Year after year, the World Economic Forum in Davos, Switzerland has been a must-attend gathering for world leaders looking to connect on the big issues of the day. It usually attracts over 100 heads of state and over 1000 CEOs.

Until this year.

Last week, the heavily guarded, invitation-only event was looking more like a ghost town. Tellingly, private jet usage to/from Zurich was down by 15% from the 2018 meeting. This was both from lack of attendance and a sudden interest in saving money.

No surprise that gold prices also just rose again to hit a seven-month high.

You can blame political unrest and the quickly collapsing global economy:

China just posted the slowest growth it has seen in twenty-eight years ( President Xi Jinping was a no-show)

Mobs of “yellow jackets” rock the streets of France daily (President Emmanuel Macron decided to stay close to home)

America just slogged through its longest government shutdown ever (President Donald Trump stayed in Washington as well)

The timing couldn’t be worse, with the global economy sliding ever closer to recession. Davos would have been the perfect opportunity for our most important heads of state and industry to compare notes!

Sadly, we can no longer rely on others to make the right decisions. In today’s world, you have to build your own foundations and make them strong.

There is no reason to be alarmed about the future, regardless of what our heads of state do or don’t do. Fear comes from a lack of preparation and a feeling of uncertainty. Is the ground under your feet starting to show some cracks?

Frankly, this is why I founded a gold and silver IRA company and tell everyone I know about safe haven assets and gold. All you have to do is consider buying precious metals for your portfolio.

DALIO & KLARMAN ISSUE DIRE RISK WARNINGS

One of the most important no-shows at Davos wasn’t a head of state at all.

Missing this year was the so-called “Oracle of Boston”… aka Seth Klarman, the billionaire CEO of hedge fund Baupost Group. Klarman is often compared to Warren Buffett for his value-oriented investment style and highly-perceptive world-view.

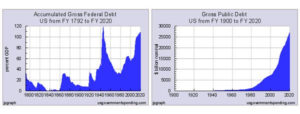

Klarman wrote a scathing letter to Davos, and he made no bones about it: his view is bleak for the global economy. He sees a huge threat from America’s exploding national debt and choking political climate as well.

“The next major financial crisis may well be found in today’s sovereign debt levels,” wrote Klarman. “It can’t be business as usual amid constant protests, riots, shutdowns and escalating social tensions.”

Klarman is only one of many who have sounded the alarm about America’s huge debt. “America will inevitably reach an inflection point whereupon a skeptical bond market will refuse to continue to lend to us at rates we can afford,” he writes.

Ray Dalio, founder of the world’s largest hedge fund, echoed these remarks on CNBC. He says the U.S. is at “significant risk” of recession in 2020, adding that “the next downturn in the economy worries me the most.”

MORGAN STANLEY SAYS ‘DISMOUNT NOW’ FROM MARKET

Morgan Stanley’s chief equity strategist, Michael Wilson, is telling investors to seek alternatives to stocks immediately. “Bulls can be dangerous animals… we think it is better to hop off now,” he wrote.

Wilson thinks America’s economy may never recover from the recent record-length partial government shutdown. “Some things likely can’t be ‘made up’ even if the temporary reopening become permanent,” he said. The China trade war is also generating lasting damage, in his view.

Patrick Ceresna, chief derivative market strategist for BigPicture Trading, said gold has established a price bottom over the last few years and is ready for a rally in 2019. “When the Fed stops their rate hike cycle and begins to ease, we’ll see the dollar start to correct. That could be the real line in the sand where gold can actually start getting bullish.”

George Milling-Stanley, head of gold investments at State Street Global Advisors, says gold prices could push $1,400/oz in 2019. “The gold investment market is becoming much healthier over the last three or four months.”

Milling-Stanley thinks the Fed is soon to cease or reverse course on its recent rate hikes. “U.S. equities won’t be artificially stimulated by government tax cuts and the U.S. dollar won’t have the same support from rising interest rates,” he says. That could mean less headwinds for gold prices, according to State Street.

MARKET ROULETTE: HOW TO STEP AWAY FROM THE TABLE

For anyone who is in or near retirement, the news each day is best digested with a handful of Tums. It is hard to plan ahead with optimism if you can’t dampen the volatility of your portfolio.

Retirement investing is about laying down solid foundations, not casting the dice. If you had to guess, would you say the future looks brighter or dimmer for any of these current issues?

Shutdowns and political unrest in the U.S.A.

The U.S-China trade war

Political situation in Venezuela

Interest rate meddling by the Federal Reserve

U.K. voting over Brexit and how to save their economy

It is anyone’s guess where these might lead us in the next few months. Luckily, you don’t have to have a crystal ball.

This is where gold can shine: smoothing out the bumps in your financial road with the diversity of a safe haven asset.

Bad things that send economies into tailspins are the same things that generally favor gold: spiraling national debt, high interest rates, a collapsing dollar, political unrest, trade wars and more.

You don’t need to be the “Oracle of Boston” to foresee more of the above in the future.

The good news is, you still have time to prepare today.

I highly suggest you consider gold and silver for your IRA. A gold bullion backed IRA is of considerable comfort in these times of uncertainty. Our IRA Specialists can help you put gold and silver to work for you today.