- The Congressional Budget Office warned of a severe national debt crisis

- A debt crisis can result in sky high inflation, a devalued dollar, record taxes, and deep cuts in government services like Social Security

- Americans are flocking to physical precious metals to protect the value of their retirement funds from the debt crisis.

Congressional Budget Office Warns of Debt Crisis

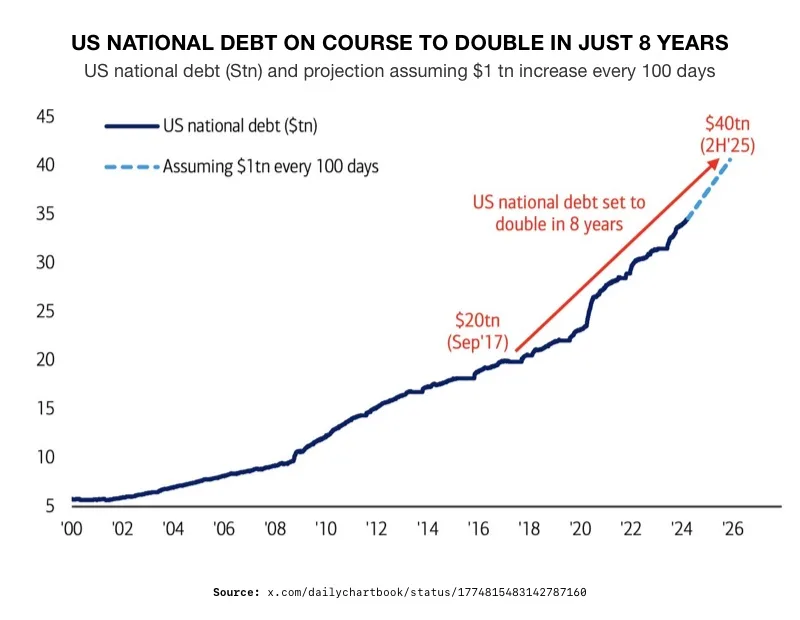

US government borrowing has hit unprecedented levels and threatens to leave “scars on our society and economy” for decades to come. The total US national debt is around $34.5 trillion. Forty years ago, it was “only” around $900 billion. Based on forecasts, the national debt will grow to an astonishing $54 trillion in the next decade. With uncontrolled debt potentially leading to sky high inflation, a worthless dollar, and reduced Social Security, Americans are turning to physical precious metals to protect their retirement funds.1

The federal debt relative to gross domestic product will likely rise above World War 2 levels by 2029. Currently, the debt to GDP ratio is 99%. That is predicted to shoot up to 123% by 2034. And that’s the optimistic prediction. It could go as high as 134% in 2034 or 185% by 2050. The head of the independent Congressional Budget Office (CBO) warned the debt could trigger a damaging market reaction if something wasn’t done.2

3

3

Bloomberg Economics found that in 88% of a million simulations, the national debt is on an unsustainable path. A recent CBO report highlighted that skyrocketing debt combined with high interest rates means the country might not be able to afford crucial borrowing in the future.4

The costs of servicing the debt are anticipated to soar. It is likely to triple from approximately $475 billion in fiscal year 2022 to a remarkable $1.4 trillion by 2032. By 2053, interest payments are forecasted to surge to $5.4 trillion, surpassing the combined expenditure on essential programs like Social Security, Medicare, Medicaid, and other mandatory and discretionary spending. That’s factoring in spending on Medicare and other major health programs are projected to rise more than 40% in the next 30 years.5

Some economists try to say there is no crisis. They say that since the dollar is the world’s reserve currency, there will always be someone to who wants to buy our debt. But this may not hold true forever. The CBO continued to say that the uncontrolled debt could “erode confidence in the US dollar as the dominant international reserve currency.” Combined with the rising de-dollarization movement , the US may find itself unable to raise crucial funds in the future.6

The Government Accountability Office said that now is the time for Congress to address the issue. They said, ” The sooner actions are taken to change the long-term fiscal path, the less drastic they will need to be.”7

Conversely, the current lack of political will may result in the government needing to take extreme measures. Measures that the CBO said, “would slow economic growth, push up interest payments to foreign holders of U.S. debt, and pose significant risks to the fiscal and economic outlook; it could also cause lawmakers to feel more constrained in their policy choices.” In other words, expect deep spending cuts is Social Security and defense along with dramatically higher taxes. 8

Bloomberg noted that action may not be taken until we are amid a crisis, saying, “that’s playing with fire.” The vice dean of research at the Wharton School said that crisis is likely to occur in 2030. It could happen as early as 2025 if the next presidential administration launches a new expensive fiscal package.

Wall Street Warnings

The private sector has been weighing on the simmering debt crisis. JPMorgan Chase CEO Jamie Dimon, Bank of America CEO Brian Moynihan, and Blackrock CEO Larry Fink have all warned about the severity of the problem. Citadel founder and CEO Ken Griffin said, “As we have cautioned over the past year, the surging US public debt is a growing concern that cannot be overlooked. It is irresponsible for the US government to incur a deficit of 6.4 percent when unemployment is hovering around 3.75%. We must stop borrowing at the expense of future generations.”9

Wharton Professor Joao Gomes foresees a fiscal crisis soon. The forced government response would cause inflation to spike and the dollar to collapse. “These measures would have a further devastating effect in the economy, leading to a decade long stagnation,” Professor Gomes explained. “Its consequences will be severe and leave lasting—probably irreversible—scars on our economy and society.”10

Conclusion

The national debt is continuing its inevitable climb to crisis. The government is now warning itself that our country’s current trajectory is unsustainable. But still no action is being taken. Facing inflation spikes, tax increases, cut services, and a devalued dollar, Americans are being left to fend for themselves. That is why so many are flocking to physical precious metals to protect the value of their retirement funds. Call American Hartford Gold today at 800-462-0071 to learn how a Gold IRA can safeguard your financial future from the severe consequences of our runaway national debt.