Debt Grows at Record Pace

The national debt is experiencing a monstrous explosion of growth that could decimate the economy. And with a government that appears to be either unwilling or unable to defuse it, the debt is poised to ruin the financial future of the country and all its citizens. Only those who take measures now can hope to avoid the severe consequences of America’s spend now-pay later policies.

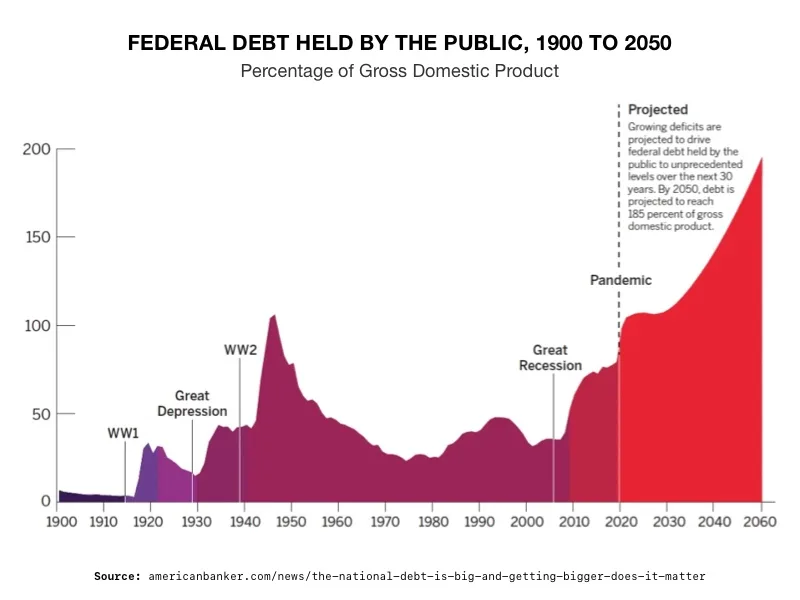

Michael Hartnett, the chief strategist at Bank of America said, “The U.S. national debt is rising by $1 trillion every 100 days.” The debt has already surpassed $34 trillion. That is up from $33 trillion 106 days earlier. It was about $32 trillion 90 days before that. Hartnett projects the debt will exceed $35 trillion by April 2024. The current level of the debt to GDP ratio as of December 2023 is 121%. That is predicted to leap up to 190% by 2050.1,2

Hartnett continued to say, “financing domestic bliss and overseas wars U.S. budget deficits” over the last four years have equated to 9.3% of GDP. The deficits of the past eight years are the greatest since FDR in the 1930s.3

4

4

Warnings From Experts

Wharton Business School Finance professor Joao Gomes predicts America’s debt burden could upset the world’s financial markets as early as next year. Especially if a newly elected president launches more government spending. He thinks mortgage rates could wind up shooting over 7% if the debt issue is ignored.

Economist and Black Swan author Nassim Taleb declared the national debt has put the economy in a “death spiral”. In this scenario, high levels of debt make it harder for the borrower to make payments. As a result, creditors may demand higher interest rates, further worsening the financial strain. This cycle continues, with rising debt costs contributing to more financial stress and a potential downward spiral that can lead to economic collapse.

Government Response

The government is aware of the crisis they are creating. Fed Chairman Powell said it’s past time to have an “adult conversation” about fiscal responsibility. But knowing about a problem and solving the problem are two different things.

Both political parties seem willing to kick the can down the road instead of putting actual solutions into effect. That is because the solution requires either raising taxes, cutting spending, or a combination of both.

Gomes admonished, “It could derail the next administration, frankly. If they come up with plans for large tax cuts or another big fiscal stimulus, the markets could rebel, interest rates could just spike right there and we would have a crisis in 2025. It could very well happen. I’m very confident by the end of the decade one way or another, we will be there.”5

Foreign Debt Holders

A government that finances itself with debt must first be able to find someone to buy that debt. Analysts see the US reaching a point where parties that buy debt will decide the US government’s policies are no longer sustainable. Government bonds, once considered the safest of safe haven assets, could be considered too risky. China and Japan were one the most reliable investors in US debt. Japan holds $1.1 trillion, and China has $782 billion. Now, not only are their debt purchases declining, but they are also now actually selling.6

These foreign nations are gaining a frightening leverage over the US government. They may decide to ask for higher interest rates to continue buying government debt. Higher interest rates that can further slow the economy and push the US into recession. Or they may even be able to demand other, more political considerations – holding US policy hostage in exchange for their investment.

Reducing Risk

To pay the debt as it stands works out to over $100,000 per person. And with growth rates slowing because of the battle against inflation, it looks highly unlikely that the country can grow its way to a better debt to GDP ratio.

The current lack of government will is make a national debt “death spiral” look inevitable. And when the country spirals down into the hopeless debt abyss, the government will be forced to respond with heavy tax increases and deep spending cuts. Dollar denominated assets, like stocks and bonds, and the retirement funds that hold them, will sink in value. Meanwhile, any exposure borrowers have, whether it’s mortgages or loans, will become severely more expensive.

The debt was cited as the reason for the why the prices of “debt debasement” assets, like gold, are at an all-time high. Gold is a safe haven asset used as a hedge when it looks like the dollar is facing major devaluation. It is known as a store of value with a finite supply. Gold tends to appreciate against currencies that lack supply control, like the dollar, due to central bank’s practice of printing money with abandon.

Conclusion

If the government can’t, or won’t, take action, it is then left to the individual to take the initiative to protect the value of their savings. As experts have rightly pointed out, gold and other precious metals, are a reliable hedge against the impact of runaway debt. Savings moved into a Gold IRA gain the wealth protection of precious metals along with tax advantages. Contact American Hartford Gold today at 800-462-0071 to learn more.