Gold Prices Continue to Climb

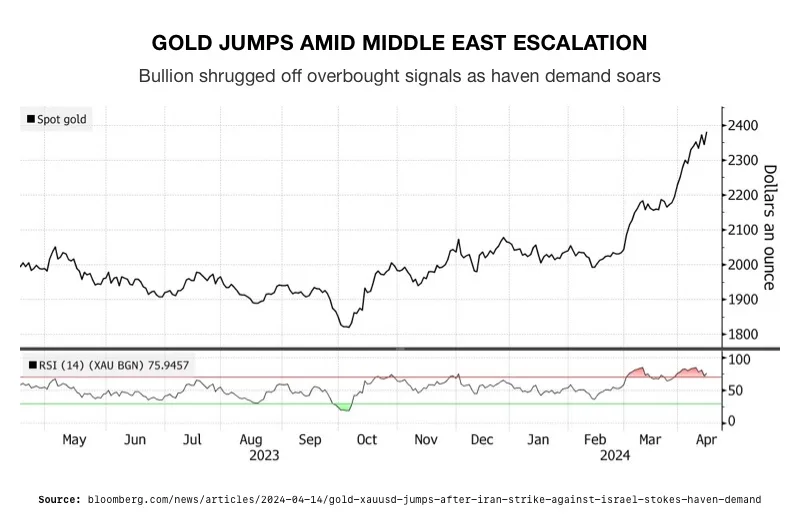

The price of gold has been hitting record highs, rallying more than 20% over the past two months. Spot gold hit an all-time high of $2,431 last week with analysts predicting even higher gains. Gold’s momentum has transcended traditional drivers and may reflect a deeper shift in the global economy.1

There are ample reasons for the rise in gold prices. The expanding conflict in the Middle East spurred safe haven demand. That demand was already climbing due to other geopolitical conflicts, upcoming Presidential elections, and uncertainty about Fed monetary policy.

²

²

Inflation continues to swell gold demand. Gold is traditional inflation hedge since it is valued in dollars. You get more dollars to an ounce of gold as the dollar drops and gold retains its intrinsic value.

We are in a period of higher-for-longer inflation. Every aspect of the economy is fueling inflation. Despite aggressive interest rates, the economy is running hot. That heat is coming from Federal fiscal stimulus and massive government spending on clean energy and re-industrialization like the CHIPS act.

Experts suspect there is something more than a simple play against inflation behind gold’s ascent. Gold breaks out like this when world is at a major pivot point – which is where we are. The days of America hegemony appear to be coming to an end. The globe is realigning. Countries are pushing back against US policy. This is seen in the trade war brewing with China. Meanwhile, the weaponization of the dollar with sanctions spurred the de-dollarization movement. The BRICS+ are moving toward a new currency to protect the economies of non-aligned nations.

China’s holdings of US financial assets have declined to levels not seen in the past 25 years. A large percentage of that money was shifted into gold. Currency Research Associates noted, “China buying gold and selling Treasuries mirrors how Europe’s central banks began to redeem dollars for gold in the late 1960s as the Bretton Woods System began to break apart.”3

Since mid-2022, record gold buying by central banks in China and emerging markets has been credited as one of the main factors driving up gold prices. This substantial central bank demand is considered a key reason gold has reached its current elevated levels.

The fate of the dollar is also affecting the price of gold. American industries are struggling to compete overseas due to the strong dollar. Analysts predict whoever wins the White House will make a move to weaken the dollar. This is good for gold, which tends to go up when the dollar goes down.

The US debt and deficit are also increasing gold demand. The debt is becoming unsustainable according to the Congressional Budget Office. Left unchecked, it will likely result in hyperinflation and extreme chaos in monetary policy and markets. This terrible for the country, but good for gold. The astronomical debt may actually help gold in another way. The Federal Reserve may be forced to cut interest rates to avoid a debt death spiral. Lower interest rates have also historically increased the price of gold.

Predictions

Major investment firms expect gold’s climb to continue. BNP Paribas Fortis’ chief strategist predicts gold will rise from $2,374 an ounce to $4,000 in “the not so distant future”. He says, “People are hedging against a new world.”4

Goldman Sachs raised their gold forecast to $2700 by year-end from $2,300. Goldman Sachs pointed to gold’s recent price stability. The fact that it wasn’t shaken by higher-than-expected inflation (and the fear of no rate cuts) showed that this surge is not driven by the usual factors.5

Analysts suggest that gold’s support levels, indicating where its price tends to halt declines and possibly rebound, currently stand at $2,305, with additional safety nets at $2,274 and $2,235.6

“None of those traditional factors adequately explain the velocity and scale of the gold price move so far this year. Yet that substantial residual from the traditional gold price model is neither a new feature nor a sign of overvaluation,” Goldman Sachs said in a report.7

What could bring gold prices down?

According to Goldman Sachs, a combination of the following: peace in the Middle East and Ukraine, a halt to central bank gold purchases, a return to Chinese economic stability, and another round of interest rate hikes. The reality is that getting one of these is unlikely, let alone all of them. Until then, the forces pushing up gold prices will continue.

With gold prices on a rapid upswing, FX Empire’s headline exclaimed now is the “Time to Buy.” The upward trend looks like it is going to continue. That’s why now is a good time to investigate how getting a Gold IRA today can help secure your future in a dramatically changing world. Call us today at 800-462-0071 to learn how.

Notes:

1. https://www.livemint.com/market/commodities/gold-rate-outlook-goldman-sachs-raises-yellow-metal-price-forecast-to-2700-per-ounce-by-yearend-11713155650616.html

2. https://www.bloomberg.com/news/articles/2024-04-14/gold-xauusd-jumps-after-iran-strike-against-israel-stokes-haven-demand?embedded-checkout=true

3. https://www.ft.com/content/bdcb7d8a-e958-4910-9d1b-a6a519812503

4. https://www.ft.com/content/bdcb7d8a-e958-4910-9d1b-a6a519812503

5. https://www.livemint.com/market/commodities/gold-rate-outlook-goldman-sachs-raises-yellow-metal-price-forecast-to-2700-per-ounce-by-yearend-11713155650616.html

6. https://www.fxempire.com/forecasts/article/gold-xau-daily-forecast-prices-surge-as-iran-israel-tensions-intensify-time-to-buy-1423590

7. https://www.livemint.com/market/commodities/gold-rate-outlook-goldman-sachs-raises-yellow-metal-price-forecast-to-2700-per-ounce-by-yearend-11713155650616.html