Gold So Far

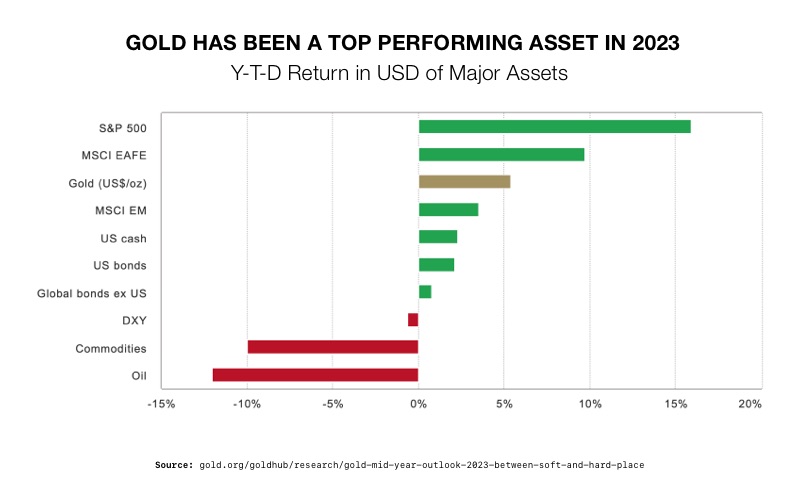

After a solid first six months, gold looks good for the second half of 2023. Closing at $1,912 in June, gold increased 5.4%. It outperformed all other major assets apart from the S&P 500. Gold’s fate is tied to the looming recession. Whether it is mild or severe, gold owners are likely to come out ahead.

1

1

Gold’s first half strength came from a few factors. One was a relatively stable US dollar and interest rates. The second came from risk hedging. Gold was highly sought after to dampen volatility throughout the year. Especially during the height of the banking crisis in March. And finally, continued central bank demand buoyed gold prices.

Where to Next

Three key drivers will support gold through the rest of the year. They include economic expansion, risk, and opportunity cost.

Slow economic growth in the West may shrink consumer spending and gold purchases. But that drop off will potentially be countered by demand in India and China. The Indian economy continues to expand. Analysts predict demand will increase in China as their economic stimulus takes effect.

A desire to hedge against risk will also maintain gold prices. Inflation has been on a downward trend. But it is persistent and still hurting the economy. Stock market volatility remains high. And an unbroken stream of ‘event risks’ (such as geopolitical or financial crisis) is likely to keep hedging strategies in place.

A reduction in opportunity costs will likely help sustain gold prices. Slightly lower interest rates and a weakening dollar will lower the holding cost of gold. This will make it more appealing compared to other interest-bearing assets. Historically, gold earned an equivalent to an 8.4% annual return during similar economic conditions.

Global monetary policy continues to shape the gold market. Central banks are closer to the end of their tightening cycles than their beginning. After a Fed pause, markets are betting on one or two more rate hikes this year. Even with interest rates levelling off, consensus points to a recession in late 2023. The only argument is how bad it will be.

The price of gold hinges on the scale of the economic downturn. Gold should experience stronger investment demand if the recession is severe. Since recession plays such a prominent role in pricing, analysts are using a range of data to make predictions. They are looking at the Purchasing Manager’s Index (PMI) for signs of future weakness. The report monitors activity in production, new orders, supplier deliveries, inventory, employment, prices, exports and imports. The index has been in decline for months.

Analysis shows that gold tends to outperform equities when the PMI is below 50 and falling. The current PMI is at 46. If PMI falls below 45, history suggests an even more dramatic outperformance. Gold has delivered positive returns even when the PMI is below 50 and rising. For this reason, gold is seen as having asymmetrical benefits. Meaning, the potential for positive outcomes is greater than the potential for negative outcomes, offering a favorable risk-reward ratio.

Role of Recession

As recession risks rise, so too will gold prices according to the World Gold Council. Recessions see tighter credit conditions. As a result, there is usually a significant increase in defaults. There are also other unintended consequences from a high-rate environment. Such periods are marked by higher volatility and big stock market pullbacks. In response, the appetite for high-quality safe haven assets like gold increases as well.

A mild recession may slow gold’s rise but is unlikely to drive the price down. Given gold’s positive performance in the first half of the year, there would need to be a drastic investor withdrawal for gold prices to drop below its 2022 average.

Recession prompts a retreat into defensive assets. The World Gold Council studied the results of including gold in that assets mix. Their analysis showed that, over the past 25 years, a strategy with gold would have improved returns. It also reduced volatility and drawdown.

2

2

Thus, a mild recession would likely cause gold prices to level off. Whereas a severe recession could send gold prices surging again. The asymmetrical benefits of gold make it a valuable component to those looking to preserve the value of their portfolio. A Gold IRA from American Hartford Gold is designed to safeguard your retirement funds from the effects of recession. With gold prices poise to rise, a Gold IRA can not only preserve value, but increase it. Contact us today at 800-462-0071 to learn more.