The May Effect is Very Real

There is an adage steeped in history and backed by the numbers stating equity investors should sell in May and go away. Indeed, that axiom has mostly held true since the beginning of the Dow Jones itself. The reasons are real. Tax bills are due, funds are needed for summer vacations, and holiday shopping must be budgeted. The May effect is rooted in real behavior by real people. It is no coincidence.

Elections Don’t Help

May has historically performed even worse in years of mid-term elections.Per the Stock Trader’s Almanac, the Dow performs much worse (minus 0.9% average) in midterm election Mays than its overall scant average drop of 0.02% in all May months. The difference is a massive minus almost 1.0% in midterm years versus an average of “flat”markets in all Mays going back over 50 years.

The Best Month Wasn’t So Good Either

Not only has May been the worst performing month for stocks on record, but it follows April, the best performing month for stocks historically. According to the same Almanac, the Dow averages gains of 1.9% in all Aprils going back to 1950. Yet this past April was a rollercoaster barely mustering a 0.9% higher close, 50% lower than the average April. Not a great jump off point for May it would seem.

Recipe for Risk

Combine a weak April with an even weaker May historically. Add to that Midterm elections and you get a recipe for volatility ending in a possible multi-year market swoon. Moreover, the Fed is now raising rates to chase inflation post an unprecedented 10-year recession-free economy.

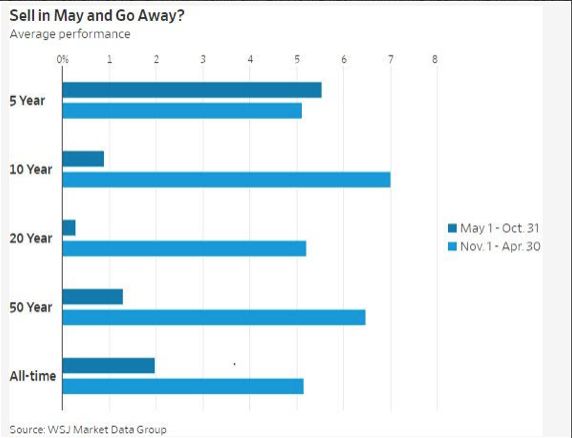

Natural laws cannot be repealed. Markets are still cyclical, and the days of higher rates undermining stock prices are now upon us. Here is the S&P 500 performance during the two “seasons” of investing.

But The Last Five Years..?

A sharp observer will note that the May Effect has been spot-on for the long haul, yet the last 5 years have not borne out the prophecy. This should serve to actually strengthen the concept for long term investors.

The last 5 years have been largely a non-event for sure on average. But the last 10 years have been well above the historical average in May-October seasonality. This just underlines the uncertainty from year-to-year short term, while emphasizing the “Sell in May” phenomenon over the long haul.

Coin-Flipping Your Retirement

If investors choose to focus entirely on the last 5 years, they are flipping coins at best and risking much if the 10 year trend reasserts itself. Should investors want to take the risk of having to withdraw the majority of their funds in a year gone bad? The answer should be a definitive “No”.

Re-Balance to Preserve Your Wealth

Investors should be wary of permitting a large percent of their nest eggs be subject to market vagaries on any given day or year. Profits should be booked when they can be, not when they have to be.

Stocks are for creating wealth. Having done just that for investors over these last 10 years, soon to be retirees should be looking to preserve wealth. Portfolios should be rebalanced at regular intervals. And given history, May is the month of uncertainty that should serve as catalyst for wealth preservation. If not now, when?

What is “Safe”?

If we are in a rising interest rate environment while US baby-boomer stockholders are liquidating their portfolios; then alarm bells should be going off for investors who will need net worth stability over the next 20 years.

More likely we are headed to a 1970’s repeat as both bonds and stocks move lower in the face of a government having to re-finance its war deficits (Iraq, Syria, Afghanistan) as it did post Vietnam. Given this scenario; What is safe?

How does one preserve wealth from adverse volatility while hedging their buying power in the face of a potential inflation tsunami?

Good as Gold

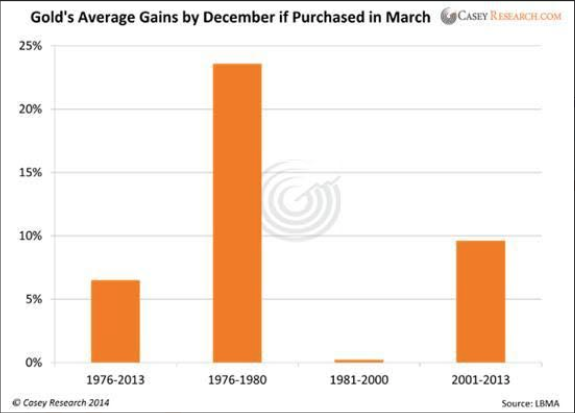

Many people are looking once again at Gold as a hedge for both domestic policy concerns like incipient inflation, as well as geopolitical risks (war, global market collapse) that can and frequently do play havoc in our markets daily now. History may not repeat itself, but it does hum the same tune. Our markets are no longer the isolated island they once were. We could very well be entering a 1970’s style of stagflation where stocks move sideways after a crash while the USD buying power shrinks. The chart below corroborates this.

Of Note:

- Gold’s resurgence comes post-mortem the 1981-2000 goldilocks economy.

- It has a long way to go before Gold reaches the heights it did during the stagflationary 1970s.

Gold historically makes its annual lows between March and April. It has come off over $50 from its high in the last 2 weeks true to form. That is a best time to enter into long term positions.

Portfolio Insurance Should Be Owned, Not Rented

When it comes to preserving wealth, gold should be bought and held until the proceeds are needed. We are not stating that gold should be bought in March and sold in December as the chart implies. Investor focus should be on decades and this graphic shows that nicely.

Gold, like home fire insurance is a policy to be held and hopefully never needed to be cashed in for a disaster. Buy dips for sure. If you have to sell the rally, then do so to repair your investment “house” only. Otherwise as long as a person earns and spends dollars, they should own gold.

Seasonality in Gold Lasts Years

Gold also has seasons in which it performs best like any other asset. Those seasons last decades rather than months as the chart above shows. Those decades are entirely a function of how the USD is doing in the global markets. A weak dollar undermines corporate profits.

That is not to say the other paper currencies won’t stumble as well, because they will. The greenback may holds its value relative to other nations’ paper money. That also means the USD will be the tallest Pygmy in the tribe. Only real assets like Gold will stand tall when the cycle finally flips.

What About Bonds?

Bonds would be no help either as a wealth preserver. The 2% CD you buy today will be replaced by a 3% one in a year. Meanwhile the price of things you need will outstrip your rate of returns as the government chases inflation higher for years. Remember: it took 10 years for the Fed to stop the deflationary cycle despite zero interest rates. Should we expect any better performance in an inflationary environment?

That means Stocks and Bonds can take turns in a race to the bottom for the next 10 years competing for so called “value buyers” if any still exist. No. Real assets may be the better way. And no real asset combines the inflationary hedge of a home with the cash liquidity of a bond than Gold.

Land versus Gold

Real estate is also an obvious hedge. But don’t count on getting a home equity loan when you need it most post the 2007-2008 housing crash. People will be locked in to their homes next time around. Real estate does offer the protection of Gold on paper, but not cash access like gold does. Gold, when it comes down to it, is money.

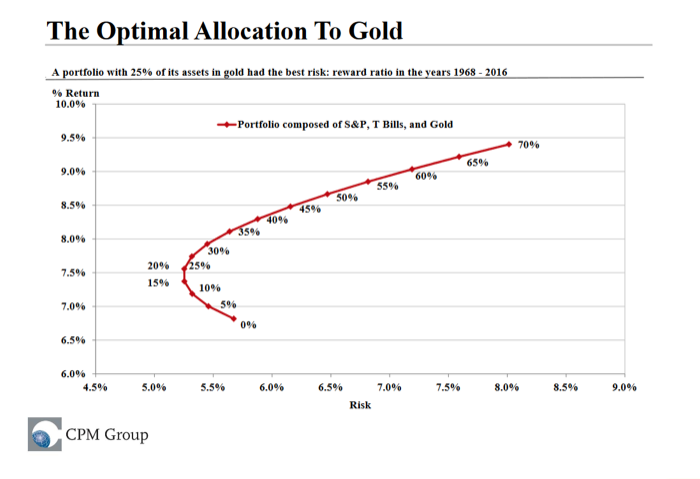

How Much Insurance is Needed?

That depends on the individual. Most portfolio managers suggest a 5-10% allocation in precious metals with a re-balancing every year or so. However there is some good research just out from CPM Group that blows that allocation model away. It should be noted that CPM has historically tempered its own enthusiasm for Gold in favor of Platinum and Palladium during the stock bull market. Now, they favor Gold. Here are their findings for the optimal allocation of Gold as part of a well balanced portfolio from 1968 to 2016:

Over the last 48 years, the best performing portfolio actually had a 25% allocation in Gold vs stocks and bonds. Frankly, that is far higher than what even many bullion dealing firms recommend. It should be noted that CPM Group is not in the business of selling bullion.

Insurance That Pays

The CPM Group believes Gold prices will average some 68% higher than current prices over the next 6 years. Using the current average price of approximately $1300 per ounce in 2018 thus far, that translates to an average price of $2185 per ounce by 2024.

Long-term outlook

Longer term, CPM expects gold prices to “rise sharply, probably to record annual average prices, in the period 2021 – 2024. Prices might reach $2,185 on a nominal average annual basis…”

Why Gold Prices Are Likely To Rise Longer Term

Gold prices are projected to rise in the coming 5 – 10 years because of a combination of:

- Economic, financial, and political factors stimulating increased investment demand.

- Continued strong investment demand trends.

- Continued central bank buying.

- Declining mine production after 2019.

Goldilocks Comes to Metals

When you combine Gold’s

- low volatility of Gold compared to other asset classes,

- tendency to move opposite equities over long recessionary time periods

- absolute reliability as hedge against the USD like we experienced in the 1970s,

one has to consider seriously why a larger percentage of their wealth is not in real assets given the unprecedented rally in stocks the last 10 years. It has been a long run, and we do hope it continues.

Can one afford to “hope” the Dow will bounce back 2,000 points when we need to cash-in for retirement? The 2007-2008 debacle forced many people to sell their 401k’s on the lows. People were emptying ATMs as if it was a true armageddon. People should not put themselves in that position again with their life savings. Goldilocks is moving to a new address if the last 2 months are any indication.

If Not Now, When?

If you are on the fence as to when a good time is to take profits in a 10 year stock bull market consider this advice from a 30 year trader colleague who manages money for a multi-billion dollar hedge fund:

At the close of every trading day that you don’t close a profitable position, you are effectively RE-BUYING that position at the settlement price. You are saying that your position is still undervalued. For traders, there is no “hold”. There is only buy or sell. Every day is a decision to recommit or liquidate our positions.

Investors have much longer term time frames than traders to be sure. But the wisdom in a trader’s philosophy becomes more relevant as we inch closer to our own retirements. Every day we do not move to preserve some of our wealth, we are re-buying our positions and hoping for the best.

The vehicle that remains the most liquid, low volatility, safe preserver of wealth with zero counter-party risk is Gold. Same as it ever was. Now is the time to consider owning physical gold and silver before the next crisis hits. Call us now at 888-997-6844 to help insulate your portfolio from black swan events that could endanger your financial future.

There’s absolutely no obligation, and the call is free. What are you waiting for?