Depositors Flee Traditional Banks

Over the past 13 months, $1 trillion has flowed out of traditional bank accounts. This massive movement of funds has raised concerns about the stability of the banking system. Individuals are exploring ways to safeguard their money. Rising interest rates and failing banks are sending depositors to higher-yielding alternatives. One such alternative gaining popularity is money market mutual funds. However, before moving into money market funds, it is crucial to understand their risks. And to learn of other avenues for preserving wealth.1

American banks have witnessed a whopping trillion dollars in deposit flight since May of 2022. The new numbers on bank withdrawals come after the Fed publicly revealed that more than 700 American banks are facing “significant safety and soundness risk.” This risk is due to unrealized losses that exceed 50% of their capital. The Fed pointed to its own interest rate hikes as the key reason those banks are now in a precarious position.2

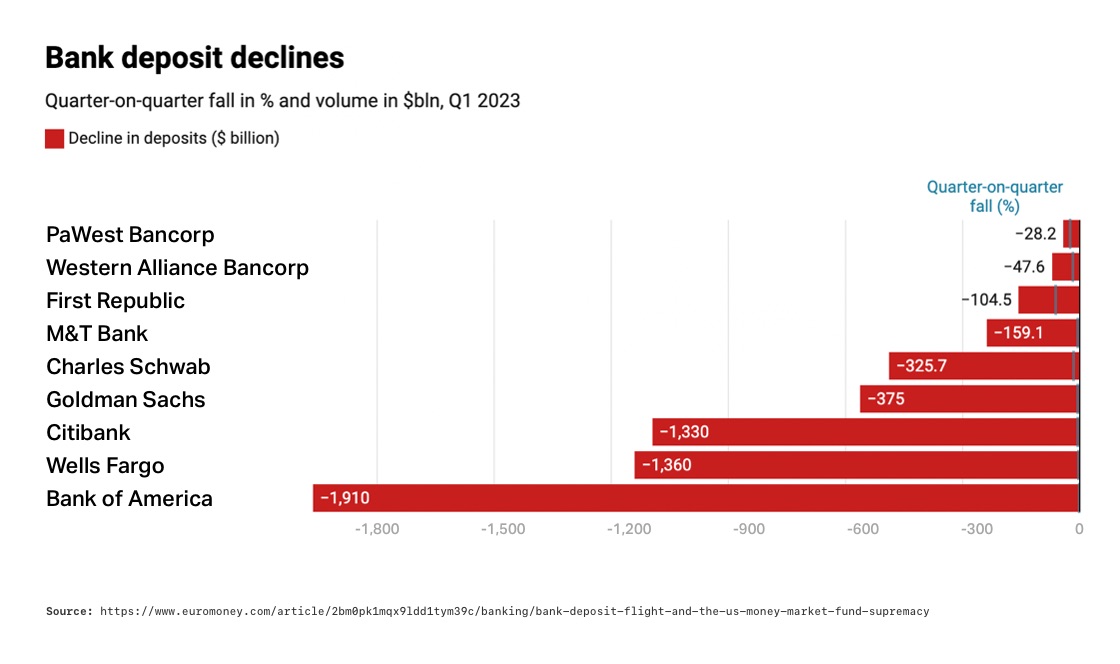

Capital flight wasn’t limited to shakier regional banks. JP Morgan was stable enough to acquire the assets of First Republic Bank. But three other big US financial groups weren’t so lucky. Charles Schwab, State Street and M&T reported $60 billion in combined bank deposit outflows in the first quarter of 2023.3

The failure of First Republic Bank highlighted the potential risks beyond the $250,000 guaranteed by the Federal Deposit Insurance Corporation (FDIC). It also showed how easy it is to transfer money out of an account. This event served as a wake-up call. Individuals looked for alternative ways to preserve and grow their wealth.

4

4

The Move to Money Market Funds

According to J.D. Powers, 29% of bank customers surveyed have moved their deposits away from their primary banking institutions. Awareness of traditional bank alternatives is growing. The Federal Reserve’s relentless series of interest rate hikes has further fueled the opportunities for higher returns.5

Money market mutual funds emerged as the primary beneficiaries of this shift. As a result, commercial bank deposits have decreased while money market fund assets have surged.

Traditional banking customers found much higher interest rates by moving their funds into money markets. Traditional bank accounts are offering meager interest rates. In comparison, money market funds offer returns of 3%, 4%, and even 5%. The difference made switching your funds into a money market seem like an easy choice.

Money Market Fund Risks

On the surface, money market funds offer attractive interest rates and liquidity. Yet concerns persist regarding their stability. Money market funds are not FDIC insured. They are not immune to “runs” or panics where investors withdraw their money at the same time. Also, money market fund yields fluctuate with short-term interest rates. Changing Fed policy could cause money market returns to drop.

Part of the concern about money market funds comes from their use of reverse repurchase agreements (reverse repos). In simplest terms, a reverse repo is when a money market fund makes short term loans using the cash within them. Reverse repos are fairly secure, but current events are amplifying a number of risks.

First, there is counterparty risk, which means the borrower may not repay the loan, resulting in potential losses. Second, there is collateral risk, as the value and quality of the collateral can affect the fund’s ability to recover the full loan amount. There is also liquidity risk, which arises when the fund needs to sell the collateral quickly but may face challenges if the market is illiquid. During this period of monetary tightening, interest rate risk exists. Rising interest rates can lower returns on reverse repos. As today’s economy walks a tightrope between inflation and recession, any of these risks could undermine the value of a money market fund.

Amidst the shifting financial landscape, one alternative that stands out is gold. Gold has long been viewed as a safe haven asset during times of economic uncertainty. It can act as a hedge against inflation, currency fluctuations, and geopolitical risks. With the possibility of a debt ceiling stalemate, gold offers stability and has historically preserved value during turbulent times. Gold doesn’t offer interest. Yet, gold prices are surging, and analysts see them hitting record highs. A Gold IRA from American Hartford Gold can be a safe alternative to a money market with its own potential to increase in value. Learn more about it today by calling us at 800-462-0071.