- The conflict in the Middle East has broad global ramifications – including negative consequences for retirement savings

- The war can cause higher inflation, recession, and stock market volatility

- A Gold IRA can protect retirement funds from the consequences of Middle East war

Market Drops as Middle East War Escalates

The Dow posted its biggest weekly loss since March 2023 in the run up to the Iranian strike on Israel. The DJIA cemented its longest losing streak in 10 months. The market dropped on fears of growing escalation between the two countries. Now investors are anxiously awaiting Israel’s response to Iran’s launch of more than 300 missiles and drones at them. The conflict half a world away holds serious implications for retirement funds for several reasons.1

Oil

Experts expect highly volatile oil trading soon. They are finding themselves in uncharted territory with a direct conflict between Iran and Israel. The Middle East accounts for roughly a third of global oil production. In addition, the Strait of Hormuz sees almost 20% of global oil supply and a significant amount of all shipping volumes. Iran’s geographic proximity to the channel poses a risk of immobilizing supply with a global impact.

The shifting alliances amongst OPEC producers is also adding to the uncertainty. Those nations are wavering between national interests against Iran and economic interests to keep oil prices stable. The managing director of Velandera Energy Partners said, “If Israel vows to respond back with greater force, or Iran basks in solidarity with the Arab neighbors, then there is a real potential for oil’s march to $100.” Chase Bank said oil could potentially hit $125 per barrel.2

Inflation reduces the purchasing power of retirees’ savings. Rising oil prices can increase inflation because it’s an essential part in the production and transportation of goods and services. When oil prices rise, businesses face higher energy costs. This often leads to increased production costs. These increased costs are commonly passed on to consumers. Higher prices result, contributing to inflation. Additionally, higher energy costs can lead to increased expenses for businesses. Economic downturns or recessions can result, negatively affecting investment returns and retirement savings.

Conditions aren’t exactly the same today as they were in the 1970s, but a bad historical precedent exists. During the 1973 oil crisis, sparked by the Yom Kippur War, the S&P 500 index dropped by nearly 50%. OPEC’s oil embargo led to quadrupled oil prices and an economic recession. Similarly, the 1979 energy crisis, triggered by political unrest in Iran, saw the S&P 500 index fall by over 27%. The drop reflected disruptions in oil supply and heightened economic uncertainty.3

Interest Rates

Rising Middle East tensions could cause the Federal Reserve to adopt a more cautious approach to cutting interest rates. Wall Street has pushed back expectations for an interest rate cut to September from March. But if high oil prices push up inflation, then those cuts are likely to get delayed further. The Fed has said they are making their decisions as data comes in. If inflation isn’t trending to their 2% goal, they won’t cut rates. There is already talk of no rate cuts this year as inflation has started increasing again.

Higher-for-longer interest rates can harm retirement funds by lowering the value of existing bonds and fixed-income investments, as newer bonds offer higher yields. Additionally, high rates can make borrowing more expensive. Thereby reducing consumer spending and potentially slowing economic growth, which can negatively affect investment returns in retirement portfolios.

Trader and investors must now factor in the higher threat of stagflation in the global economy with the Middle East crisis driving up inflation and slowing growth. They must do this at a time when fiscal policy and monetary measures are already losing their effectiveness in taming inflation.

Gold and Silver

4

4

The chaotic international crisis may present an opportunity to buy gold and silver at lower prices according to Peter Spina of goldseek.com. He believes a major market selloff could bleed over to precious metals. A selloff can cause investors to sell their precious metals holdings to cover their losses. The sudden influx of supply could create a temporary drop in prices.

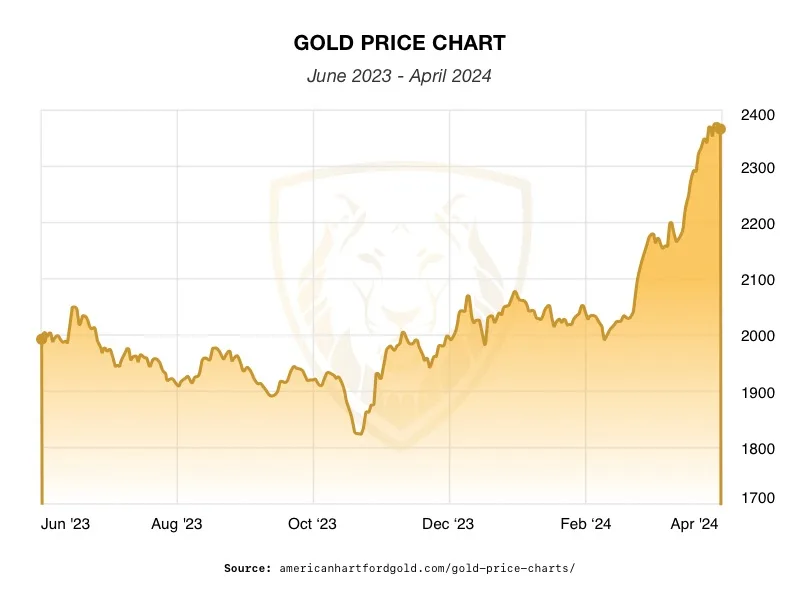

But that drop wouldn’t last long. Gold prices rallied to yet another record high last Monday. Gold’s recent rapid price increase is predicted to only accelerate with the increased war tensions. Spina continued, “The gold price is reflecting all sorts of problems, risks, and now the fear-war premium will likely be added should there be no quick de-escalation to these very serious events in the Middle East.”5

Conclusion

The conflict in the Middle East is having broad global ramifications. Included in them is a potentially serious negative impact on retirement savings due to inflation, recession, and market volatility. Gold’s upward trajectory reflects a universal sprint towards to economic security. Before the war heats up more, now is a good time to learn how physical precious metals can protect the value of your nest egg. Contact American Hartford Gold at 800-462-0071 to find out how a Gold IRA can help secure your financial future.

Notes:

1. https://www.marketwatch.com/livecoverage/stock-market-today-dow-futures-climb-after-iran-attack-on-israel-causes-little-damage

2. https://www.marketwatch.com/livecoverage/iran-attacks-israel-live-coverage-of-events-and-markets-reaction

3. https://thehill.com/opinion/international/4270641-the-global-impacts-of-todays-war-in-israel-are-not-the-same-as-1973/#:~:text=The%20S%26P%20500%20index%20plunged,its%20low%20in%20September%201974.

4. https://www.americanhartfordgold.com/gold-price-charts/

5. https://www.marketwatch.com/livecoverage/iran-attacks-israel-live-coverage-of-events-and-markets-reaction