Taiwan would lead to much fiercer global resistance and harsher whole-of-society repercussions that would likely last years. And he intends to ready China to endure them.”4

The move on Taiwan is looked at as potentially more than a territorial dispute. For the Chinese, it could be the dawn of a new world order with China at the top. Militarily, China is building up its nuclear arsenal, missile capabilities, and space-based weapons. The military expansion is backed by its massive espionage and cyber campaigns. Overall, China is positioning itself to usurp the role of global superpower.

Economic Attack

China’s attack may not be limited to Taiwan. Economists are interpreting China’s actions as a prelude to a global economic assault.

“China is preparing for something major. That seems increasingly obvious judging from the stockpiling of important resources. Could it be that they are preparing a major one-off devaluation of the CNY?” said Andreas Steno Larsen, CEO of Steno Research.5

Devaluing their currency is widely described as a “nuclear option” by economists. It could trigger worldwide consequences. The action would make their goods drastically cheaper, escalating a trade war with the US. The US is already accusing China of flooding markets with cheap goods. By hoarding gold and oil, China can hedge against the negative effects of a large devaluation.

Effect on Gold

Gold may skyrocket if China invades Taiwan. China’s gold demand may continue increasing if they are planning a Taiwan attack. They’d do this to support their economy and defend against sanctions. China holds a massive $3.25 trillion in foreign currency that could quickly be converted into gold. They could effectively corner the gold market at a time and date of their choosing. Doing so would send the price of gold soaring. An attack would send investors around the world rushing to protect their wealth with gold against volatility. This too would force the price of gold skyward. Analysts predict an attack on Taiwan could result in gold hitting $3,000 an ounce and going as high as $5,000 an ounce.6

Conclusion

Gold has been consistently breaking price records. The last 18 months have seen the greatest net gold bullion purchases by central banks worldwide since 1950. BRICS nations are leaning into gold to further their de-dollarization agenda. The Middle East conflict is sending people flocking to safe haven assets like gold.

A Chinese attack on Taiwan could send gold prices to unheard of heights. In addition, the stock market is predicted to fall between 20 and 30%7 during the initial attack. Coupled with a trade war, the US economy could be stuck in a negative growth loop for years. This moment in time presents an opportunity to protect one’s retirement funds and potentially grow them with gold. A Gold IRA is designed to secure your nest egg from global instability and economic chaos. Contact American Hartford Gold today at 800-462-0071 to learn more.