- The “Buffet Indicator” is signaling that stocks are overvalued and due for a crash

- The crash could be caused by overvaluation, recession, and shrinking money supply

- Warren Buffet advises seeking safer long-term investments

Buffet Indicator Warning

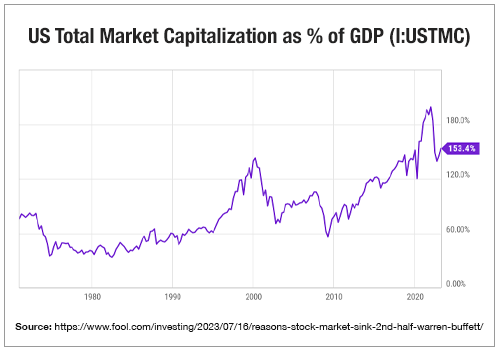

As the Nasdaq saw remarkable gains exceeding 30%, and the S&P 500 has close to a 20% increase, an ominous warning emerged from the legendary investor Warren Buffett. His favorite market gauge, known as the “Buffett Indicator,” is flashing red signals. It is suggesting that stocks might be overvalued, and a potential crash is looming.1

The indicator just hit 171%. It reflects the exuberance of investors betting on artificial intelligence, anticipated rate cuts, and a soft-landing scenario. Given Buffett’s endorsement of this gauge as “probably the best single measure” of stock valuations, his concerns have garnered attention. He is not alone in expressing caution about the stock market’s current state. As experts echo this warning, it becomes crucial to take appropriate measures to safeguard your retirement funds.

2

2

The indicator takes the total market capitalization of all actively traded US stocks. It then divides that figure by the official estimate for quarterly gross domestic product (GDP). Investors use it to compare the overall value of the stock market to the size of the national economy.

Buffet said stocks would be fairly valued at a 100% reading. You should aim at buying them at 70% or 80%. He warned it would be playing with fire to purchase them close to the 200% mark.

The gauge today is calculated using the Wilshire 5000 Total Market Index for the value of all traded stocks. The index jumped 22% this year. Market capitalization is now at $46.32 trillion.3 That was divided by the GDP estimate of $26.84 trillion from the Bureau of Economic Analysis. The result was a startling measure of 171%. The gauge proved accurate last year. It plummeted from over 210% in January 2022, to below 150% by September as stocks fell accordingly. 4

Reasons for a Crash

There are several reasons why the market could crash.

Overinflated valuations – as the Buffet Indicator show, stocks are expensive on an overall basis. Besides a period from 2020 to 2021, stocks haven’t been priced so high since the dot-com bubble in the early 2000s.

Recession forecasts – the Fed is saying a recession can be avoided and a ‘soft landing’ achieved. However, a recent Bloomberg survey found that 63% of economists still expect an economic downturn within the next 12 months. The stock market often begins to decline even before the economy does.5

Money supply – the M1 money supply includes all physical currency in circulation. The M2 money supply adds in deposits in savings or money market accounts. Since 1870, every single time the M2 money supply has fallen by 2% or more, a major economic downturn followed. In three cases, depressions occurred, including the Great Depression. As of now, the M2 money supply has dropped by more than 4%. If you believe history over economists, recession in on the way.

Warren Buffet and his namesake indicator aren’t alone in their negative forecast. John Hussman is President of Hussman Investment Trust and an asset-bubble expert. He thinks the S&P 500 risks a 64% collapse. This is due to extreme valuations and “unfavorable market internals.”

Hussman said stocks enjoyed an impressive rally in 2023. The S&P 500 has rallied 19% so far this year. That takes its gains since the end of 2008 – the year of the global financial crisis – to more than 400%. The price-earnings ratio of the index, one of the valuation metrics tracked by investors, has climbed to about 26 from last year’s lows near 19.6

Hussman attributes the rise to cooling inflation, fading recession fears, and growing interest in AI. He concludes a steep plunge in stocks is necessary to get market conditions back to normal. He summed up his prediction by saying, “Yes, this is a bubble in my view. Yes, I believe it will end in tears.”7

“Rich Dad, Poor Dad” author Robert Kiyosaki also warned about a collapsing market. He tweeted, “too many signs point to a severe stock market crash. If your future depends on stocks and bonds, please be careful, possibly ask for professional advice.” He continued, “Afraid depression coming.”8

What to Do

When it comes to protecting your financial future, forewarned is forearmed. Many are riding the current stock market wave, convinced good times are here again. But some of the world’s most preeminent investors are warning otherwise. Buffet says forget trying to time the market. He’s putting Berkshire Hathaway’s money in cash and long-term investments. The idea is to focus on the future. And one of the most secure long-term assets is physical gold. A Gold IRA from American Hartford Gold can protect the value of your portfolio from a crashing stock market. Contact us today at 800-462-0071 to learn more.