- Citi analysts predict gold could hit $3,000 an ounce

- The primary driver of the price surge would be rapidly accelerating de-dollarization

- To prevent portfolio losses, Americans are moving dollar-denominated assets like stocks into safe haven assets like physical gold.

Gold Could Hit $3,000

As gold holds steady, with critical support above $2000 an ounce, experts are saying that $3,000 an ounce is possible within a year’s time. While traditional concerns over recession and stagflation are driving safe haven demand, the rapidly accelerating de-dollarization movement may be what pushes gold to record heights.

Aakash Doshi is head of commodities research at Citibank. He said there is a chance for gold to surge 50% and hit $3000 with the next 12 to 18 months. At the very least, he sees gold averaging $2,150 in the second half of 2024. That’s up more than $100 an ounce from current prices. Bank of America is also bullish on gold. They see the potential for it to hit $2,400 an ounce this year.1

If the country slides into recession, the Fed may cut interest rates. Gold typically has an inverse relationship with interest rates. If they go down, the price of gold goes up as interest-bearing alternatives like bonds become less attractive. However, Citibank thinks the major boost in gold prices will come from central banks buying gold as de-dollarization gains momentum.

“The most likely wildcard path to $3,000/oz gold is a rapid acceleration of an existing but slow-moving trend: de-dollarization across Emerging Markets central banks that in turn leads to a crisis of confidence in the U.S. dollar,” Doshi wrote in a recent note.2

BRICS+ and De-dollarization

De-dollarization is accelerating on several fronts. The BRICS Alliance is working to wean other nations off the dollar. Twenty nations have adopted a new Russian payment system to stop using SWIFT, the international interbank system that makes payments between 11,000 organizations in every country on the planet.

BRICS recent expansion is another major catalyst in the fall of the dollar. As of January 1st, Saudi Arabia, the United Arab Emirates, Egypt, Iran and Ethiopia joined the BRICS alliance. With the expansion, the bloc now represents over 3.5 billion people or 45% of the world’s population. Their collective GDP exceeds $28.5 trillion or about 28% of the global economy. The BRICS+ is also now responsible for producing about 44% of the world’s crude oil.

Experts say the admission of Saudi Arabia is epic because they are the linchpin to dollar hegemony. Having oil traded exclusively in dollars, i.e., the petrodollar, is key to US dollar dominance. If the Saudis begin accepting other currencies, the US could face a “day of reckoning.” The UAE, the seventh largest producer of oil, is also in talks to start trading their energy with up to 15 countries based in local currencies.3

The BRICS Alliance is also growing more integrated beyond using the new Russian payments system. Every OPEC country is part of BRICS member China’s Belt Road and Rail initiative. Saudi Arabia joined the Shanghai Cooperation Organization and the BRICS New Development Bank.

The BRICS common currency is the next stage of de-dollarization. Russia has declared that the BRICS common currency will be in focus this year.

“There will be a moment…where they issue a common settlement currency…tied to a basket of commodities. In particular, I believe it will be gold,” said Andy Schectman, President of Miles Franklin Precious Metals.4

Central Banks, De-dollarization, & Gold

5

5

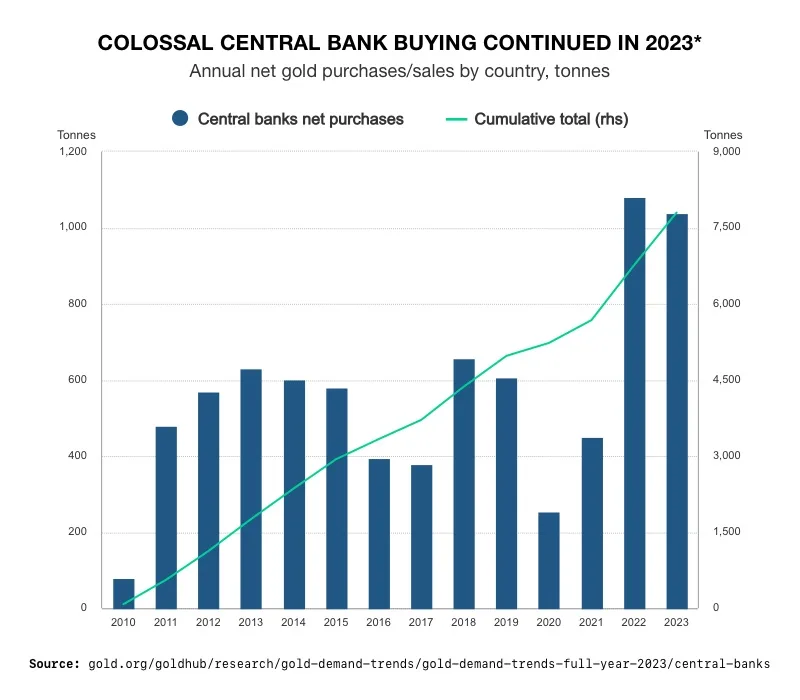

Central bank purchases have already increased to record levels in recent years. They are seeking to diversify their reserves and reduce credit risk. BRICS nations and emerging economies want to defend against US dollar coercion. They need to insulate their economies from the sanctions currently punishing BRICS members Russia and Iran.

The BRICS countries are shedding US Treasuries and replacing them with gold. If central banks doubled their purchases, they would become the dominant source of demand in the marketplace. Already, the world’s central banks have sustained two successive years of more than 1,000 tons of net gold purchases. The sector was only 45 tons away from breaking record purchases made in 2022.

Last year, the People’s Bank of China led the gold market with its purchases. Analysts note that China’s gold holdings only represent about 4% of its total reserves, which means there is plenty of room to grow. They are followed closely by Russia.

Oil & Gold

The positioning of the BRICS Alliance could allow them to reap massive benefits from a spike in oil, including a resulting surge in gold prices. Increased profits from oil and increased value of their swelling gold reserves hastens their ability to drop the dollar completely.

Analysts say oil could go over $100 a barrel on escalating conflicts in the Middle East and Ukraine, deeper OPEC+ cuts, and supply disruptions in oil producing regions.

Higher oil prices often result into higher prices for gold. Though there isn’t a direct correlation, high oil prices can lead to higher inflation. A rise in inflation creates demand for gold to protect against the erosion of purchasing power.

Conclusion

The accelerating de-dollarization movement is poised to both weaken the dollar and boost gold prices. To prevent portfolio losses, Americans are moving dollar-denominated assets like stocks into safe haven assets like physical gold. With a potential upside of 50% within a year, gold can not only preserve value, but increase it. Contact us today to learn what a Gold IRA can do for you. Call American Hartford Gold at 800-462-0071 to get started.

Notes:

1. https://www.kitco.com/news/article/2024-02-20/citi-sees-potential-gold-hit-3000-thats-not-base-case

2. https://www.kitco.com/news/article/2024-02-20/citi-sees-potential-gold-hit-3000-thats-not-base-case

3. https://www.kitco.com/news/article/2024-01-19/brics-plus-expansion-accelerating-petrodollar-collapse-ultimately-leading

4. https://www.kitco.com/news/article/2024-01-19/brics-plus-expansion-accelerating-petrodollar-collapse-ultimately-leading

5. https://medium.com/@nassif.co.uk/gold-reached-an-all-time-high-last-year-and-theres-a-chance-it-could-continue-to-gain-momentum-d0f4265b3f64