Simmering Banking Crisis Set to Reignite

The long simmering banking crisis could be heating up again. Regulators were forced to close Republic First Bank. The regional lender imploded under the weight of declining deposits and a collapsing commercial real estate portfolio. The FDIC seized roughly $6 billion in assets and $ 4 billion in deposits. The bank’s failure will cost the FDIC $667 million. Experts are concerned that while this is the first collapse of 2024, it may not be the last. 1

Republic First exemplified the increasing risks being faced by regional and community banks. They reported a decline in deposits. In addition, the value of the company’s mortgage loan portfolio had “declined substantially in a rising rate environment.”2

Republic First’s seizure makes it the fourth in just over a year to be seized by state and federal regulators. It follows the collapse of Silicon Valley Bank last March. That bank failure lit fears of a potential sector wide failure. Two days after SVB’s failure, New York-based Signature Bank also collapsed. New York regulators seized its $110 billion in assets and $88 billion in deposits. San Francisco’s First Republic Bank failed after that last May. 3

“Zombie Office” Timebomb

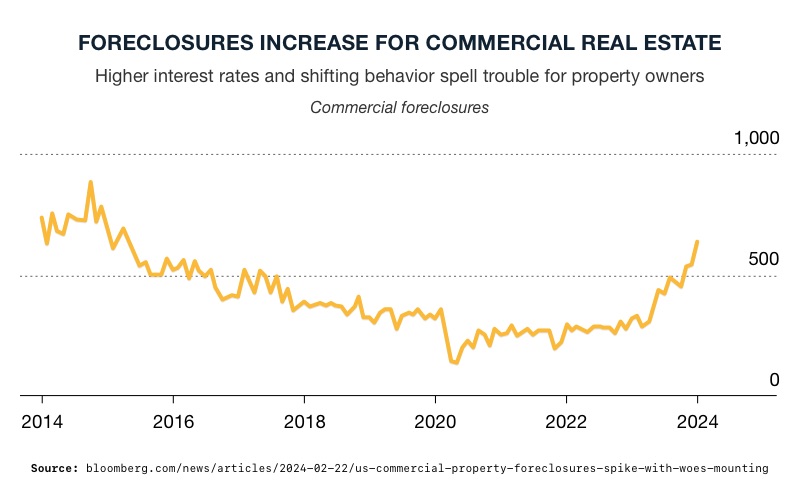

The commercial real estate meltdown continues to be a ticking time bomb for the regional banking sector. Interest rates hitting a 23-year high and the disintegrating demand for office space have utterly devalued commercial real estate.

Like something out of a horror movie, industry experts decry the rise of “zombie offices.” A “zombie office” refers to an office space or building that is vacant or significantly underutilized for an extended period. These spaces remain unoccupied, sometimes for years, with little to no activity or interest from potential tenants.

Much like a movie “zombie”, these office properties may appear outwardly intact but lack productivity. They are effectively “dead” in terms of generating revenue or contributing to the local economy. Property owners and investors struggle to find tenants or face declining property values due to the lack of demand. Efforts to revive or repurpose these spaces often require significant investment and strategic planning to attract new tenants. However high interest rates put the money needed to do that out of reach.

4

4

Small and regional banks hold about 80% of the commercial real estate outstanding debt. Around $929 billion in CRE loans are due to mature this year. With defaults on the rise, economists think another banking crisis could be on the horizon. Forty percent of office loans on bank balance sheets were underwater – owing more than the property is worth. Small banks holding the debt may be at risk if the loans default because they cannot handle the losses. 5

And the trend seems to point to investors choosing foreclosure over expensive refinancing. Commercial real estate foreclosures jumped 117% in March from last year. There were 625 CRE foreclosures that month. California had the highest amount with 187 – which was a 405% jump from last year. As a result, almost a third of the 127 banks in the state have property debt above the 300 percent level. Meanwhile, New York had a 65% increase in foreclosures from last year. Florida and New Jersey saw 129% and 133% jumps respectively. 6

Risky Shadow Banks

The growing risks from the commercial real estate sector are out in the open. But the banking industry is exposing itself to more ‘under the radar’ risks. As the rate of standard loans have slowed down, loans to ‘shadow banks’ have become the fastest growing business for established banks. Shadow banks are alternative asset lenders such as private equity firms and hedge funds.

US banks, including such firms as Citigroup and Wells Fargo, have given out $1 trillion of loans to non-regulated shadow banks. The amount loaned to them has surged more 12% in the past year. 7

Regulators say these alternative lenders increase a bank’s exposure to higher risk debt.These shadow banks are often less regulated. They make riskier loans than a what a regulated bank would be allowed. Therefore, shadow banks are exposed to significantly greater losses. That risk, and those losses, ripple back onto the established banks. Since 2010, the share of financing to shadow banks now exceeds auto lending and is slightly below credit card debt.

Shadow banks’ reliance on short-term funding and complex financial products can amplify market volatility and exacerbate liquidity crises. They can potentially disrupt the broader economy.

Conclusion

The recent failure of Republic First is an ominous sign for the banking industry. Risk and financial instability are on the rise. Fed Chair Powell said issues with commercial real estate will likely ruin some banks. He said, “This is a problem that we’ll be working on for years more, I’m sure. There will be bank failures, but not the big banks.”8

With no commercial real estate rebound in sight, or relief from high interest rates, a domino effect of failures may undermine the banking system. As banks pursue riskier means of profit, your retirement savings may be in jeopardy. That’s why now is the time to see how physical precious metals in a Gold IRA can insulate your nest egg from a looming banking crisis. Call us today at 800-462-0071 to learn more.

Notes:

1. https://fortune.com/2024/04/26/philadelphia-bank-implodes-failure/

2. https://www.forbes.com/sites/tylerroush/2024/04/27/heres-what-led-to-republic-firsts-collapse-and-why-its-different-from-2023-failures/?sh=32423a1d5878

3. https://www.forbes.com/sites/brianbushard/2024/04/26/republic-first-bank-seized-by-regulators-first-bank-collapse-of-2024/?sh=3703ee892359

4. https://www.msn.com/en-us/money/realestate/us-commercial-property-foreclosures-spike-in-january/ar-BB1iJ7wc?ocid=entnewsntp&pc=U531&cvid=c6d6ad0018e54c68ad3ec0370ef0556b&ei=78

5. https://www.dailymail.co.uk/yourmoney/banking/article-13324063/commercial-real-estate-foreclosure-banking-crisis.html

6. https://www.dailymail.co.uk/yourmoney/banking/article-13324063/commercial-real-estate-foreclosure-banking-crisis.html

7. https://www.businessinsider.com/banks-shadow-lenders-1-trillion-fed-private-credit-hedge-funds-2024-2

8. https://www.dailymail.co.uk/yourmoney/banking/article-13324063/commercial-real-estate-foreclosure-banking-crisis.html