- $1.5 trillion of commercial real estate loans are coming due in two years

- Banks fear commercial mortgage holders will default due to high interest rates and low occupancy

- A crumbling commercial real estate can drag the economy into recession

Commercial Real Estate a ‘Ticking Timebomb’

A potential disaster is waiting to strike the US economy. The commercial real estate market is on the edge of cliff. It is about to be pushed over by rising interest rates and declining occupancy. And it just might take down the economy with it. With recent turmoil in the banking industry, experts foresee another mortgage crisis leading to a potential recession.

The US economy faces an economic time bomb with approximately $1.5 trillion in real estate mortgages set to mature within the next two years. This impending wave of maturities is adding to the stress of high interest rates and low occupancy. 1

The Federal Reserve has raised key interest rates by 5 percentage points since March 2022. Interest rates have more than doubled for some types of commercial mortgages. High rates were blamed for the recent series of bank failures. Those crashes were tied into their overweight investment in commercial real estate.

Continued office vacancies are making matters worse. The significant increase in remote work since the pandemic has kept offices empty. This shift in work dynamics has reduced the demand for office spaces. Commercial landlords are now left in a vulnerable position.

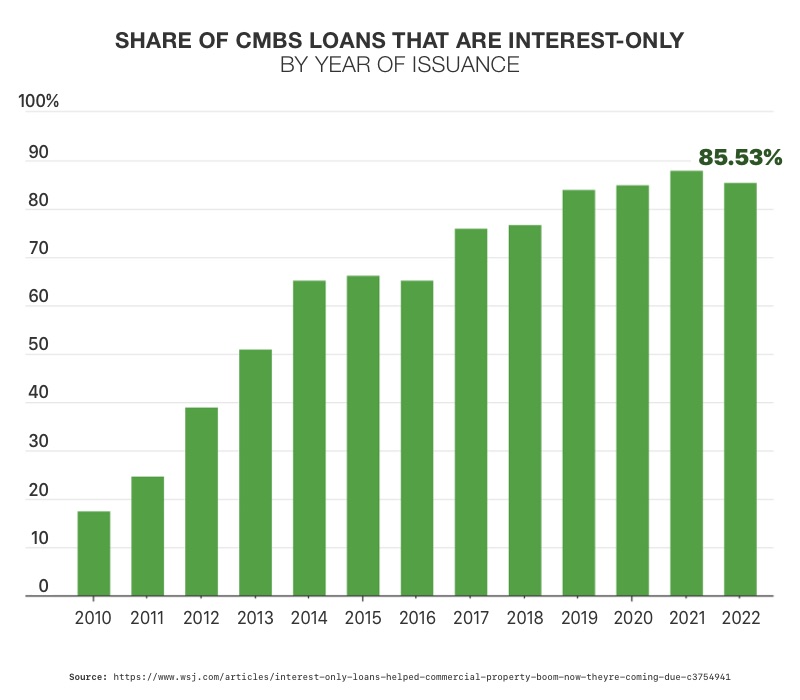

In addition, many of the landlords are on the hook because they have interest-only loans. Unlike traditional home loans, commercial mortgages often require borrowers to only pay the interest during the loan term. The entire principal comes due at the end. Interest-only loans as a share of new commercial mortgage-backed securities issuance increased to 88% in 2021, up from 51% in 2013.

2

2

The risk seemed minimal at the time. Interest rates were low and property values kept rising. Owners could expect to simply pay off the loan with a new one when the bill came due. Now, many landlords are no longer able to get new loans big enough to pay them back. Fitch Ratings estimates that 35% of commercial mortgages won’t be able to refinance. While many malls and hotels face high default risks, the situation is particularly dire for office owners.

Banks Respond

Banks recognize the danger facing them. They can see the rising risk of default from office tower and mall owners. Decreased demand and lower rental prices are contributing to a decline in property valuations. Banks fear being left with less valuable collateral and insufficient security in the event of default. Such defaults would expose them to potential losses and destabilize their loan portfolios.

Banks are determined to reduce their exposure to the teetering commercial real estate market. They are cutting back on commercial property loans. Doing so could lead to a slowdown in new office construction and impede the market’s recovery.

Some banks are selling off property loans at a discount even when borrowers are up to date on repayments. Wells Fargo is cutting its losses by preparing to offload debts at discounted prices, even from borrowers who have remained current on their repayments. Of its $142 billion in commercial real estate loans, Wells Fargo chief executive said, “We will see losses, no question about it.”3

HSBC is in the process of pawning off hundreds of millions of dollars’ worth of loans at a discount. They are also winding down direct lending to property developers. And PacWest unloaded $2.6 billion worth of construction lending contracts at a loss in May.4

As large banks cut their losses, the banking crisis for regional banks continues. Roughly 70% of bank-held commercial mortgages still sit on the balance sheets of both regional and small lenders. These banks may be more vulnerable to the effects of a commercial real estate crisis. Another round of bank failures may occur in the not-so-distant future.

The FDIC is monitoring the potential crisis. They said, “The banking industry continues to face significant downside risks from the effects of inflation, rising market interest rates, slower economic growth, and geopolitical uncertainty.”5

Effects of the Crisis

As the fear of delinquencies rise, commercial real estate stocks are down. An index of publicly traded commercial real estate investment trusts (REITs) has fallen 18.1 percent since this time last year. Fewer commercial buildings are being sold more than three years after the coronavirus surfaced in the US.

The prospect of widespread default and plummeting demand could stifle construction and development in major US cities. Fewer lenders are betting on a quick recovery. With the crumbling of commercial real estate’s crucial role in the economy, a chain of events may be in motion that could end with recession. The 2008 mortgage crisis resulting in stocks dropping by 50%. Retirement savings were devastated. With a potential repeat crisis, the time is now to protect your assets. A Gold IRA from American Hartford Gold can safeguard the value of your portfolio from another market crash. Contact us today at 800-462-0071 to learn more.