- Commercial real estate values are plummeting in the aftermath of the pandemic’ shift to remote work

- Drastically reduced valuations are running headlong into the need to refinance at record high interest rates

- The collapse of the commercial real estate sector can send shock wave through the entire economy

The Collapse of Commercial Real Estate

The pandemic’s enduring impact on work dynamics has reshaped the office landscape, turning office towers into empty husks. The seismic shift towards remote or hybrid work has shattered the very foundations of commercial real estate. The fall of WeWork was an $18 billion canary in the coal mine, shedding dozens of leases in New York City alone. Experts fear an impending collapse of what was once a cornerstone of the American economy. The ramifications of which could resonate and upend the financial system.1

Gary Shilling is a financial analyst best known for forecasting the 2008 housing crash. He said ” I think the biggest bubble right now is commercial real estate… I think it is a bubble which is beginning to crack.”2

The office sector is the most visible sign of the commercial real estate collapse. Vacancy rates are at nearly 1.5 times the amount of 2019. There may be as much a 1 billion square feet of unused office space by the end of the decade. Moody’s Analytics calls the office vacancy rate of 19.2% this quarter “perilously close” to the 19.3% record-high vacancy rate in 1986 and 1991.3

Schilling sees this as part of larger economic downturn. He also predicts the S&P could fall to its lowest level since the pandemic and that there is a recession on the horizon, if we aren’t already in one. “I’ve been of the opinion that stocks would decline about 30% to 40%, peak to trough…If you look at many of the major indicators that are reliably forerunners of recessions, when you look at that combination of things, it’s pretty hard to escape a recession.” 4

Commercial real estate’s recovery will take a long time. Stijn Van Nieuwerburgh, a professor of real estate and finance at Columbia Business School, said “It could easily take several years for the office market to stabilize…it’s a trainwreck in slow motion.”5

“Shark Tank” star Kevin O’Leary shares the belief that the commercial real estate sector is on the brink of collapse. He says the ripple effects will be detrimental to investors and small business owners.

O’Leary pointed to the typical commercial real estate business model. A property is bought with a loan from a bank, usually a regional one. The owners then only pay back the interest on the loan, refinancing when the balloon payment comes due. This model worked when interest rates were near zero.

But in the next four years, roughly two thirds of the commercial office real estate will need to be refinanced. Crashing vacancies and lower valuations are going to meet significantly higher interest rates. There will be losses all around as owners are unable to pay back the banks.

Delinquency rates for commercial mortgages, which include office, multifamily, and other commercial properties, have been on the rise for four consecutive quarters, according to the Mortgage Bankers Association (MBA).

This will cause serious issues for the regional banks that are invested in these buildings. The banking system has about $3 trillion of commercial real estate on their balance sheets. Roughly two thirds of that are held outside of the largest 25 banks.6

“These banks are going to fail because up to 40% of their portfolio is in commercial real estate,” O’Leary said. The rapid rise in interest rates is what sparked the banking crisis and caused the collapse of Silicon Valley Bank and First Republic. Both were overleveraged in commercial real estate. 7

This will spillover and hurt small businesses. Regional banks are the prime commercial real estate lenders. With commercial real estate draining their resources, they will be unable or unwilling to make small business loans.

Adding to the problems caused by low vacancies and high interest rates are new banking rules. The rules were put into effect after the collapse of SVB to stall the banking crisis. Previously, banks didn’t have to do anything as long as loan payments kept coming in. Now, banks are required to set aside reserves for expected losses from existing loans. This strains the liquidity of some banks. It potentially turns a slow-moving downturn into a value disaster that everybody has to put in their balance sheet at the same time. Suddenly 500 banks can become insolvent on paper.8

9

9

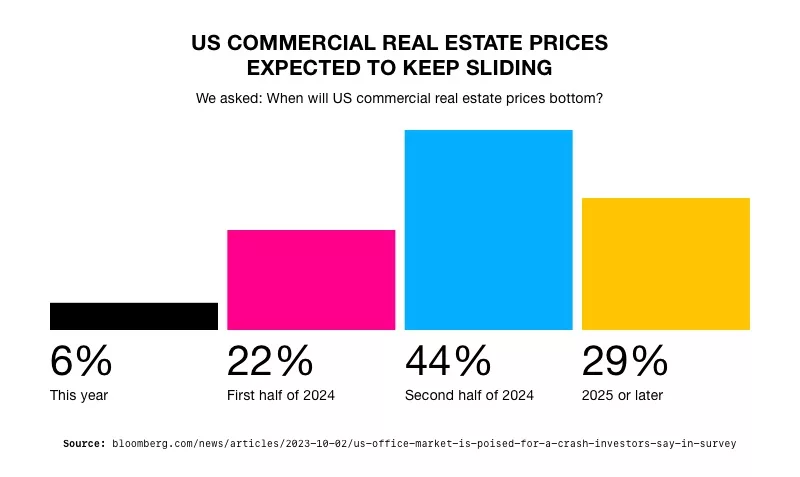

There is no precise date of when the commercial real estate sector will collapse. Some believe it is happening as we speak. Real estate tycoon Jeff Greene, who bet against the mid-2000s housing bubble and netted about $800 million, said that we’re just in the initial stages of a commercial real estate crash, “I think we’re just in the first inning of this correction.”10

The impact of such a crash will reverberate throughout the economy and could ultimately drag down the value of stock-based retirement funds. Now is the time to protect those funds. A Gold IRA can safeguard the value of your portfolio from the imminent real estate collapse. Contact American Hartford Gold at 800-462-0071 to learn more today.