Conflicting Market Predictions

Famed economist John Kenneth Galbraith said, “The only function of economic forecasting is to make astrology look respectable.”1 There is a lot of contradictory information out there. While some analysts hail a new bull market, other experts are predicting a possible market crash and a decline in 401(k) balances. In the face of confusion, advisors recommend sticking with fundamentals. Diversifying your portfolio with gold is a solid strategy during uncertain times.

Wall Street is saying we’re in a “new bull market.” The S&P 500 stock index, has risen 20% from the lows hit last October. While this is one way to define a bull market, it is not the only definition. Technically, a bull market isn’t defined until it is over.

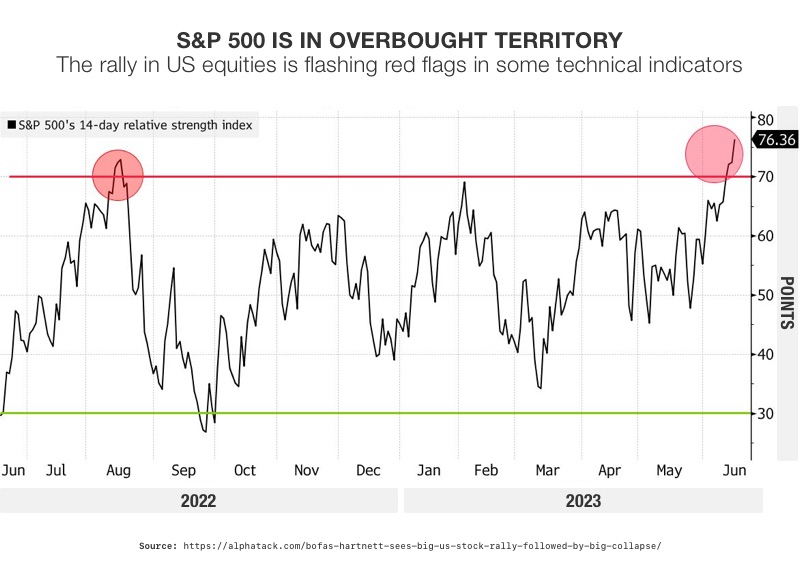

Michael Hartnett, Bank of America’s chief investment strategist, has a different take on the market. He said, “We are not convinced we are at start of brand, new shiny bull market, still feels more like combo of 2000 or 2008, big rally before big collapse.” He suggests the S&P could drop 300 points by September.2 Hartnett references the chart below to indicate that stocks are overvalued and ripe for a correction:

3

3

Hartnett said the Fed will need to “reintroduce fear” to break sticky inflation. He sees interest rates hitting 6%. In his opinion, stocks will stay elevated until that happens. But when it does, everything will come crashing down. Especially since only seven mega-cap stocks have been driving the markets recent strength. Seven tech stocks that are very vulnerable to rate changes.

Impact on Retirement Funds

The gloomy forecast comes after a brutal year for the stock market. It had its worst year since the 2008 financial crisis. All three indexes tumbled in 2022, snapping a three-year win streak. The Dow Jones Industrial Average ended the year down 8.8%, the best of the three. The S&P 500 sank 19.4% while the tech-heavy Nasdaq Composite plunged 33.1%.4

A recent Vanguard report revealed the damage the rout caused to retirement accounts. According to Vanguard Group’s research, the average balance in employer-sponsored retirement contribution plans took a tumble of over 20% in 2022. The average account balance for 401(k)s and 403(b)s was $112,572 in 2022 – down nearly $30,000 from the previous year.

This drop is mainly due to the decrease in equity and bond markets.

At the same time, a growing number of Americans tapped their retirement accounts to cover financial emergencies as high inflation raged. Inflation is retreating, but slowly. Meanwhile, core prices, which exclude the more volatile measurements of food and energy, climbed 0.4%, or 5.3% annually. The report showed a 40% increase in workers making “hardship” withdrawals in 2022. Not only do these withdrawals reduce retirement savings, but they can also be subject to taxes and penalties. 5

How to Diversify Your Portfolio

Left with no clear direction on the state of the economy, many folks are growing concerned about their financial future. Even go-to target date funds are being questioned. Nicole Webb is senior vice president of the Wealth Enhancement Group. She is advising people to get out of the popular target date funds because they all focus on only a handful of stocks. The lack of diversification exposes them to risk.6

With so much uncertainty, diversification is key. And one of the best ways to diversify your portfolio and reduce risk is with gold. Especially now. VanEck, a leading investment firm, suggests that gold has formed a new base at around $1,900 an ounce.

VanEck reported, “Gold is showing resilience despite a strong stock market and recent U.S. dollar strength.” They propose all-time highs are within reach for gold as the Federal Reserve halts its most aggressive tightening cycle in decades. “The $2,075 per ounce all-time high seems well within reach, in our view.”7

In a world of market uncertainties and declining 401(k) balances, it’s crucial to explore alternative investment options that can safeguard your financial future. Bank of America’s warning about a possible market crash should make us pause and consider our strategies. While 401(k) balances experienced a significant drop last year, gold has emerged as a beacon of hope. Its resilience and potential for record-breaking heights make it an attractive choice for those seeking stability.

So, how do you make gold a part of your retirement savings? You can consider a Gold IRA. Offered by American Hartford Gold, Gold IRAs allow you to transfer your existing retirement funds into a gold-backed account. By doing so, you retain the tax advantages of a traditional IRA while gaining exposure to the potential growth of gold. Contact us today at 800-462-0071 to learn more.