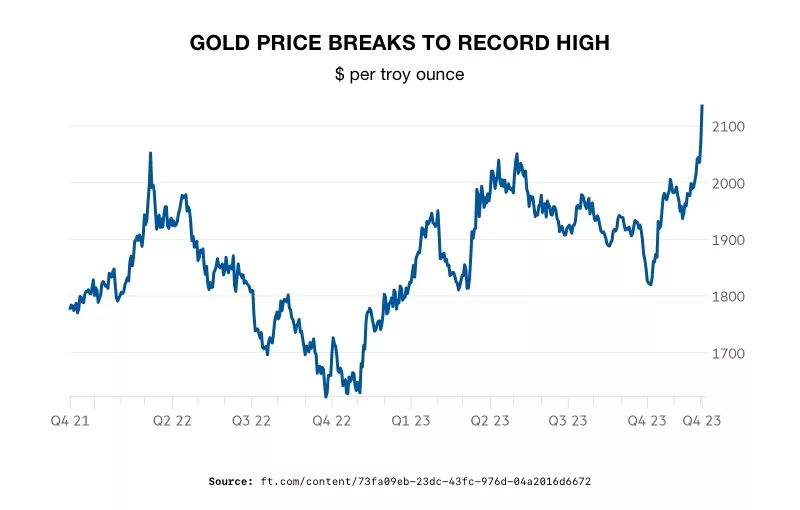

Gold Reaches All-Time High

Gold hit an all-time of $2,135 an oz just as analysts predict stock prices to plunge in 2024. Gold reached its previous record high of $2,072 in August 2020. The pandemic caused investors to flock to gold. Now, gold’s gains are part of a powerful rally that began in November last year. The rally was fueled by record central bank purchases and fears over wars in Ukraine and the Middle East. Analysts are predicting gold prices will keep rising while the S&P 500 drops. 1

2

2

Gold prices have risen for two consecutive months with war in the Middle East boosting demand for safe haven assets. Gold prices are expected to remain above $2,000 levels next year. They will likely stay elevated due to geopolitical uncertainty, a weakening dollar and possible interest rate cuts.

Gold is known to perform well during periods of economic and geopolitical uncertainty due to its status as a reliable store of value. TD Securities expects gold prices to average $2,100 an ounce in the second quarter of 2024. And, according to estimates, gold prices could reach up to $2,200 an ounce by the end of 2024.3

According to a recent survey by the World Gold Council, 24% of all central banks intend to increase their gold reserves in the next 12 months, as they increasingly grow pessimistic about the US dollar as a reserve asset.

“This means potentially higher demand from the official sector in the years to come,” TD Securities said.4

Gold & Rate Hikes

Fed Chair Jerome Powell indicated the central bank may be done hiking rates for now. But he did push back on expectations for a serious rate cut ahead. A possible policy pivot by the Federal Reserve in 2024 could also boost gold prices. Lower interest rates tend to weaken the dollar and a softer greenback makes gold cheaper for international buyers thus driving up demand.

The Fed started its steady stream of rate hikes in March 2022 as inflation climbed to its highest in 40 years, diminishing gold’s appeal. Higher interest rates hurt demand for gold, which does not pay any interest, as assets such as bonds become more lucrative due to their higher yields.

The surge in gold prices seems to be centralized on physical gold, with ‘paper gold’ assets like ETFs still lagging.

Stock Market to Fall

JPMorgan’s Head of Technical Strategy said the S&P 500 is heading for a stark reversal in 2024. It will sink down into a new bear market. “Stocks should pull back, [and] in my base case on the technical side, the S & P 500 is gonna drop to 3,500,” they said.5

That move represents a roughly 20% pullback from the benchmark’s current level. Their bearish outlook for the S & P 500 comes from a looming recession risk. The economic contraction could come despite a soft landing, hindering stock prices as a result. JP Morgan also cited the continuing inverted yield curve. Recessions have almost always followed an inverted yield curve. If historical data holds true, the recession should start in the beginning of 2024.

JP Morgan analysts are concerned because markets are pricing in an expected interest rate cut by the Federal Reserve. This can point to a weaker stock market.

If investors believe that the rate cut is already anticipated and priced into the market, the potential positive impact might have been largely accounted for in current stock prices. In this case, there might not be much additional upside for stocks when the rate cut actually occurs.

If there are rate cuts, investors must factor in why they are happening. In the most likely case, rate cuts are going to occur when a recession hits and the Fed needs to stimulate the economy. In other words, the cuts are only going to happen after stocks are dropping. Meanwhile, if the rate cut doesn’t meet the market’s expectations (either the magnitude or timing), it might lead to disappointment, causing stocks to weaken.

JP Morgan says the stock drop is likely as global growth decelerates, household savings shrink, and high geopolitical risk, with national elections in the US adding to volatility. JP Morgan counters the more optimistic outlooks of some other banks. They say that optimism is misplaced as long as interest rates are in a “higher-for-longer” condition.

Currently, the market is in a rally, having reached its highest close for the year on Friday. The predicted drop would erase all the gains the market made this year. This rally may continue into the new year, JP Morgan says, but will peter out soon after. They advised “you should be lightening up positions and starting to hedge at this point already.”6

Conclusion

As the stock market is poised for a drop, gold prices are set to keep rising throughout 2024. Those looking to protect the value of their portfolio from dropping stock prices and recession should investigate a Gold IRA. A Gold IRA can secure the value of your funds and potentially grow them as well. Don’t miss out on this opportunity. Contact American Hartford Gold today at 800-462-0071 to learn more.