Biden Proposes New High Taxes

According to the Trump campaign, Biden is proposing ‘largest tax hike ever’. His 2025 budget is a mix of massive spending increases and huge tax hikes on Americans. If it goes thru, the new taxes could have a punitive effect on individuals and the economy.1

With a $7.3 trillion price tag, Biden’s 2025 budget plan is one of the largest federal budget proposals in recent history. It includes $4.9 trillion in tax hikes and proposes $86.6 trillion in spending over ten years. The plan would significantly grow the size and scope of the federal government if enacted. It would also result in the largest debt in American history. Economists estimate the debt could hit $54 trillion in ten years.2

According to the Manhattan Institute, roughly half of the revenue raised by the tax increase would not be used to cut the deficit. Despite the debt reaching crisis proportions, the taxes would be “plowed into…new entitlement expansions.”3

Broad Impact of Tax Hikes

Biden’s tax proposals would dramatically raise the rates paid by corporations and wealthy Americans. There would be several different hikes. The proposals include a 25% minimum tax rate on ultra-high worth households. The capital gains tax rate would go up along with a quadrupling of the corporate stock buyback rate. The corporate tax rate would also increase. There would be a hike in the Medicare tax paid by wealthy Americans. In addition, it adds a global minimum tax on multinational corporations.

A report by the Tax Foundation found that Biden’s plan would lower economic output, reduce wages and result in the loss of more than 700,000 jobs. The damage would primarily be done by the higher corporate taxes. A director at the Heritage Foundation calculated that the tax hikes amount to almost $36,000 in tax hikes per American family. 4

End of Tax Cuts

Millions of more Americans could face higher taxes in 2025. That’s when the Trump tax cuts in the Tax Cuts and Jobs Act expire. The law was signed into effect in 2017. It overhauled the nation’s tax code. The top individual tax bracket was reduced and nearly doubled the size of the standard deduction. It also raised the tax threshold for several income brackets. As a result, taxes dropped across all income levels.

The Tax Foundation said, “Congress has less than two years to prevent tax hikes on the vast majority of Americans from taking place.” According to them, if the cuts are allowed to expire, a single person making $30,000 per year would pay $253.75 more taxes in 2026. Someone making $75,000 would pay $1,700 more than they paid in 2025. And a married couple with two children making $165,000 would pay $2,450 more per year. 5

Biden vowed that the 2017 tax cuts would not be renewed if he is re-elected. He said, “There is no exaggeration here: It’s going to expire and if I’m re-elected, it is going to stay expired.” His staff maintained that Biden would extend the tax cuts for those making less than $400k. However, growing pressure to control the national debt may prevent Democrats from approving the continuation of those tax cuts.6

One problem with letting the tax cuts lapse is that there is no guarantee that the deductions they replaced would come back. Taxpayers traded off things like a state and local tax deduction and home loan interest deduction when they got the new tax cuts. Now Americans may be left with nothing but higher taxes. This is on top of the rabid “invisible tax” of soaring inflation.

Overall Taxes

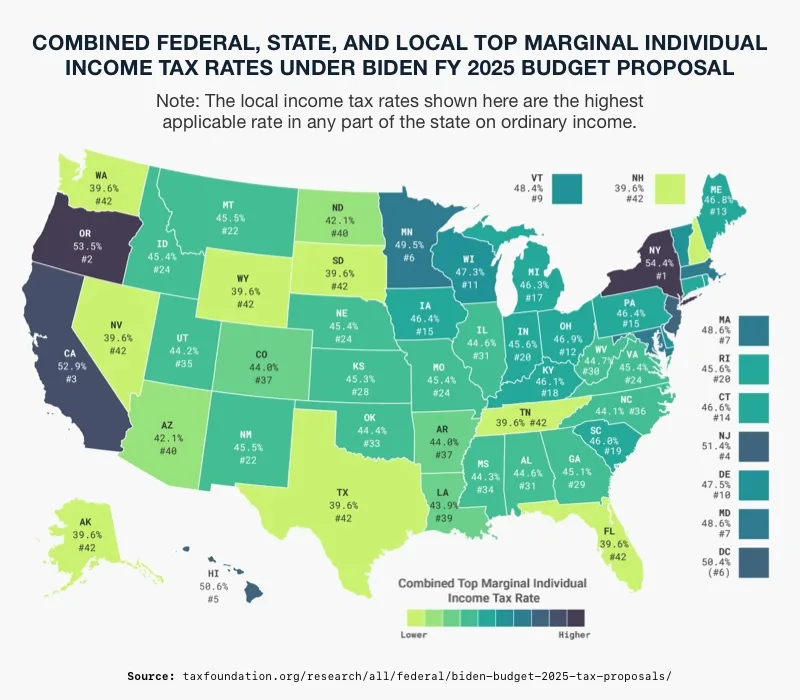

7

7

The dueling tax debate between the presidential candidates is overlooking what is happening at the state and local level. Property taxes generate almost a third of state and local income. And those property taxes have risen more than 25% since 2019. According to the Tax Policy Center, all major sources of state and local revenue have grown in real dollars since 1977. Among state and local revenues, individual income tax saw the largest increase in percentage terms (from $131 billion in 1977 to $545 billion in 2021, or a 317 percent increase). 8

Conclusion

There is a significant possibility of all Americans facing higher taxes next year. Advisers say one of the easiest ways to protect your income is to increase contributions to pretax retirement plans such a 401(k). That can reduce federal and state tax exposure dollar for dollar. Yet traditional retirement funds are still subject to risk from market volatility and losses from inflation. For greater protection, many Americans are looking into a Gold IRA. This specialized self-directed retirement account allows you to hold physical gold and silver in your portfolio. Thus, gaining the safe haven benefits of owning physical precious metals along with the tax advantages. Contact American Hartford Gold today at 800-462-0071 to learn more about how a Gold IRA can protect your nest egg from massive tax increases.

Notes:

1. https://www.foxbusiness.com/politics/trump-campaign-blasts-biden-largest-tax-hike-americans-face-record-high-inflation

2. https://www.foxbusiness.com/politics/trump-campaign-blasts-biden-largest-tax-hike-americans-face-record-high-inflation

3. https://www.foxbusiness.com/politics/trump-campaign-blasts-biden-largest-tax-hike-americans-face-record-high-inflation

4. https://www.foxbusiness.com/politics/trump-campaign-blasts-biden-largest-tax-hike-americans-face-record-high-inflation

5. https://nypost.com/2024/04/19/us-news/biden-teases-tax-hikes-for-everyone-saying-trump-cuts-will-stay-expired-if-re-elected/

6. https://nypost.com/2024/04/19/us-news/biden-teases-tax-hikes-for-everyone-saying-trump-cuts-will-stay-expired-if-re-elected/

7. https://taxfoundation.org/research/all/federal/biden-budget-2025-tax-proposals/

8. https://www.taxpolicycenter.org/briefing-book/what-are-sources-revenue-state-and-local-governments