- Buy Now, Pay Later loans are luring consumers into deep debt

- Called ‘Phantom Debt’ due to the lack of oversight, its rapid rise can lead to recession

- Physical precious metals can protect portfolio value from runaway debt

The Heavy Price of Buy Now Pay Later Services

A new fintech version of the old layaway plan, Buy Now, Pay Later (BNPL) services are growing rapidly. And are dangerously luring people deeper into debt. Economists are calling the loans ‘phantom debt’ because it exists outside the scope of regulators. For a country already drowning in national and consumer debt, experts fear the exponential growth of BNPL can pose a threat to individuals and the economy at large.

Promoted as easy and convenient, BNPL split purchases into four equal payments. Adding to their appeal, this type of short-term loan doesn’t involve a credit check. They seem like an attractive option compared to credit cards averaging 21% interest, a record high rate for the past 30 years since it’s been tracked.

Experts estimate 93.3 million people will use buy now pay later services by the end of 2024.

BNPL purchases are projected to top $1 trillion by 2025. BNPL surged more than tenfold between 2019 and 2021, pushing the dollar volume from $2 billion to $24.2 billion.

BNPL are promoted as short-term no-interest loans – a cost effective way to spread out payments. But users who miss payments find themselves swamped by penalties and late fees. And fees stack up quickly when payments are due every 2 weeks. Ultimately, an average of 25% is added onto the purchase price.1

BNPL fans say they use the service to avoid high interest rates on credit cards. Credit card debt has broken record levels – hitting more than $1.08 trillion nationwide. However, some BNPL are paid with credit cards. “New BNPL users experience rapid increases in overdraft charges and credit card interest and fees, as compared to non-users…They are facing fees on two products rather than one. “2

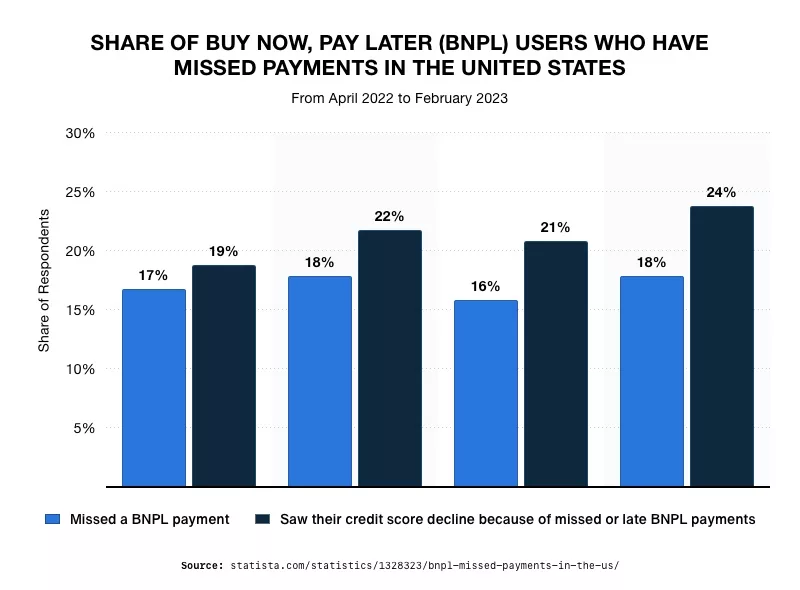

The Consumer Finance Protection Bureau said last March 43% of BNPL clients had overdrawn their bank accounts in the preceding 12 months. Missed payments can also impact user’s credit rating. 3

4

Critics of BNPL-linked fees are turning to regulators to consider consumer protections. The relatively new field has virtually no oversight. There is also no transparency. The Senate Banking Committee found that BNPL programs lure consumers into taking more debt and overextend themselves. The debt quickly becomes unmanageable. The Committee stressed that the rapid rise in household debt, high inflation and a massive drop in savings are putting Americans in financial jeopardy and urged some oversight.

Credit Risks

The short-term loans are not reported to credit bureaus. Lenders can’t see the true financial risk posed by potential borrowers. And borrowers can easily get in over their heads with new loans. Putting fragile banks and indebted consumers in jeopardy.

“Until there is a definitive measure for it, there is no way to know when this phantom debt could create substantial problems for the consumer and the broader economy,” Wells Fargo economists wrote earlier this month. They continued, “But it could also be an “unregulated danger zone that could lull consumers into a false security in which many small payments add up to one big problem.”5

Impact on the Economy

There is no central repository for monitoring “phantom debt.” Its growth could imply total household debt levels are much higher than traditional measures capture.

Consumer spending accounts for 70% of the American economy. Unpaid consumer debt, when widespread, can strain the financial health of individuals. As debt accumulates, people spend less on goods and services, impacting businesses’ revenues. This reduced spending can lead to a slowdown in economic growth, potentially causing job losses, decreased investments, and a general economic downturn, which, if severe, can result in a recession.

National and consumer debt already pose an existential threat to the American economy. The explosive growth of BNPL services looks like a last gasp by desperate consumers facing high inflation and dropping income. That’s why experts are looking at gold and silver. Physical precious metals have intrinsic value that’s not tied to national debt or currency fluctuations. When national debt rises, it can weaken a country’s currency. Precious metals tend to retain their value or even appreciate during such times. They act as a hedge, preserving wealth by offering stability and serving as a safeguard against the erosion of value. A Gold IRA from American Hartford Gold can help protect your financial future. Contact us today at 800-462-0071 to learn how.