National Debt Skyrockets Out of Control

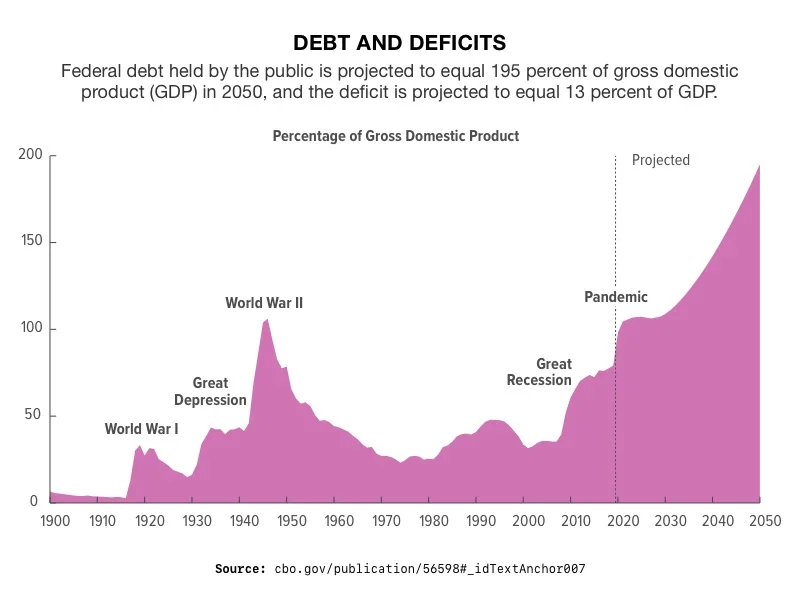

After the latest Congressional Budget Office report, financial leaders and government officials are issuing a stark warning – time is running out to do something about the national debt. Currently, the national debt is over $34 trillion. It surpasses the annual Gross Domestic Product by over 20%. If left unchecked, the US economy could become an empty shell of itself within ten years. 1

For decades, the US relied on being able to borrow cheaply due to historically low interest rates. But in a bid to control inflation, the Fed rapidly hiked interest rates. They raised rates 11 times in a period of 16 months. Interest rates hit their highest level since the 2008 financial crisis. As a result, the cost of borrowing skyrocketed.

Now the Federal Reserve is keeping interest rates higher for longer. As a result, the cost to service the debt is spiking to a historic high. Interest payments are the fastest growing part of the federal budget. They are set to exceed both Medicare and defense spending this year.

“You can think of the increase in net interest payments as two-thirds resulting from higher rates and one-third as a result of the amount of debt,” CBO Director Phillip Swagel told reporters.2

Interest payments are expected to triple from around $475 billion in 2022, to an astonishing $1.4 trillion by 2032. By 2053, interest payments are projected to leap up to $5.4 trillion. 3

A US Treasury report showed the $357 billion in interest payments has easily passed the $283 billion spent on defense the 2024 fiscal year so far. Total interest on the national debt is projected to hit a record 3.1% of GDP. By 2034, that number is expected to by 3.9%. 4

The net interest as a percent of GDP will exceed non-defense discretionary spending in 2024. Non-defense spending includes education, health and human services, housing and urban development, transportation and energy.

The growing annual deficit is feeding the massive debt. The Congressional Budget Office report projected the yearly US budget deficit would grow by an estimated $1 trillion over the next ten years, hitting $2.6 trillion. High interest rates, an aging population, and growth in federal healthcare costs are also adding to the national debt. The debt is predicted to climb to a record 116% of GDP in 2034. 5

4

4

Leaders Warn of Crisis

Financial leaders from Wall Street to Washington are raising the alarm after the release of the CBO report.

Elon Musk said the “U.S. national debt growth is unsustainable…When you add unfunded obligations [e.g. social security & medicare], plus state and local debt, government debt will soon exceed $100 trillion!”7

Jamie Dimon says Washington is facing a global market “rebellion” because of the tab it is racking up. Bank of America CEO Brian Moynihan says ‘we need to get after’ America’s $34 trillion national debt, ‘You can either admire the problem or do something about it’. ‘Black Swan’ author Nassim Taleb, who correctly called the 2008 financial crisis, says the US is in a ‘death spiral’ over government debt.8

Even Fed Chair Powell urged Washington to have an “adult conversation” about the debt.

What to Do

A deeply divided Congress shows no signs of working out a solution, especially during a Presidential election year. There appears to be no movement on raising taxes or slowing down spending, the two things necessary to address the debt. Instead, the Biden administration approved about $4.8 trillion in borrowing in 2022. 9

The government credit rating has already been cut by Fitch and Standard & Poor’s. Moody’s is likely to downgrade the US rating as well soon. If that happens, it will mark the end of the sterling AAA rating for US sovereign bonds.

The Congressional Budget Office reached a dire conclusion. Identifying the national debt as a threat to the continued existence of the United States.

“Under current law, there would be not enough resources to pay the promised benefits of social security,” CBO Director Phillip Swagel said. He continued how the debt poses an existential threat to the country. “Rising interest costs will crowd out other possible uses of government resources, and then also pose a risk to our economic stability” in the coming decade he said. 10

Our elected officials are either unwilling or unable to stop the US from suffering what Jamie Dimon called, a ‘predictable crisis.’ Everyone sees it coming but no one is doing anything about it. Which means people who want to protect their financial future may have to take matters into their own hands. Contact American Hartford Gold at 800-462-0071 to learn how a Gold IRA can safeguard the value of your retirement funds from the impending collapse brought about by the national debt.

Notes:

1. https://fortune.com/2024/02/13/national-debt-elon-musk-government-spending-interest/

2. https://www.cnbc.com/2024/02/14/cbo-director-warns-lawmakers-of-rising-deficit-and-interest-costs.html

3. https://www.foxbusiness.com/economy/interest-costs-us-national-debt-set-exceed-defense-spending-year

4. https://www.foxbusiness.com/economy/interest-costs-us-national-debt-set-exceed-defense-spending-year

5. https://www.cnbc.com/2024/02/14/cbo-director-warns-lawmakers-of-rising-deficit-and-interest-costs.html

6. Google

7. https://fortune.com/2024/02/13/national-debt-elon-musk-government-spending-interest/

8. https://finance.yahoo.com/news/jamie-dimon-believes-u-debt-093000484.html

9. https://www.foxbusiness.com/economy/interest-costs-us-national-debt-set-exceed-defense-spending-year

10. https://www.cnbc.com/2024/02/14/cbo-director-warns-lawmakers-of-rising-deficit-and-interest-costs.html