- JP Morgan CEO Jamie Dimon says the US is entering withdrawals from its addiction to debt

- Rising interest rates and rising debt are likely to drive the country into recession

- Adding physical precious metals to a portfolio can hedge against the impact of runaway national and consumer debt

Runaway Debt Threatens Economy

America’s addiction to debt, both corporate and consumer, has economists and experts cautioning about the state of the economy in 2024. Wells Fargo warns the first half of 2024 is going to be “really, really sloppy” for stocks. Investors can expect high volatility with frequent price fluctuations. That might be good for speculating in short term trades, but spells trouble for those with long-term strategies and retirement fund holders.1

Debt is surfacing as a primary source of concern. The US has acquired an enormous amount of debt since the pandemic. That debt includes around a trillion dollars in stimulus checks and $4 trillion doled out by the Federal Reserve to buy government bonds. That massive cash infusion led firms to rake in profits as stocks soared higher.

Record inflation soon followed the debt-fueled stimulus. The Fed had to apply the brakes to the easy money. Comparing debt to heroin, JPMorgan CEO Jamie Dimon said our debt addiction is putting the economy in a dangerous position as it faces ‘withdrawal’. Stocks struggled through 2022 and are plagued by extreme volatility throughout 2023.

Dimon continued to say that despite high interest rates meant to slow the economy, inflation is likely to stay elevated.

“We’re on this sugar high and I’m not saying this ends in a depression [but] I think there’s more inflationary forces out there,” Dimon warned. “There’s a higher chance that rates go higher, inflation doesn’t go away, and all these things cause more problems of some sort.”2

This is in part due to continued high levels of government spending. The US total debt hit a record $33 trillion for the first time this year. It’s closing in on $34 trillion as gridlocked lawmakers fight over a new budget.

Economists have been banging the drum about the dangers of the country’s runaway debt. But the problem is constantly kicked down the road. They have warned of a potential crisis over the coming decades. If the US doesn’t change course, it could potentially default on its debt in 20 years, the Penn Wharton Budget Model predicted. A default could end up having catastrophic consequences on the US economy.

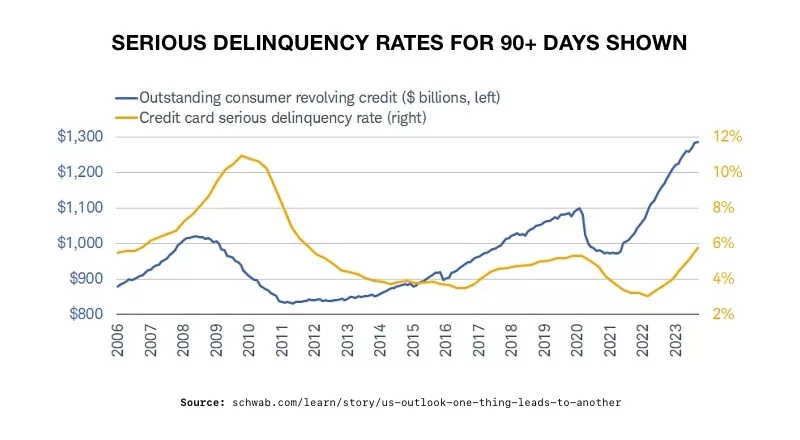

While Dimon’s concerns focused on corporate and government debt, others are pointing in alarm at the dramatic spike in consumer debt. Non-mortgage interest payments by consumers are up more than 50% year-over-year, surpassing $1 trillion (annual rate) in the third quarter of 2023, per Bureau of Economic Analysis data. As shown below, the burgeoning “living beyond means” character of the consumer can most easily be seen when looking at consumers’ revolving credit, shown in the blue line; and the associated increase in serious credit card delinquencies, shown in the yellow line. Those delinquencies are particularly acute among younger borrowers.

3

3

Debt-fueled Recession

The rising cost of capital is starting to take a toll on corporations. The interest owed on their debt is ballooning. Historically, there is an 18-month lag between a move in Treasury rates and companies’ effective interest rates. Which means the problem is only going to grow more severe over time. Corporations will soon be facing major defaults and bankruptcies. And those that don’t will find themselves with very little capital to invest and retain workers.

Charles Schwab predicts ‘economic pain is likely’ for 2024. They say the chances of the Fed “sticking the landing” are quite low. Their analysts believe that a recession in the traditional sense, meaning one declared by the National Bureau of Economic Research, is more likely than not in 2024. The Fed may want to do something to relieve the recession but will be unable to for fears of reigniting inflation. 4

Until that formal declaration is made, Schwab has been using the term “rolling recessions” to describe the economy. They point to several key segments of the US economy, including housing, manufacturing, and many consumer-oriented segments of the economy have experienced recession-level weakness.

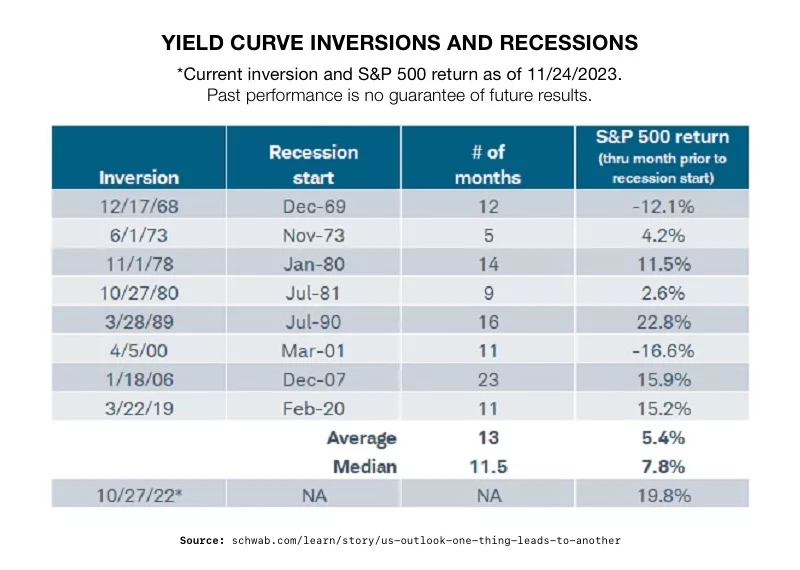

Schwab also points to a yield curve that has been inverted for more than a year. As shown in the chart below, except for an extremely brief/mild inversion in 1998, inversions over the past six decades have had a perfect track record of signaling recessions.

5

5

Conclusion

The price for America’s addiction to cheap debt is starting to be paid. And it may cost this country its economic future. For those looking to protect their portfolios from the ravages of runaway debt, now is the time to investigate safe haven assets like precious metals. A Gold IRA from American Hartford Gold can safeguard your retirement funds. To learn more, contact us today at 800-462-0071.