This year, Halloween is delivering bigger scares than usual.

Many Americans are feeling mighty spooked by the big spike in stock market volatility and the headlines don’t help at all.

Today on the front page of MarketWatch, financial columnist Howard Gold writes: “What bothers me most is that some of the previous biggest gainers are trailing badly, while economically sensitive sectors have sold off dramatically, and bellwether home builders’ stocks are already deep in a bear market.”

The good news is: it isn’t too late to get ahead of the next big market drop.

We’ve been telling our clients to view this period as a possible opportunity. Perhaps it is even a life-saving “shot across the bow” for their financial futures.

We have no crystal ball and we can’t predict what is ahead… we can only see the lessons of history that show us that volatility is a reality.

Stocks have big peaks and valleys and the ride can be a painful one.

That’s why common-sense diversification and safe haven assets make sense to our clients, who want to sleep better at night regardless of where the market might go tomorrow.

Over the last month, the Dow is down over 8% and the S&P 500 is down over 9%.

Gold is up about 1%.

This is a powerful example of how diversification can help your portfolio ride out the bumps.

While it might be scary to think about the possible loss of your retirement portfolio, getting informed is the only way to get prepared!

The first step is to get the facts.

The information below could save your family’s financial legacy, so please read on!

THE STOCK MARKET IN A NUTSHELL

The latest GDP report seems to show that the economy has peaked.

Growth in the third quarter was down 0.7% from the second quarter of 2018, according to the Commerce Department.

Business investment has been very slow, despite the recent tax cuts for businesses. Poor trade numbers have hurt GDP growth. In fact, with all the recent trade wars breaking out, trade is delivering the largest negative contribution to GDP growth in over 30 years!

Despite the fact that many S&P 500 companies have topped Wall Street’s earnings estimates, stocks are still selling off.

Why is the market looking so scary right now?

Howard Gold writes in MarketWatch today: “Clearly, investors already are asking what will you do for me next year? As the Federal Reserve continues to raise short-term interest rates, investors are faced with rising rates and lower earnings growth next year. No wonder they’ve been selling. I don’t know if we’ll have another recession and bear market or if stocks will just post lower returns over the next decade, but something fundamental has changed and I’m worried.”

DON’T WORRY… JUST GET PREPARED

We see no reason whatsoever for worry, as long as you get prepared. Let Howard Gold’s worry work for you!

It can be a catalyst to your own thinking about where your own portfolio is positioned.

What if the market did crash hard tomorrow… what does history show? You might be surprised to learn the facts about safe haven assets and how they have performed.

These are the six largest stock market declines we’re experienced in the last 30 years:

Aug 87 – Dec 87 S&P500: -34% GOLD: +6%

Jul 90 – Oct 90 S&P500: -20% GOLD: +7%

Jul 98 – Aug 98 S&P500: -19% GOLD: -5%

Mar 00 – Oct 02 S&P500: -49% GOLD: +12%

Oct 07 – Mar 09 S&P500: -57% GOLD: +26%

May 11 – Oct 11 S&P500: -19% GOLD: +9%

In every case, gold outperformed the S&P 500. In some cases, it did so by as much 83% over just 1.5 years!

Clearly, past performance is no guarantee of future results. We are not market timers here at American Hartford Gold Group and never have been.

We are fans of all-weather strategies. Your family’s legacy is too important to gamble with.

RECESSION-PROOFING YOUR PORTFOLIO

Can you imagine a recession ahead for America?

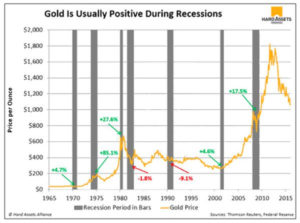

We certainly can, though we hope for the best. Either way, here’s a useful graph to illustrate what gold might do during the next recession, according to data from Thomson Reuters and the Federal Reserve:

In almost every case, gold rose.

In almost every case, gold rose.

Also, in times of recession, gold gets LESS correlated to global equities and to the S&P 500, giving gold owners the diversification benefits they are seeking.

This data is very compelling!

LET HISTORY’S LESSONS WORK FOR YOU IN THE FUTURE

Here’s what history tells us about gold:

1. In most cases, gold prices rise during periods where the stock market is crashing

2.Gold and stocks tend to be negatively correlated, with stocks leading the way in times of optimism and gold benefiting when fear and uncertainty take hold

3. Historically, gold has also benefited in times when stocks have been in a holding pattern, like in the 70s decade, when gold rose over 2000% while stocks gained only 1.4% per year

4. Diversifying with safe haven assets tends to lower overall portfolio volatility

Gold and silver clearly deserve your careful consideration at a time like this, when volatility and ugly headlines seem to come every day.

There are plenty of reasons to consider buying gold now:

Commerzbank says gold prices will exceed $1,300/oz again in 2018

Goldman Sachs says gold will be over $1,325 in the next year

RBC Capital Markets says gold will be over $1,338 in 2019

Bank of America Merrill Lynch says gold will hit $1,300 in 2019

Physical gold can provide safe haven protection for your portfolio in these uncertain times. Peace of mind, diversification, privacy and more could be yours.

Let’s talk today, before the next market drop occurs!