Legendary investor Warren Buffett relies on one simple rule to know when stocks are too hot. In pro investing circles, it is known as the “Buffett Indicator.”

Buffett himself calls it “the best single measure of where valuations stand at any given moment.”

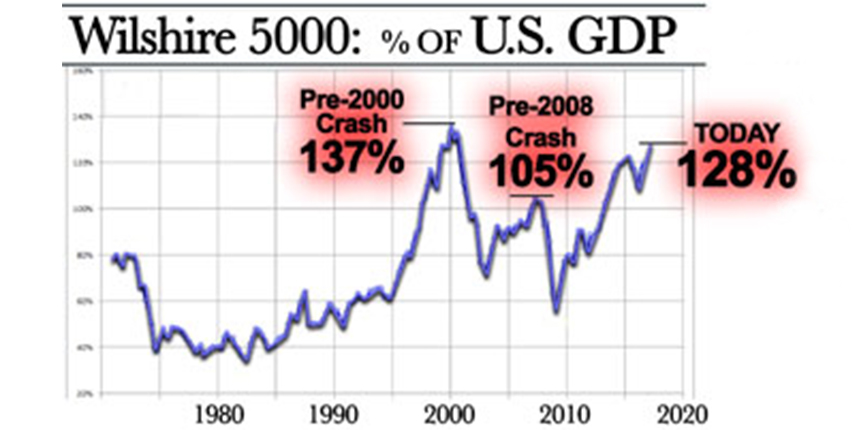

What is the magic indicator? The ratio of total stock market capitalization to Gross Domestic Product (GDP).

If Buffett is right, then the clock is ticking on America’s $25 trillion in retirement accounts. Just this month, the stock market hit a bubble milestone: we are now in the second most expensive market since the 2000 meltdown. As represented by the Wilshire 5000 Index, market cap has already reached 128% of GDP.

This is even more overheated than we saw before the 2008 crash. Remember the crazy Internet bubble? Even then, the market didn’t exceed 105% of GDP, at a time when the market was at the top of dotcom frenzy.

This means that retirement investors are sitting on trillions in paper gains that could head south at any moment. If they start to sell en-masse, it could get ugly. Nobody wants to be the last one out the door of a burning building.

This is why common-sense diversification matters now more than ever.

According to Tyler Durden of Zero Hedge, data since January 1978 shows that every 1% drop in annualized total returns on S&P 500 has brought a 1.5% increase in gold prices.

Durden thinks that the very real prospect of negative returns on stocks makes a compelling case for gold as a portfolio hedging tool.

Capital preservation and diversification are two reasons why gold can be a safe haven asset when stocks are trading at unrealistic levels.

POLITICAL CHAOS: WHAT IT MEANS FOR GOLD

Members of both political parties, the general public, and even President Trump himself have been quite dismayed by the extreme level of drama surrounding his current administration.

In addition to any possible tarnishing of our political system, this constant turmoil puts the future of big promises like tax reform and infrastructure spending at risk.

It is a stark reality of dollars and cents. Those programs represent huge potential windfalls to American companies, but nothing has actually happened yet. However, sky-high expectations are already more than baked into their current overheated stock prices, and then some.

Weak economic results combined with higher expected inflation, higher oil prices and a lower dollar have been key supports to gold in recent weeks. Regardless of your political bent, it is clear that increased criticism and scrutiny of the new President – including deep investigation and even some calls for his impeachment – raises the level of risk very high.

U.S. Global Investors chief executive Frank Holmes likes to remind investors that there will always be massive imbalances between any government’s fiscal and monetary policies. This is a key reason why he continues to advise every investor have up to a 10-percent weighting in gold.

GEOPOLITICAL TENSIONS ARE ON THE RISE

Geopolitical anxiety is rising as North Korea reported that it had successfully tested an intermediate-range ballistic missile to confirm the reliability of the late-stage guidance of a nuclear warhead.

An explosion at a popular concert in Manchester, UK wreaked havoc and shocked people around the world. This is a sad reflection of our new reality: one that every investor must look at clearly and adjust accordingly.

Jeffrey Halley, senior market analyst, notes that the geopolitical heat is rising. He believes that this soaring level of uncertainty means that gold prices represent a buying opportunity on any material market dips.

A COMMON PORTFOLIO MISTAKE: TOO MUCH IN “PAPER ASSETS”

Are you over-invested in paper-based, fiat-controlled assets like stocks and bonds, or even in U.S. currency?

If so, you are making a very aggressive bet that the markets are going to keep on soaring higher. But many market experts would tell you that the tea leaves say otherwise.

The Trump presidency is reeling from scandals. Prospects for meaningful tax reform, infrastructure spending and healthcare reform are cloudy at best.

The U.S. economy is limping along and inflation is creeping up. On the international front, North Korea is closer to achieving a nuclear weapon hitting the continental United States and may be the source of recent worldwide cyber attacks.

The only people who stand to benefit from the bruising political battles and investigations in the coming months are high-priced lawyers, the political pundits and the professional politicians who love a good sound bite.

Have you considered your game plan in case the unthinkable happens, like a severe stock market correction or a cyber attack on your bank?