- Caused by high interest rates, a recession often sees dropping stock prices, collapsing businesses, increasing unemployment, and shrinking retirement funds

- Recession is especially difficult on pre-retirees due to lack of time to make up retirement fund losses

- Investors can prepare for recession by adjusting when they retire, building savings and investing in safe haven assets

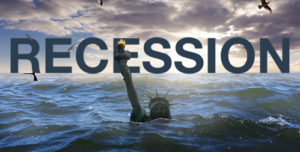

Recession and Retirement

Skyrocketing inflation is punishing Americans with drastically higher prices at every turn. It’s also eroding people’s futures by reducing the value of their retirement funds. The Federal Reserve recognizes the dangers of inflation. Bringing it under control is now their top priority. The Fed is prepared to raise interest rates until inflation is tamed. Even if it means pushing the economy into a recession.

Recessions have several negative impacts on the economy. Financial markets drop. There is an increase in foreclosures and personal bankruptcies. There is also a decrease in consumer spending and business investment. Some businesses may be forced to close their doors. Others are forced to lay off employees. Unemployment numbers tend to go up during a recession.

A recession is hard for the economy overall. But it’s especially difficult for those who are about to retire or have recently retired. The five years before and after retirement are often referred to as the “fragile decade.” A recession during this period can have a serious impact on your retirement funds. It is harder to make up portfolio losses once you enter the fragile decade. And if you’ve started to draw on your retirement funds, the withdrawals combined with the market losses could deplete your account faster than you had planned.

Ideally, you should avoid selling off investments during a recession. When you sell an investment that’s lost value, you lock in your losses. The market will someday recover, and your investments will bounce back. However, near-retirees don’t have as much time to ride out the ups and downs of the market. It is more difficult for them to recover from any losses in their retirement plan. This why some people choose to postpone retirement. The hope is that working for a few more years allows you to make up for your losses.

By continuing to work, you can keep contributing to your retirement account. If you stop contributing, you’ll be doing so when prices have dropped. As a result, you won’t see the benefits when the market bounces back. You will also be able to delay your withdrawals.

Delaying retirement has potential benefits. However, it is not always an option. During a recession, companies tend to layoff pre-retirees first. People are forced to retire earlier than planned. A worst-case scenario emerges. Without a job, you stop contributing to your retirement fund. You need to tap into your savings earlier than planned. Plus, you’ll be making these withdrawals when your portfolio itself is taking losses. You are basically depleting your funds with very little chance of ever gaining them back.

Recession Proof Your Retirement

A recession is obviously bad for people in the fragile decade. While economists argue if we are officially in a recession, there are things you can do now to protect yourself.

Advisors recommend saving money and building an emergency fund. You should also pay off high interest debt, like credit cards. Perhaps most importantly, you should diversify your portfolio with recession proof assets.

Gold is an exceptional hedge against recession. Former Federal Reserve Chairman Ben Bernanke said, “The reason people hold gold is as a protection against what we call tail risk, really, really bad outcomes. And to the extent that the last few years have made people more worried about the potential of a major crisis, then they have gold as a protection.” 1

Historic gold prices prove out its value during a recession. After rising 2.6 percent in 2008, the Producer Price Index for gold increased 12.8 percent in 2009 during the Great Recession. From September 2010 to September 2011, gold prices jumped a whopping 50.6 percent, due to the uneven recovery and volatility in the U.S. financial markets. 2

As part of the business cycle, a recession is all but guaranteed. All you can do is prepare for it. Especially if you are nearing retirement or are already retired. Call us about a Gold IRA to learn how precious metals can protect your wealth.